BlastPoint CEO & Co-Founder Alison Alvarez has spent a lot of time analyzing billpay data in order to support our utility partners during the current pandemic. Based on her findings, Alvarez has defined three ‘customer balance risk zones’ that are key to prioritizing at-risk customers and reducing lost revenue, so companies can stay afloat during times of crisis. Her article below was originally published on Energy Central.

Utilities are bracing for a potential budget crisis in anticipation of Covid-related disconnection moratoriums being lifted. With millions of Americans still out of work and falling behind on their bills, utilities expect that when state governments allow shut-offs to go back into effect, they may have no choice but to distribute a higher-than-usual number of disconnection notices.

This is obviously a negative outcome for both utility companies and customers. Shut-offs are costly and unpleasant for utilities. And for customers, having the power, heat, or water turned off pushes them deeper into debt and can create negative mental and physical health outcomes – in addition to eliminating a safe residence for them to shelter in place during a pandemic.

But the current and emerging billpay situation resulting from the pandemic and accompanying economic downturn could be more dire than we thought. While applications to government assistance programs are down at the moment, making it seem like most Americans are able to continue paying their bills, recent billpay data indicates that the worst of the impact has yet to strike.

Analysis of one Mid-Atlantic gas company’s most recent customer data shows that the total amount of outstanding bills their struggling customers still owe this year is well over $20M above the expected amount. That’s $20M+ of yet-to-be-collected revenue above baseline, revenue that utility may never see.

Specifically, May data trends show that customers who were already at risk of paying late are in a worse financial situation than they were several months ago. In fact, their balances are up more than $200 on average than where we would expect them to be last month, given their payment histories.

Also concerning is the fact that customers in the $100K – $124K/year income bracket are outpacing some lower income brackets as first-time late payers. Overall, middle-income earners appear to have accrued overdue balances far higher than what’s typical for them at this time of year.

And so, it seems, struggling customers are going to need more time and more support if they are to stay connected to power and remain solvent.

Learn more about BlastPoint data solutions for utilities.

How can utilities mitigate this potential billpay catastrophe?

Household-level data analysis of customer payment histories allows utility companies to find and prioritize customers most at-risk for accruing high balances and being unable to pay. This type of analysis will reveal:

- Customer benchmarks, or a household’s typical payment behavior over time;

- Irregularities to that benchmark which would indicate whether that household has hit hard times or is maintaining financial security;

- Overall payment patterns within a utility’s footprint which indicate the average dollar amounts that are due and overdue by neighborhood; and

- Thresholds that show the exact dollar amounts that customers are willing or able to pay, either in full, in part, or not at all.

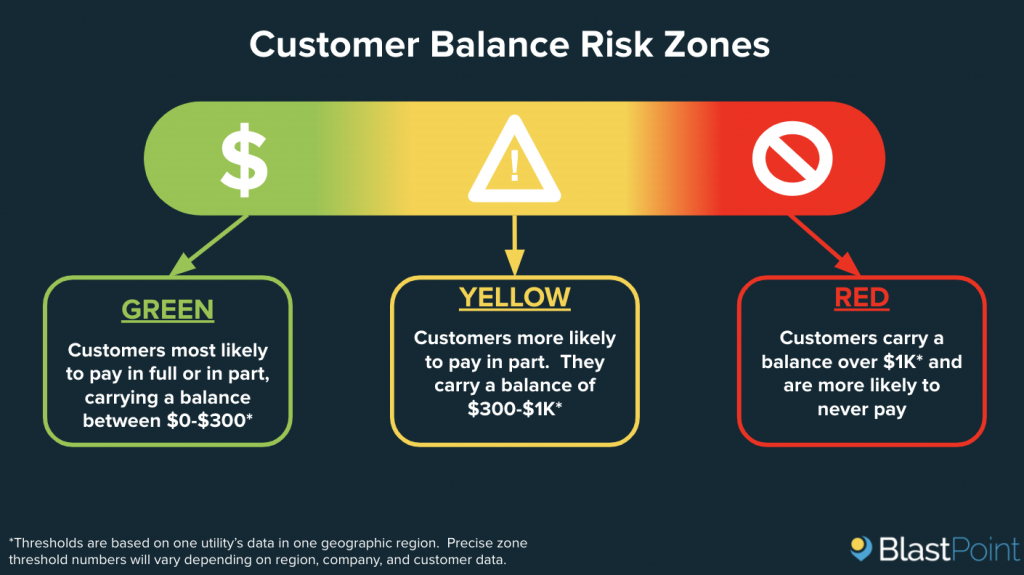

We’re calling this last point Customer Balance Risk Zones, and if utilities can define theirs, they will have a leg up in mitigating the difficulties that lie ahead. Customer Balance Risk Zones are unique for every utility, given variation among humans, regions, geographies and needs.

For illustration purposes, our example above outlines one company’s specific customer balance thresholds.

The Green Zone

Customers in the Green Zone pay in full or in part, and may carry a balance from one month to the next, up to $300 in this example. Generally, customers in the green zone are considered financially stable, and may be great targets for adopting energy efficiency measures or enrolling in digital programs like autopay or direct debit. Learn more about Green Zone customers here.

The Yellow Zone

The Yellow Zone shows customers who have apparently hit hard times. They’re carrying a balance somewhere between $300 and $1K (again, these numbers vary by region) and have missed a few payments. Yellow Zone customers are people who utilities need to engage and educate right now. They may not be familiar with cost-savings programs like budget billing or payment plans that offer consistency, but they should enroll in them. Now is the time to reach out to them and offer help on how to sign up.

Likewise, Yellow Zone customers may know little about government assistance programs like LIHEAP or crisis grants made available through nonprofit agencies, simply because these are customers who may never have encountered this level of financial hardship before. There is a small chance some of them are newly eligible for these programs and could apply. In either case, Yellow Zone customers need help now to control their balances so that they stay out of the Red Zone. Read more about them here.

The Red Zone

Red Zone customers are those who are so deep in debt and financially at-risk that the chances of them ever being able to pay what they owe (in our example, more than $1K) is slim to none. It is more likely than not that they will end up in collections and have their power turned off.

The Red Zone emerges as the point at which it becomes nearly impossible for utilities to collect any payment. Customers in the Red Zone absolutely need to be informed about LIHEAP, state-run energy assistance programs, or outside agencies offering crisis funding right now, or they are almost sure to face shut-offs as soon as moratoriums are lifted. Take a deeper dive into what defines Red Zone customers here.

Outreach and education about the help that’s available needs to happen quickly, before moratoriums end, and ideally when customer balances are still in the yellow zone. If customers wait until the shut-off notice appears on their front door, it will be too late. Government funding may already have been disbursed, and customers will be facing cooler temperatures with potentially no heat or electricity, and without having any kind of energy support.

Moreover, utilities risk losing more revenue if this trend continues. Their employees’ jobs could be at risk and, as some experts speculate, energy rates could spike around the country.

Despite these concerns, we know that utilities are working extremely hard around the clock to serve their customers, protect their bottom line and keep people connected. We hope that they are equipped to intervene now, ideally, or within the coming months to prevent the current economic situation from affecting their customers even more negatively.

When business resumes to some level of normalcy in the coming months and years, we expect that continuous, staggered customer outreach about the many cost-saving programs will be effective ways to protect customers, safeguard revenues and generate positive touchpoints for the long term.

To learn more about engaging with at-risk customers during a crisis, visit our Crisis Customer Engagement Guide and download our FREE resource, “Identifying & Engaging with Vulnerable Customers During an Economic Crisis.”

This shareable slide deck collects our top insights for targeted, effective customer engagement, including a high-level checklist for creating an engagement plan. Simply fill out the form below to get started!