When shut-off moratoriums end, utilities will be faced with having to disconnect service for thousands of delinquent customers. Is there anything they can do to mitigate the economic disaster that awaits? The answer’s in the data.

Over the last few weeks, we’ve talked about customers in the Green and Yellow Customer Balance Risk Zones. This week, to wrap up our series, we focus on the Red Customer Balance Risk Zone. The Red Zone refers to account balances that have gotten so high and overdue that they will most likely never be paid and, instead, end up in termination. Below, we look at which customers are in the Red Zone and how you can work with them to prevent costly shut-offs.

Red Zone Payment Behavior

Red Zone customers have not paid a bill in months, and their balances exceed roughly $1K.* The higher above that inflection point a customer’s bill rises, the less likely they will pay anything toward it at all.

(*This figure is an estimate based on a general overview of patterns around the country. Actual amount-due thresholds vary by region and as they are derived from analyzing a specific utility’s internal data. To inquire about defining your company’s Customer Balance Risk Zones, please reach out to us.)

Many Red Zone customers have gotten help from energy assistance programs such as LIHEAP in the past, but they are not now. There was a time during which your company received consistent payments from them, but those days are over (keep reading to find out why they’ve rolled off of assistance).

Yet, under today’s economic circumstances, new customers are landing in the Red Zone. Our research shows that newly-delinquent customers are unaware that financial programs (LIHEAP, CAP, Dollar Energy Fund, etc.) exist. Having been, until recently, employed and keeping up with bills, these customers haven’t had to engage with community-based social service agencies to ask for help with energy assistance or other interventions.

Unfortunately, it’s common for assistance programs to require a “good faith” payment of any outstanding balance before they agree to offer a customer help. Which means that, for those whose bills have mounted out of control, it’s too late for them to get help once they’ve hit the Red Zone.

Meanwhile, they would have likely qualified for help months ago had they only known to ask for it.

Education, then, is key. And if education about payment programs hasn’t been offered by the utility, perhaps it’s time the utility considers changing its policies for customers who have an otherwise good payment history.

Red Zone Customers’ Financial Standing

Red Zone customers are in debt over credit cards, mortgage payments, utilities and more. As Chad Quinn of Dollar Energy Fund told us in our May 2020 interview, missing utility payments is a symptom of a bigger problem.

Customers who’ve hit this level of risk are in survival mode. They face the ‘Heat or Eat’ conundrum, choosing every day whether to feed their families or pay the gas, water and light bills.

Make sure they are aware of all cost-saving programs–not just energy assistance, but budget billing, payment plans and paperless billing, too. If they don’t enroll in something now, they may never recover.

Red Zone Program Enrollment

Red Zone customers may have been enrolled in assistance before, but they are not now. Our research indicates this is not because they landed their dream job or won the lottery.

More likely, they got fed up or fell behind with the cumbersome paperwork required to stay enrolled, or were unable to meet onsite with a community-based agent to get their application processed and, thus, missed an application deadline.

While some utilities have transitioned to online program enrollment, many still require applicants to meet in person with a counselor at an agency for help filling out paperwork. Unfortunately, in the Covid era, service agencies have had their funding cut. Social distancing measures have meant fewer counselors can work at one time. So customers face longer wait times for help, and their documents are processed more slowly.

Meanwhile, some Red Zone customers who needed assistance before their bills got out of control would have had to travel by bus, with kids in tow, to agencies to meet with counselors. Facing exposure to the coronavirus by venturing out into public is an unnecessary risk for vulnerable groups.

What to Offer Red Zone Customers

Creative measures can ensure you receive some payment now to avoid customer terminations.

- Share news of extended deadlines to get people enrolled in programs.

- Make announcements (via text if you can!) when new grant money becomes available.

- Advertise qualification requirements so that people are aware that they may be eligible for funds.

- If your utility still has federal money to distribute and is willing to accept people into programs late, then arm your customers with education on how to enroll.

- Make the application for all of these programs easy.

- Allow for rolling deadlines rather than hard cut-off dates.

It also helps to remind this group of the negative consequences that terminations bring. Let them know that if they ever want to reconnect after a shut-off, the cost is high. It’s better for them to pay some portion now than face steeper consequences later.

Best Practices for Engaging Red Zone Customers

Pew Research Center’s Mobile Fact Sheet says 96 percent of Americans now own and use a cell or smartphone, and many of those users are ‘low income.’

In order to recoup some payment from them, reach out via text with offers of help to enroll them in assistance, payment plans or late fee forgiveness programs.

If your utility isn’t set up with a mobile app, put adopting one like Dollar Energy Fund’s MyApp at the top of your to-do list. In the meantime, gather customer cell phone numbers and include an opt-in message to get their permission to receive texts from you in the future.

Red Zone customers vary in communication channel preference. While some open every piece of snail mail out of sheer boredom while under quarantine, others scroll Facebook or Instagram. Still others may notice billboards or flyers posted at food pantries or health centers if they’re out and about.

Community organizations like these make great partners for disseminating critical information and building trust. Be sure to spread the word about available help through agency workers and volunteers.

Make enrollment a snap with online forms people can fill out themselves. Remember, many of these customers are new to assistance and expect signing up to be as easy as ordering shoes from Amazon. Likewise, they may be embarrassed to ask for help. Giving them a way to sign up discreetly will likely create a better response.

Include tips like these on reducing energy consumption at every touchpoint so they can dial back their usage and reclaim control over future bills, because every penny counts toward cutting costs.

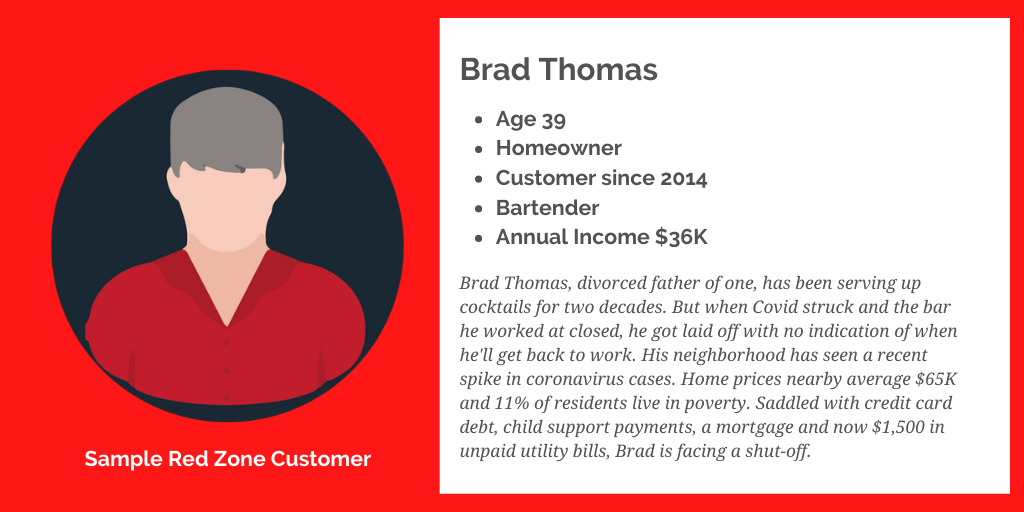

Red Zone Customer Persona Closeup

Meet Brad. He’s our imaginary friend who’s been having a rough go of life since coronavirus closures caused him to lose his job. Find out what life is like for him in the Red Zone.

The Red Zone persona above is an imaginary customers. Names and characteristics are purely fictional and do not represent any actual living person. Any similarity to a real person is purely coincidence.

Red Zone Takeaways

Utilities want to avoid terminations just as much as customers do. Red Zone customers need immediate outreach that includes education on how to get help and offers reassurance that their utility wants what’s best for them.

Mine your customer data to find out which customers have a history of delinquency and which don’t. Be sure not to penalize those who make a good faith effort to get back on track. The goal is to minimize the damage that lies ahead. You can do that by capturing as many partial payments as possible.

Doing so will help to prevent major revenue losses and ensure you maintain customer trust which, in the end, is priceless.

We hope this exploration of the Red Zone has been helpful in understanding customer risk. Click here for an overview of Customer Balance Risk Zones and why they’re critical for customer engagement during a crisis. If you’re interested in taking proactive steps toward reducing lost revenue, contact us to find your Customer Balance Risk Zones.