Info-rich customer data rings a warning bell for companies, clarifying customers’ level of need during the Coronavirus outbreak and beyond.

Two customers may appear, on paper, to be very similar. But scratch the surface and you find that drastic differences exist between them, making it necessary to approach and serve them in extremely different ways.

Let’s say you need to generate a marketing campaign for a new service or program designed to serve low-income wage earners during this frightening time. For example, a low-interest loan or a new bill deferment program that you know will be especially useful to vulnerable customers as they navigate through the COVID-19 epidemic’s aftermath.

You may begin by looking at your customer data to find out who, among your customers, is in need, indicating who will be a good match for your new program. You filter your data to search for ‘low income’ customers, setting a $20K yearly income limit.

Lo and behold, you uncover hundreds, maybe even thousands, of low-wage-earners in your service area to whom you think you should market your valuable program. Now that you’ve cued up a batch of customers who earn less than $20K annually, you’re ready to launch your outreach campaign…right?

Not so fast.

It’s easy at this point to assign your ‘Low Income’ customers to the same segment and simply plow forward with your beautifully-designed advertising campaign. But we advise our partners to avoid making this mistake, because they may be driven by false assumptions, based on one singular factor alone – income level – that could wind up being costly.

Instead, you need more. More depth. More nuance. More understanding.

Observe household-level, behavioral information about these customers in order to really be able to communicate effectively with and appeal to them. Because two people who both happen to earn about $20K may, in reality, be experiencing life in totally different ways.

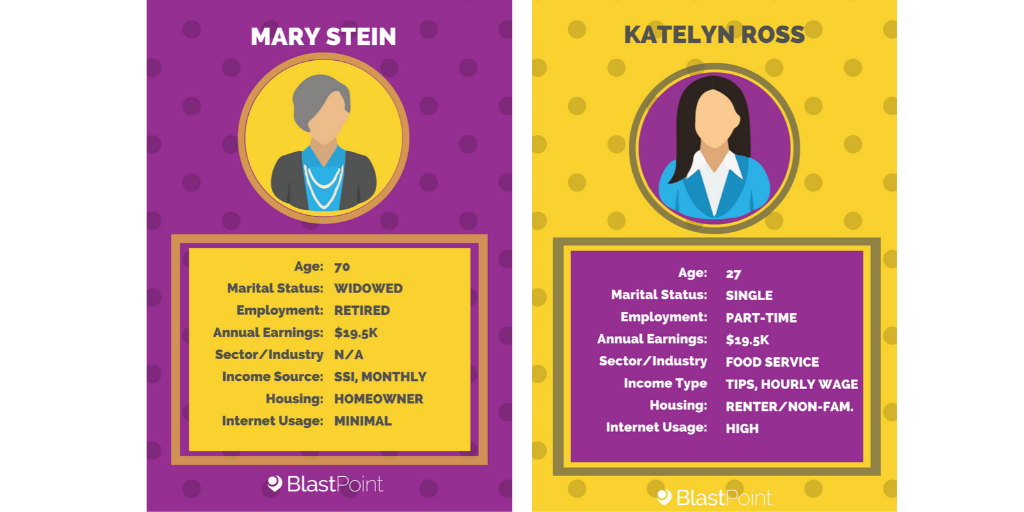

Customer 1

Now, $20K seems an unfathomably low amount of money to many of us when we think about what we need to survive. While indeed, it is a small amount to live on, it may be manageable if the person (who has no choice but to survive on it) is a relatively healthy senior citizen who’s receiving a steady, reliable check every month on a consistent basis that’s issued by a government program.

That senior may be retired, may have paid off a mortgage for a house in an affordable neighborhood, may receive Medicare and energy assistance funding to ease their monthly payments. Their children are likely working-age adults who might be assisting them with household chores and in getting around. This person may not consume much electricity, day in and day out, and they may not have a lot of other expenses, or expensive tastes.

Customer 2

In contrast, another low-income customer who makes $20K annually could be much younger and swimming in college debt. She might be raising small children, and patching together two or even three part-time jobs because she can’t find work in her chosen field. She might be working for minimum wage plus tips – providing the opposite of consistency – and she may experience peaks and valleys in her income depending on the season, depending on whether her children are in school. She may be sharing expenses with a roommate in a rental apartment that’s located in a gentrified neighborhood where rents are on the rise.

BlastPoint CEO and Co-founder, Alison Alvarez, lays out this idea further in her most recent video chat, recorded from her home in Pittsburgh, as she’s been poring over customer analytics for an energy industry partner. In it, she explains this idea called ‘income variability’ in the clearest terms. She outlines which of these customers, in the coming months, will need special attention as a result of the projected, COVID-19-related economic downturn. Give the video a view to find out more!

Understanding Specific Customer Journeys Through Personas

You can imagine the two households Alvarez talks about, both earning the same annual income amount, but who are likely experiencing the COVID-19 pandemic in contrasting ways.

Just as fiction authors set about ‘world-building’ to create believable, relatable characters, we at BlastPoint like to put our imaginations to work, too, breathing life into the data we analyze all day.*

Take a look at the customer comparisons we generated above – which are 100 percent fictional, by the way – and you can begin to imagine how different life is for people who, at first, appear to be the same.

Questions for Targeted Customer Engagement

Taking income variability into consideration, it’s clear that a one-size-fits-all campaign for low-income customers will not meet the needs of both customers above. Once our partners understand specific customer personas, they can begin to design effective initiatives that will yield results. These are some of the questions our partners can answer once they’ve done a deeper analysis of the people they serve:

- How would you engage these customers differently?

- What might make one of them less of a good match for the program you are endeavoring to advertise, and what might make one of them more appropriate for it?

- Knowing these deeper details about each person, what steps might you need to take to craft tailored messaging so that it resonates with each of them?

- Which channels or methods of communication might you attempt to reach them through?

If you’re interested in better understanding your own customers, particularly during such an unprecedented time, the BlastPoint team is here to help. Please reach out to us for help in discovering the humans in your data.

*Please note that the above images are fictionally manufactured persona cards that were created by BlastPoint strictly for illustrative purposes, and they are not intended to reflect, represent, resemble, or otherwise reveal any particular, real, living, breathing, actual individuals! Consider them as examples of the kinds of people who may comprise a portion of a given customer segment in order to help you devise a more targeted marketing or sales plan.