- Understand the typical and expected behavior patterns of each, individual customer

- Predict the products or services each household is likely to buy or seek information about next

- Intervene during a crisis to offer relevant solutions that keep customers engaged and satisfied

A.I.-based predictive modeling can be performed on each household in your database, helping you to anticipate every customer’s next step and letting you meet them when they get there, with relevant, revenue-generating solutions. Here’s how businesses are using it to get ahead.

What Is Household-Level Predictive Modeling?

Predictive modeling is a statistical technique used by data scientists for determining future outcomes. It’s applied in fields like healthcare, sports and cybersecurity, among others. And it’s used to predict things such as the likelihood certain groups of people will develop a disease, or which football teams could make it to the playoffs.

At BlastPoint, we apply predictive data modeling to help businesses better understand their customers as individuals. We put our statistical analyses to work at the household level, placing predictive models onto each and every rooftop in a company’s customer database.

This gives companies the ability to better understand their customers’ buying decisions, habits and values. It lets business teams see just how differently each household behaves, what solutions would be most meaningful for them, and what kinds of triggers are most likely to motivate those people to act.

The Benefits of Household-Level Predictive Modeling

Three of the biggest benefits we see our partners deriving as a result of household-level predictive modeling are:

- Improved customer service performance and, thus, increased customer satisfaction,

- Boosts in customers participating in special programs that generate revenue, and

- Effective crisis management.

Let’s dive into each of these areas more deeply.

Improved Customer Service Performance & Increased Customer Satisfaction

When a customer calls a 1-800 number and the service representative pulls up their information, the rep can usually see the caller’s name and account number. Perhaps they see the amount a person currently owes, an address and phone number.

But what if the rep could know more?

Imagine seeing the customer’s past payment behavior. The steps they’re most likely to take with your company next. Suggestions for special programs the customer is a good match for. A score showing how likely that person is to enroll in a given program. A list of relevant products that would appropriately suit that caller’s situation.

You can imagine the engaging, efficient conversations the customer service rep could carry on with customers if they had those kinds of insights at their fingertips. But imagine no more. All of that is possible when we apply household-level predictive modeling to your customer database.

When every household is given a statistical model that lays out their most likely customer journey, business teams get a fuller picture of the humans they’re serving and, thus, know how to best interact with them.

With household-level predictive modeling, customer service reps are able to know exactly what kinds of solutions their callers need–sometimes before the callers even realize it, themselves. That means reps are problem-solving effectively and quickly. And they’re offering appropriate, relevant, data-backed suggestions for actions each customer can take.

Naturally, when customers are met with solutions that meet their needs, when they’re given helpful suggestions tailored just for them, they’re satisfied. And when customers have positive experiences like these, they’re more likely to remain customers for life.

Higher Customer Participation in Special Programs

Household-level predictive modeling grows participation in programs that generate revenue or save money. We’ve applied this process for our utility partners to boost enrollment in paperless billing (to reduce company spending on postage), in payment assistance (to ensure customers don’t fall behind on their bills), and more.

Case Study Download: Boost CAP Enrollment and Prevent Lost Revenue with BlastPoint Billpay Personas

By applying a predictive model to every household, our partners could see which customers were the best fits for those programs. More than that, they were given a score showing how likely each customer was to enroll. Teams also learned which media channels would most effectively reach those customers, so they funneled marketing dollars toward the right platforms.

This was critical information to know, given that no two customers are alike. One customer may be interested in switching to e-statements to save money on postage. Another may be motivated to go paperless to ‘save the trees.’ Predictive modeling distinguished between these two very distinct customers.

Case Study Download: Enroll More Customers in E-billing & Save Millions of Dollars

And, just as Amazon suggest we buy items because similar shoppers also purchased them, predictive modeling can make suggestions for programs and services your similar customers may be interested in.

For instance, the customer who enrolled in e-statements to save money might also like to know she qualifies for Budget Billing, based on her past payment record and income level. Signing up could save both her and the company money down the road by ensuring she stays on track, financially. The customer who wants to save the trees may also be ripe for receiving information on electric vehicle rebates or smart thermostats based on other green values and income data. Special products and services like these generate revenue and lifelong loyalty.

Effective Crisis Management

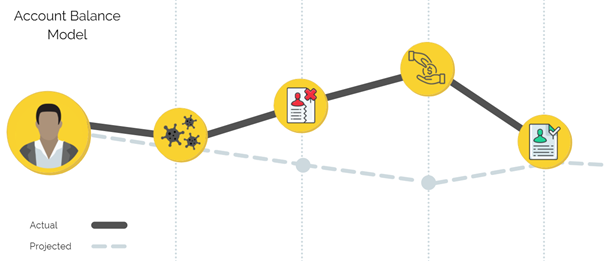

Household-level predictive modeling is being used to manage crises like the Covid-19 economic downturn. Statistical analysis on each rooftop protects customers and prevents lost revenue, as we’ve shown through BlastPoint’s Customer Balance Risk Zones.

With full, predictive pictures of every customer, business teams know what a typical customer journey ought to look like for each household. More importantly, when a crisis strikes, they know when a household suddenly steps off their predicted pathway.

Any divergence from the model indicates a problem, signaling the customer likely needs help.

Millions of Americans lost their jobs throughout the coronavirus pandemic. That meant they couldn’t cover every credit card, rent, mortgage, water, electricity or gas bill. Shut-off, late fee and foreclosure moratoriums went into place to protect them. But that translated into billions of dollars in lost revenue for the companies not receiving payments.

Some of our utility partners used predictive modeling to enroll struggling customers into payment assistance programs. But even some, typically-good-paying customers began to miss payments, so our partners knew it was time to act.

Taking Swift Action During a Crisis

Predictive modeling showed them who to reach out to (typical good payers who showed no other signs of financial risk). Taking those customers’ historical payment data into consideration, the company knew these folks had excellent track records, with very few instances of shut-offs or delinquencies. They also realized this cache of customers was unfamiliar with the dunning process, so they should be sent messages about the consequences of lapsed payments.

Launching swiftly into action, our partner sent an email urging these good payers to contribute any amount they could toward their bills, as soon as they could. They let the customers know avoiding delinquencies now would prevent future late fees and shut-offs.

Within a week, 47 percent of those customers paid their balance in full, recouping hundreds of thousands of dollars for the company.

Household-level predictive modeling helped our partner pivot during the coronavirus crisis. They used it to protect at-risk customers and prevent devastating revenue losses . It can help others do the same, no matter what type of business they run, and no matter what crisis strikes next.

For more information on BlastPoint’s household-level predictive modeling, reach out to us! We’d love to hear about your goals. Be sure to sign up for BlastCast, our weekly e-newsletter, and don’t forget to follow us on LinkedIn, Twitter and Facebook for the latest news on data-driven customer intelligence!