Customers who’ve never missed a payment before but suddenly do this month indicate a new swath of people in need of assistance due to COVID-19. Luckily, reaching them with help is possible, through data-driven customer personas.

26 million Americans have applied for Unemployment Insurance (NPR.org) since the coronavirus crisis hit the U.S. The pandemic’s economic claws have already scraped through the retail, hospitality and food service sectors, accounting for many of those Unemployment applications.

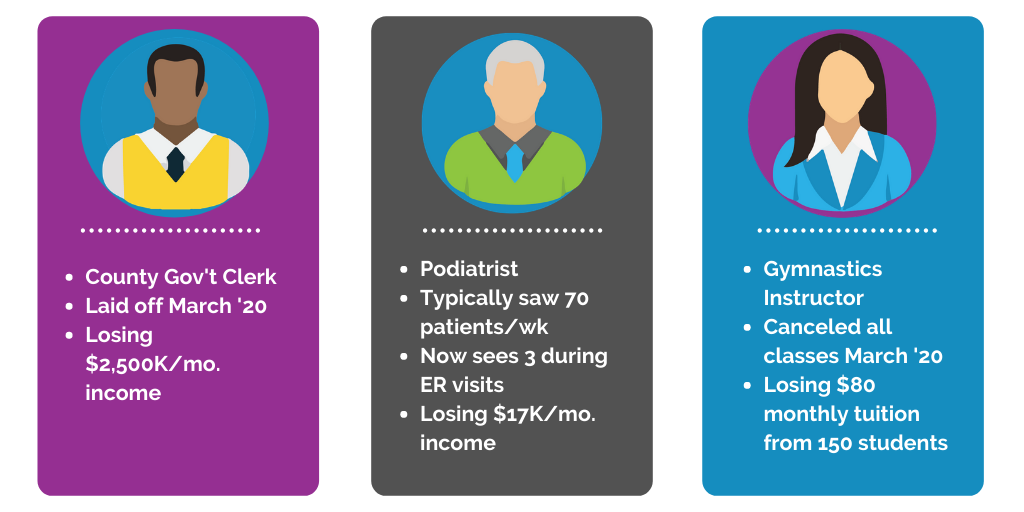

Now they’re piercing non-emergency medical professionals – workers at dental, dermatological, and chiropractic offices, for example, can’t treat their patients (or at least, not nearly as many of them). Construction has been halted, leaving laborers and managers out of work and architects and engineers with reduced hours. Local governments in Pennsylvania, Michigan and elsewhere have laid off thousands of staff. Artists, dancers and musicians can’t perform. Home service providers, like carpet layers, nannies and cleaning companies, can’t serve clients.

Please note that these are sample personas and are not based on specific individuals.

Meanwhile, countless more Americans have lost part-time positions, freelance contracts and gig work – the kinds of jobs that often make workers ineligible for Unemployment benefits. While the federal government irons out a new stimulus package to assist some of them, many of the still-employed juggle online work with no childcare, diminished productivity and reduced hours.

Either way, a lot of paychecks are thinner these days, if they haven’t vanished altogether. Which means that many workers who may have seemed perfectly fine, financially speaking, two months ago are likely teetering over the edge of instability now, and they may not be able to pay their bills in the coming months.

Living On The Edge of Risk

Consider these facts about the typical, middle-income wage earner:

- The average yearly income in America is $64K (Wallethacks.com)

- 59 percent of Americans live paycheck to paycheck (Investopedia.com)

- The average American’s mortgage payment is $1,030/month (Lendingtree.com),

- The average American household carries $5,700 in credit card debt (Valuepenguin.com)

- The average college-educated American needs 20 years to pay off a school loan (cnbc.com)

- 18 percent of six-figure wage earners live paycheck to paycheck (Investopedia.com)

Taken together, these stats paint a dire picture, one that grows even more perilous for workers who have more little mouths to feed at home. If any of your customers look like the folks above, they’re going to need your help, stat.

While the most vulnerable populations should continue to present a major concern throughout this crisis and beyond, newly-at-risk households ought also to raise an alarm.

How to tell the difference?

A review of customer payment history will be telling. Look for the usually-on-time payers. The small-balance carriers. The family households as opposed to non-family roommates.

If they pay late in April, assume COVID has taken its toll on them, in some form, and reach out with solutions to keep them afloat.

A lot of employers didn’t impose layoffs or furloughs until the end of March, so this newly-at-risk group likely held steady until now. With bills coming due again and savings accounts getting drained, folks who miss April’s payment will need attention. And May will be even more telling, which means putting a plan in place to reach these customers now is critical.

It’s crucial to note that these customers may have never needed a lifeline before, and they may have no idea what programs or services are available to them now. The messaging that may once have resonated with them may not be relevant anymore, and what they’ll need moving forward will look very different.

Service Providers Doing Their Part

Utilities, telecoms and financial service providers could engage these newly at-risk customers effectively – right now – to help them stay afloat.

“A little help will go a long way with this group,” explains BlastPoint CEO and co-founder, Alison Alvarez.

Through our research at BlastPoint, we know that these are the kinds of customers who, more often than not, are most likely to quickly complete application forms and submit required paperwork. Why? They’re typically more engaged with your business.

They surf your website. They’ve signed up for your digital platforms. They like automatic alerts. They interact with your mobile app or respond to emails. These behaviors indicate they’re generally on top of things and work to avoid accruing more debt.

Thankfully, companies plan for times of crisis by creating special assistance programs or adapting existing ones. They know they need to support folks who go through extenuating circumstances from time to time. Doing so is good business. It keeps customers happy and returning, and it generates goodwill.

If there was ever a time to shout from the rooftops that your company offers customer assistance, it’s now.

Even as so many people require extra help now, offering them a break will allow companies to recoup something rather than nothing, which is a huge risk during this pandemic. Put another way, a little help now could prevent at-risk customers from defaulting altogether later. And we know through our research that pursuing default measures – sending trucks to a home to cut the gas line, for example – is costly, for both customers and companies.

Take Advantage of Existing Platforms to Boost Engagement

Thankfully, defaults are avoidable with effective outreach. Engaging the newly-at-risk shouldn’t cost much in advertising or employee time. Remember, these are customers who are already engaged. They’re digitally-adept. Typically responsive to outreach about other issues. They’re low-hanging fruit, especially now, and ripe for enrolling into assistance programs. Take advantage of your existing engagement infrastructure to boost the signal of whatever you’re able to offer in the way of assistance.

Like a lot of companies, many of your customers likely fall into the ‘middle class, middle income’ bucket. You could assume, correctly, that these are folks who might need a little help from time to time.

But that’s not enough, especially during times of crisis like these, to show us whether certain customers will remain truly safe or if they’re going to require intervention in the coming months.

We need to look at more data to figure out what’s underlying their current, past, and potential future circumstances. While Unemployment data is still murky and we don’t necessarily know which precise customers have been laid off, we can analyze their payment histories now in order to understand what they’ll need in the future. This is one reason building customer payment personas for your initiatives allows you to hit the ground running during a crisis.

For more on how to find, keep and engage your customers with BlastPoint, explore our solutions, learn more about our initiative-specific customer personas, and get in touch today.