Utility companies are gazing into the future with worry over what the see: More and more customers falling behind on their bills. BlastPoint identifies these customers as being in the Yellow Customer Balance Risk Zone, which means they’ll be facing major debts and late fees when moratoriums are lifted. Here’s how to keep them engaged and connected–and prevent a bad situation from getting worse.

Companies that deliver essential services like gas, water and electricity need to generate revenue (despite regulated rates) if they want to stay in business, keep their workforce employed, and serve their customers well. One of the ways they do this is by receiving payments from customers, on time and in full, every month.

But collecting payment seems to be getting more challenging these days with so many struggling customers unable to cover what they owe.

If you missed our recent Late Payment Report, which gives an overview of utility balances that have yet to be paid, check it out here. It’s staggering, so prepare to gasp. Get back to us after you’ve taken a moment to process.

Given what you know now, it’s clear that utilities need to pull out all the stops to get Yellow Zone customers, those who are falling behind, onto some sort of payment plan or into an assistance program as soon as possible.

Boosting enrollment numbers in programs like LIHEAP, average monthly payments or even paperless billing may be a utility’s only ticket to keeping payments rolling in, employees protected, and customers connected to power.

So, who are Yellow Zone customers? To find them, we suggest taking a good hard look at your data. In particular, customer payment history data.

Identifying payment patterns across time allows utilities to uncover precisely who needs to be reached urgently, and what information would be most useful to them.

Defining Customer Balance Risk

We perform data analysis for our utility partners to define specific dollar thresholds that their customers owe and are capable (or not) of paying. We call these thresholds Customer Balance Risk Zones, and they tell us what balances are most likely to be paid in full (Green), in part (Yellow), or not at all (Red).

We covered this concept at a high level in our recent article on Customer Balance Risk Zones. Last week, we launched a new, 3-part series to explore each zone individually. Be sure to review the Green Zone here and get your free cheat sheet. Now let’s turn to the Yellow Zone, focusing squarely on those worrisome customers who have reached financial hardship and need their utility company’s attention stat.

Yellow Zone Customer Payment Behavior

Yellow Zone customers have entered into financial difficulty.

Utilities will know where to find them because their balances show an amount due roughly between roughly $300* and $1K*.

(*Note: These figures are based on a general average of patterns we are finding around the country. Actual thresholds will vary by region and company, as they are derived from analyzing a specific utility’s internal company data.)

Recently, you’ll notice that Yellow Zone customers have been paying their bills late. Or, if they’re managing to pay on time, what they’re sending is inadequate to cover their total balance, which has been mounting ever since Covid-19 took its hold on life as we once knew it.

Be on the lookout for two or more consecutive months of late, partial or missed payments, as this indicates that the customer needs intervention now.

Yellow Zone Customers’ Financial Standing

Financial troubles may be a new issue for Yellow Zone customers, or it may be a continuing pattern you’ve noticed before. Seasonal workers, tip-based employees, minimum wage workers, or anyone earning a variable income that depends on shift availability or childcare coverage are particularly susceptible to spending their life in the Yellow Zone.

However, a sudden job loss from an otherwise stable field (e.g., massive layoffs of city government offices, closures of fitness centers, cuts in home care services) may be contributing to Yellow Zone customers’ ability to keep up with their bills.

Likewise, a sudden health crisis (their own or a loved one’s) may have diminished their ability to work and earn an income. At this point, Yellow Zone customers have bigger fish to fry in the way of medical bills, safety and well-being.

Utilities should understand that all of these people are likely desperate for a lifeline, some kind of financial intervention, that could help them stay afloat. While they may have some savings or a helpful family member who has come to the rescue recently, their rainy day fund is running out, or already has.

If they don’t receive help to keep them solvent in the coming months, they may never be able to catch up and pay what’s due. That means they’re likely to progress into dunning and potentially have their service terminated, a step their utility would really like to avoid.

Yellow Zone Program Enrollment

Yellow Zone customers who are new to financial hardship are not typically enrolled – and may not even know about – energy assistance programs. However, you may find that they’ve signed up and frequently utilize paperless billing, online portals or budget billing. Remember, in a crisis economy, those who are struggling come from all walks of life.

Yellow Zone customers who’ve faced hardship before will already know the drill when it comes to signing up for energy assistance. But for those who are new to this desperate situation, they need to be educated.

Make sure they know about available programs. Perhaps they need a one-time crisis grant. Maybe all they need is to get their bills to a consistent amount-due level every month. Either way, make sure they know they have options.

These customers would also benefit from receiving weatherization and energy efficiency tips. While renters may not control temperature settings in their buildings, they can be given guidance on how to apply appropriate window coverings to keep their homes cool, use LED light bulbs, or dry their clothing on a laundry line instead of a machine. If your utility offers variable demand rates, be sure your customers know to charge their electronics and wash their clothes during off-peak hours to save money.

More useful tips and tricks you might consider sharing with your customers about energy savings for renters can be found at SaveOnEnergy.com.

Best Practices for Engaging Yellow Zone Customers

Yellow Zone customers vary in background and channel preference, so no single outreach mode will suit them all. While you’ll want to use digital as well as hard-copy channels like billboards and snail mail, focus targeted outreach dollars on the right messaging, in particular.

Send information about available assistance (cash grants, crisis programs, LIHEAP, etc.) to ensure your billing department continues to receive payment, and while you’re there, include help on how to sign up.

Go a step further and make enrollment a snap, with online forms people can fill out themselves rather than requiring them to seek counsel from a community agency counselor. Gather mobile phone numbers and utilize text bots like Dollar Energy Fund’s MyApp to reach people via cell phone (just be sure to get their permission first).

Again, include guidance with every touchpoint on energy efficiency so they can dial back their long term usage, because every little bit counts toward future savings.

Follow up at regular intervals – become a utility liaison or a billing mentor, however you want to think about it – to ensure they are prompted to take action rather than passively slip into the dreaded Red Zone. (We’ll cover that next week, so stay tuned.)

Yellow Zone Customer Persona Closeup

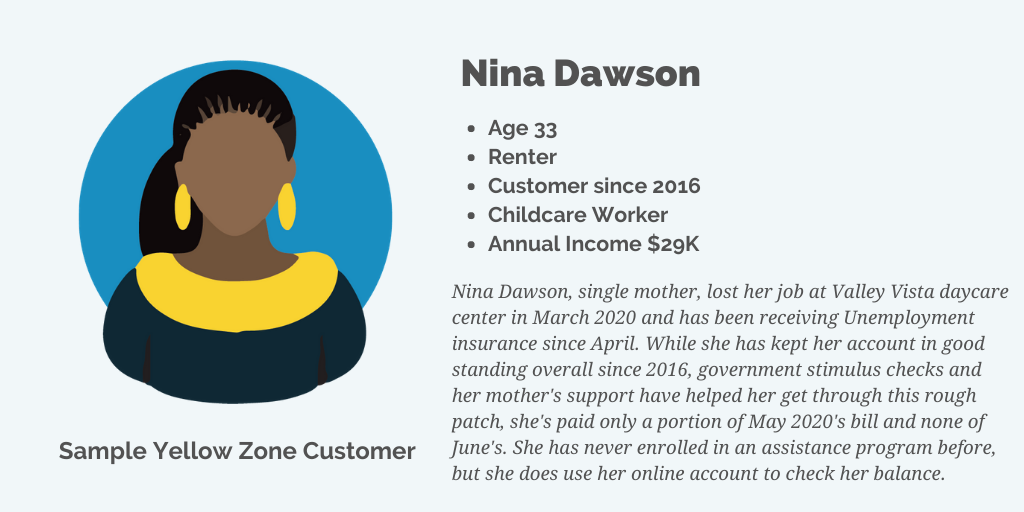

At BlastPoint, we offer our customers personas based on their data. Rather than show them a spreadsheet that our algorithms generate, we offer Sales and Marketing teams fictitious people who encapsulate the characteristics of the kind of customer they should keep in mind when conducting an engagement campaign.

In that spirit, we present our good (imaginary) friend and Yellow Zone customer, Nina.

The Yellow Zone persona above is an imaginary customers. Names and characteristics are purely fictional and do not represent any actual living person. Any similarity to a real person is purely coincidence.

Yellow Zone Takeaways

Look to your data for people who have missed consecutive payments and owe more than ~$300 to find out who Yellow Zone customers are.

They need urgent outreach about what’s available to help them pay their bills. The simpler and more straightforward you can make their enrollment experience, the better.

Be the solution, not the Grim Reaper that’s threatening to take their power away. That means, present them with ways to get back on track rather than reminding them their lives are about to go from bad to worse.

Keeping your relationship peaceable at this difficult time will go a long way toward building lifelong customer satisfaction. In the process, because you’ll have gotten them signed up for a program, you’ll keep revenue coming in.

When this storm passes, and it shall, offer them news of your amazing job training courses, workforce development programs and attractive employee benefits. Who knows? Today’s delinquent customer could be tomorrow’s Employee of the Month.

We hope this exploration of the Yellow Zone has been helpful in understanding customer risk. Please join us again next week for an up-close look at the Red Zone. And if you’re interested in determining your utility’s Customer Balance Risk Zones, please contact us.