Case Studies

Results-driven Customer Intelligence

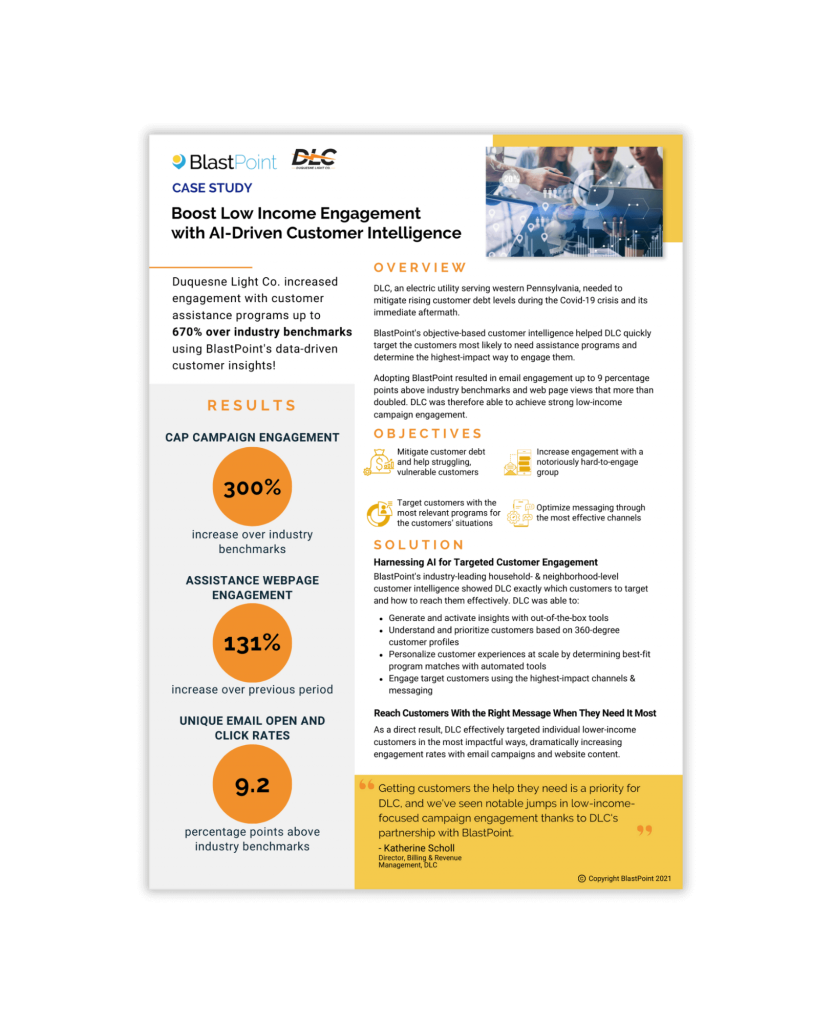

Our partners’ strategic objectives are at the core of the customer intelligence we deliver.

Teams utilize data-powered insights to surpass business objectives.

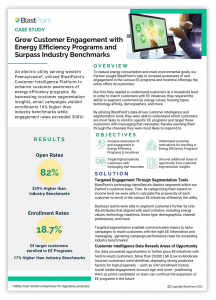

- Collect more on past-due accounts

- Boost awareness of and enrollment in customer programs

- Grow engagement with new technologies

- Find new commercial and residential customers

and more…