A newfound sense of urgency is bearing down on utility companies as they look to the future. They want to conduct targeted, meaningful customer engagement, efficiently and within the confines of limited budgets, in this new, Covid-ravaged economy. Luckily, clear guidance is available to achieve this, once they identify and understand their unique Customer Balance Risk Zones.

With so many Americans out of work and struggling to get by, fewer utility customers each month seem to be keeping up with their bills. And from what we’re seeing, this pattern is poised to amplify in the coming months rather than resolve itself anytime soon.

What should utilities do, then, to keep customer accounts in good (or good-enough) standing, keep revenue coming in, and avoid costly, labor-intensive, unpleasant terminations?

Identify Your Customer Balance Risk Zones

BlastPoint has been analyzing customer payment data, past and present, to shed light on this topic. Through our processes, we’ve identified some disturbing patterns that reveal when, where and which customers have hit a level of financial hardship that is so insurmountable that they will not be able to recover.

We can also see which customers are holding steady, remaining relatively safe from financial harm and, thus, are most likely to pay their bills in full and on time. And further, our research shows which customers have historically paid on time but have recently approached financial difficulty, as their accounts have mounting unpaid balances and gaps in payment. (*Note: these are the customers to really watch out for.)

We call this range spanning from financial safety to financial ruin Customer Balance Risk Zones, where each zone is color-coded (Green, Yellow, Red). We invite you to read our high level overview on them to understand the big picture and decide if you’d like help identifying your utility’s unique zone thresholds.

Making Customer Balance Risk Zones Work for Your Utility

Utilities use Customer Balance Risk Zones (which vary from company to company, as their thresholds are derived from analyzing internal customer data) to understand precisely where to focus employee time and advertising dollars.

They use it to determine which households to target with crucial information, such as educational materials about assistance programs or how customers can enroll in payment plans, in order to engage people in ways that will be most relevant to their situations.

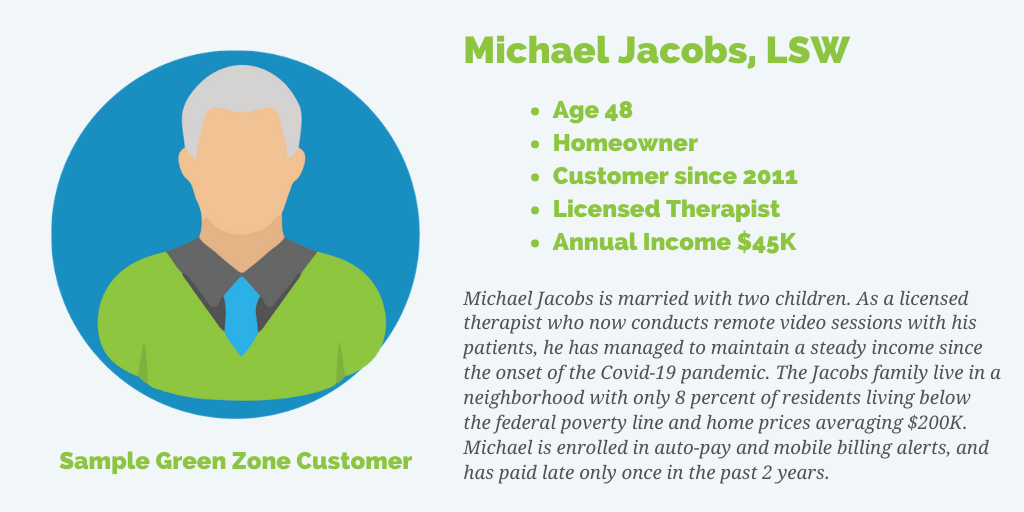

In order to help our partners more clearly understand this spectrum, we’ll be covering each zone individually, today and over the next few weeks. We’re including a cheat sheet infographic you can keep at your fingertips, too, along with a hypothetical persona, which should lend some concreteness to the ‘Zones’ concept and get you thinking about the real humans who live inside your data.

Get the free Green Zone cheat sheet now! Click here to download.

To begin our three-part series, let’s kick off with the Green Zone, which encompasses customers who are most likely to pay in full and on time each month.

Green Zone Payment Behavior

Green Zone customers are more likely than other groups to pay their bills in full and on time every month. They occasionally carry a small balance from one month to the next but rarely ever proceed to the dunning process.

Generally, we’re seeing balances due in the range of zero to $250 or $300; amounts that Green Zone customers will easily be able to pay off all at once.

Green Zone Customers’ Financial Standing

Green Zone customers exhibit steady job security and/or consistent access to resources. They do not typically request financial assistance for help paying their bills. However, a portion of these customers may earn a low income. But they still make payments a priority, perhaps due to consistent enrollment in energy assistance, payment plans or other programs.

Likewise, this group may include some seniors living on a fixed income who have budgeted out their monthly dues and keep on top of their bills.

For more insights on serving low-income customers, check out this earlier post.

Otherwise, it’s safe to assume many of your Green Zone customers are employed in industries that have not been negatively affected by Covid-related shutdowns. In other words, these are the medical professionals, IT employees, researchers and even educators, who transitioned to teleconferencing and working from home easily when many businesses shut down.

Green Zone Customer Program Enrollment

Green Zone customers are more likely to be signed up for programs like Budget Billing, Direct Debit and e-billing, all of which are proven methods that boost consistent monthly payments. Overall, we see high numbers of these customers enrolled in online platforms, suggesting they value having a say in their financial well-being and appreciate cost savings while managing their money.

As stated previously, some receive assistance through programs like LIHEAP and Dollar Energy, and have the wherewithal to recertify each year.

Best Practices for Engaging Green Zone Customers

The best way to reach Green Zone customers is through digital channels like email, mobile alerts and social media. These are people who have an online presence and are adept at navigating internet technology.

Target them with messaging about the benefits of things like paperless billing, weatherization, energy efficiency programs and advanced technologies. These customers are more likely than other groups to respond positively to these topics, both because of their cost effectiveness and earth-friendliness.

Green Zone Persona Closeup

Green Zone Takeaways

Green Zone customers are holding steady financially, at least for right now. While they do not need urgent outreach with regard to paying their bills, we suggest coordinating future engagement that will speak to their needs and resolve their concerns as they travel along the customer journey.

For instance, now and in the coming months, utilities have an opportunity to engage Green Zone customers about issues relating to home ownership, increased power usage due to working from home, clean energy and raising children in a world where parents are increasingly concerned about the health effects of air pollution. Messaging in this regard will resonate, and these customers are likely to enroll in programs that facilitate savings and environmental benefits.

We hope this exploration of the Green Zone has been helpful in understanding customer risk. Please join us again next week for an up-close look at the Yellow Zone. And if you’re interested in determining your utility’s Customer Balance Risk Zones, please contact us.