Businesses have few options when it comes to collecting payments on delinquent accounts. One, send notices. Two, make phone calls. Three, send the account to a third-party collection agency. Or, four, cease account activity until the customer pays. These options lead to an increase in operating costs and strain on customer relationships. However, BlastPoint’s innovative household-level predictive AI is providing businesses another option. Predict future delinquency spikes – our platform provides teams with the insights to target at-risk customers with the right messaging through the right channels, when they need it the most.

Collection departments historically experience an ebb and flow throughout the year. Pre-pandemic, these departments could prepare for oncoming seasonal spikes – and typically that meant hiring third-party agencies to manage the increase of outbound calls for payments. However, since 2020 collection departments across industries struggle to collect on and decrease past-due balances.

Simultaneously, as teams work to collect on current delinquent accounts, they are failing to target customers who are most at risk of defaulting in the future.

In this article, we’ll show you how using household data, at a residential level, can help predict payment trends and help your team create actionable campaigns to get more customers to pay in full and on time to avoid delinquency spikes later.

Using Predictive AI to Avoid Future Delinquency Spikes

Every organization experiences an ebb and flow in its collections cycle. Responding to seasonal spikes typically includes teams working overtime, hiring more personnel, or outsourcing the entire list of past due customers to third-party agencies. Overall, operating costs increase when attempting to recoup payments, and unfortunately, when at the same time, payments coming in may be at their lowest.

Predictive modeling is a statistical technique used by data scientists for determining future outcomes. BlastPoint’s A.I.-based predictive modeling can be performed on each household in your database, helping you to anticipate every customer’s next step and letting you meet them before they’re past due, with relevant, revenue-generating solutions.

1. Identify Factors That Drive Delinquency Spikes

Collections data is the most complex customer data. Because of this, many companies avoid analyzing their collections data. Many just don’t have the sophisticated tools necessary for this major undertaking.

Every AR team, across industries, meets regularly to discuss collection backlogs. At a high level, they discuss factors that are driving delinquent spikes. At this moment, each may cite reasons of inflation, impacts of the power bill crisis, and unemployment – to name only a few. However, these reasons fail to identify the specific factors that affect your customer, individually, at a household level.

What do we mean by “household level”? Unless your business is surveying every single customer, you don’t actually know what factor(s) are affecting that customer and keeping them from paying. Rather, you’re making high-level assumptions, lumping all past-due accounts into a single segment. Doing this makes it impossible to target customers with relevant programs or messaging that can assist that customer in paying their bill(s) and increase overall customer satisfaction.

At BlastPoint, we utilize AI and machine learning to understand patterns in customer behavior by attributing events to specific payment behaviors and program enrollment. Our Technology makes it possible to map the collections journey for a company’s entire collections database, as well as for distinct customer segments. Mapping allows your team to identify factors that drive spikes so they can intercede with the relevant programs that support the continuity of payments.

2. Profile Customers Who Are Most At-Risk of Nonpayment

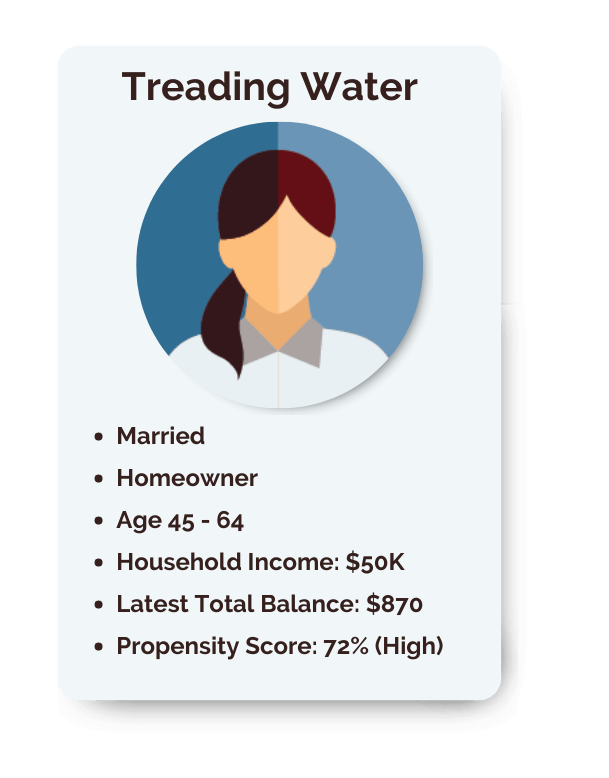

Utilizing BlastPoint’s Customer Balance Risk Zone analysis can not only help your team collect on current past due customers, but predict future delinquency spikes as well.

BlastPoint’s household-level data analysis of customer payment histories allows companies to find and prioritize customers most at-risk for accruing high balances and being unable to pay.

Our Customer Balance Risk Zone feature defines and assigns your customers according to their propensity to pay in full, partial, or not at all. These thresholds combine your internal data (including billing and payment information, program engagement, and customer journey data information) with BlastPoint’s data (including open data, 3rd party data, and our own proprietary data) to reveal insights such as:

- Customer benchmarks, or a household’s typical payment behavior over time;

- Irregularities to that benchmark – which would indicate whether that household has hit hard times or is maintaining financial security;

- Overall payment patterns within your company’s footprint – which indicate the average dollar amounts that are due and overdue by neighborhood; and

- Thresholds that show the exact dollar amounts that customers are willing or able to pay, either in full, in part, or not at all.

Check out our article on how to Find Your Good Payers with Customer Balance Risk Zones where our founder shares insights into understanding bill pay data.

As you can see, identifying a customer’s propensity to pay, according to data-backed analytics, allows for a better understanding and insight into predicting future cash flows. Next, BlastPoint’s Customer Intelligence Platform provides teams with the ability to target at-risk customers with relevant information through the channels they are most likely to respond to.

3. Target At-Risk Customers Through the Right Channels

Collection departments typically utilize few channels to reach customers with bill pay information. Email, snail mail, phone, and possibly SMS – depending on whether or not your company offers this program, and if your customer agrees to this form of communication. When physical resources are utilized, operation costs go up.

Customers experiencing hardships are not likely to respond to your typical collection outreach efforts. So, it’s up to the company to adjust its messaging and communication style to increase engagement with those unengaged customers.

Many times, customers are unaware that a company offers programs to assist with payments. Utilities, for instance, offer assistance programs to help income-eligible customers pay their bills. Whatever your program may be, it’s important to get that information to the customers who need it the most.

Our technology can assign individual propensity scores to every customer in your database. Once the ‘propensity for’ is defined, teams can see how likely a customer is to enroll in your available program. To use the previous utility example, the provider can segment customers with the highest propensity to enroll in assistance programs, and follow by reaching them through their preferred channel with this specific information that the customer is most likely to be interested in.

Customer channel preferences allow teams to avoid spray-and-pray messaging. Rather, teams can create campaigns to reach customers through the channel they are most likely to respond to. Insights may reveal your at-risk customers highly engage with Facebook, or, they may prefer cell phones over email or vice versa. Direct resources toward reaching customers to increase engagement and decrease operating costs.

Learn how our partner increased paperless billing enrollment and generated over three times its ROI in under a quarter by reaching target customers through the right channel at the right time by downloading their case study.

Our methodology is easy and fits within existing workflows – so your team doesn’t have to rewrite its current collections procedures. Rather, we provide teams with insights into identifying factors that drive delinquency spikes and profile customers who are most at risk of falling behind on payments. By targeting those customers with the right information at right time through the right channels, teams can save on operating costs and increase customer satisfaction.

Visit our case studies page to see more results we’ve helped companies achieve, and get in touch with our Solutions Experts to talk about how customer intelligence can help your team boost engagement and improve customer experience.