BlastPoint’s A.I. powered Customer Balance Risk Zones help companies decrease customer debt while increasing customer satisfaction.

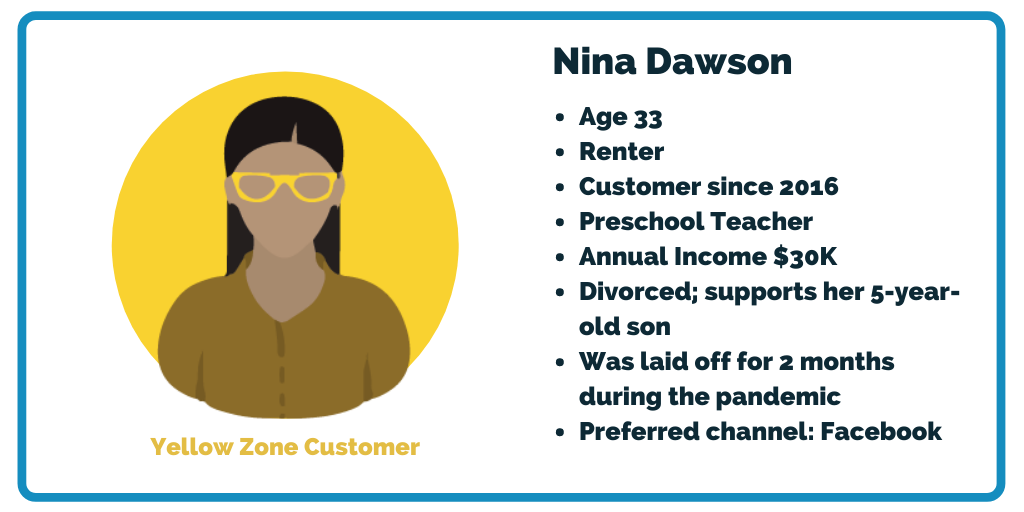

When times are tough, customer balances go up. With widespread layoffs and furloughs, increased expenses, and high levels of stress, it’s no surprise that more customers fall behind on payments during an economic crisis. They may be hoping for their circumstances to improve soon and direct limited resources to other necessities, such as groceries, child care, and/or mortgages.

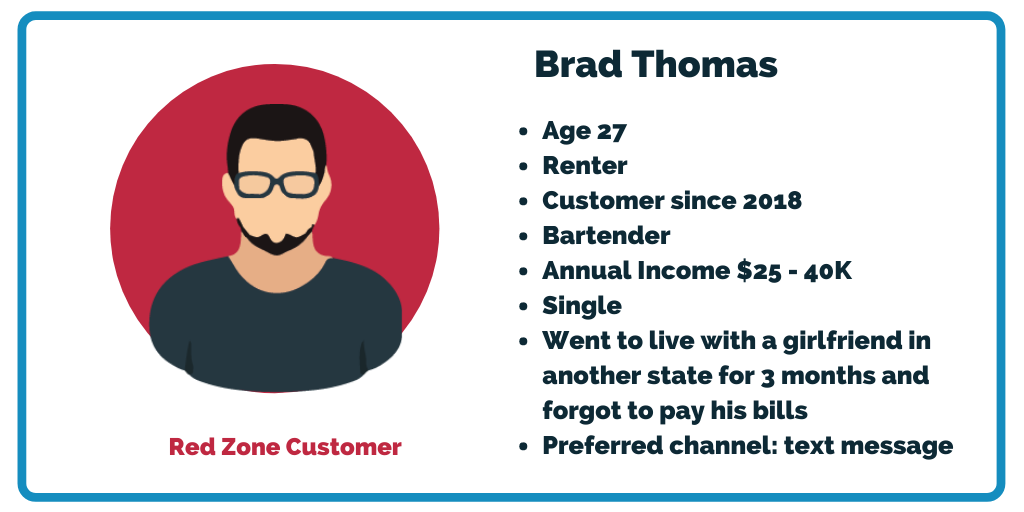

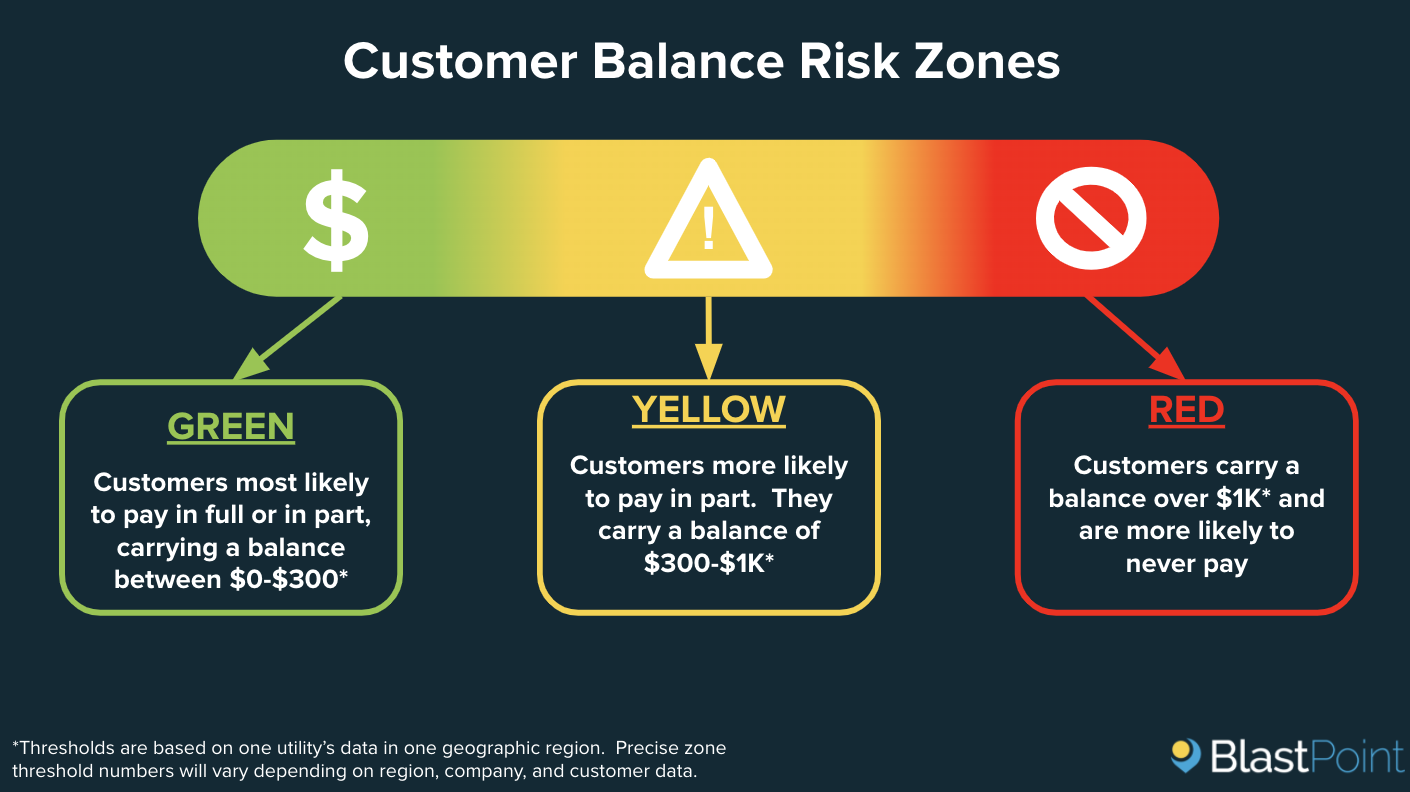

Yet if their balances reach a pivotal threshold, it will be increasingly difficult for them to pay in full – or at all. Which will result in more hardship for them, and lost revenue for your company.

We call those pivotal thresholds Customer Balance Risk Zones, and knowing them is a game-changer for your billing and collections strategy.

- Understand each customer household’s billing patterns and personalize outreach

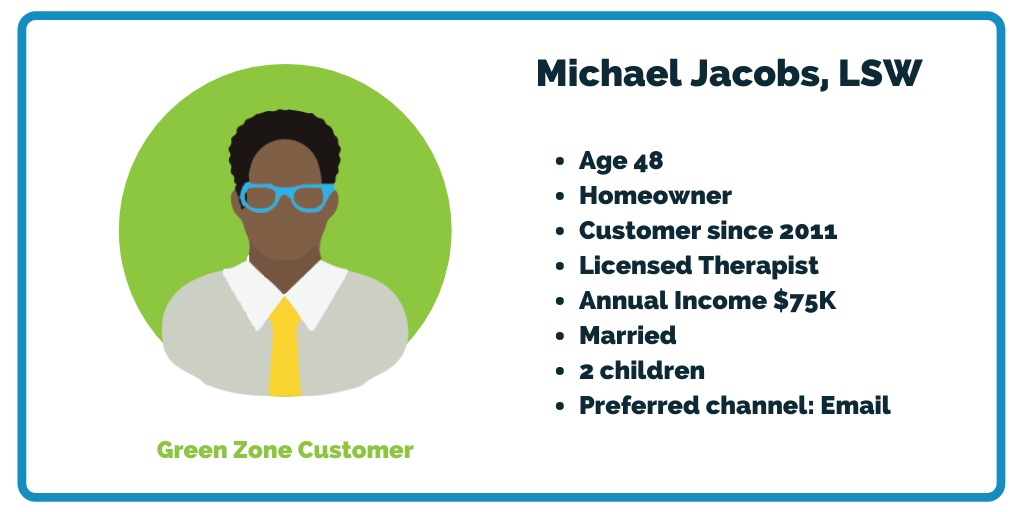

- Target “good payers” for quick collections wins

- Target struggling customers with the right assistance programs

- Intervene quickly when households deviate from their predicted behavior

Transform billing & collections outreach with A.I. Check out our Risk Zone Snapshots below, and read BlastPoint CEO & Co-Founder Alison Alvarez’s article about why Customer Balance Risk Zones are so important.