Every year, utilities write off millions of dollars of debt caused by customers who don’t – or in many cases can’t – pay their bills. Optimizing your collections process starts with AI-powered, objective-driven segmentation. We’ll show you how BlastPoint’s Customer Intelligence Platform maps collections journeys so teams can invest resources and intervene to recoup lost revenue, decrease overall costs, and keep customer satisfaction high.

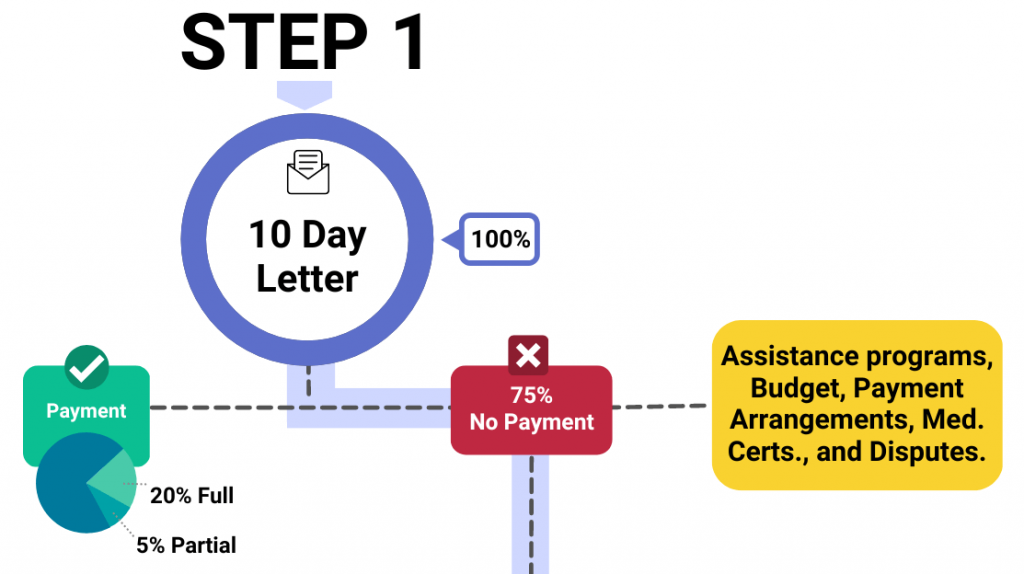

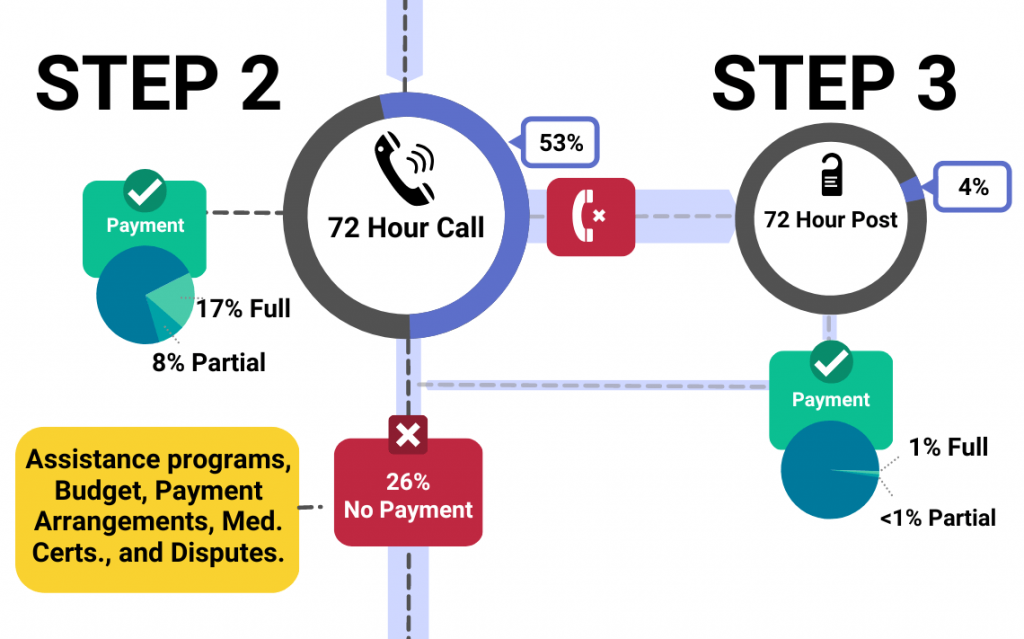

Collections payment data is particularly complex. Not only are there multiple steps, but there are multiple ways at each step for a customer to pay along the process. For example, beyond simple cash or credit transactions, payments can be received via assistance programs, grants, medical certifications, etc. Even more, customer service representatives may handle payment situations differently – like accepting partial payments – which further complicates mapping the collections journey.

As utilities and their customers navigate a volatile economy, it’s becoming more critical to understand your collections data. As you know firsthand, collections is an expensive process. Expenditures become more significant the further a customer moves along in the process. Furthermore, customers who end up in collections are typically less satisfied, negatively impacting the utility’s overall CSAT scores.

In this article, we’re sharing how mapping collections events and attributing collections payment behaviors to customer segments can help your team build an effective strategy to reduce debt and overall operating costs. With fewer customers in the dunning process, CSAT scores are likely to rise.

Learning from Collections Data: Payment Attribution Models

Enriching internal data with external sources – demographic and psychographic data – provides teams the ability to create powerful collection campaigns. Teams can segment customers based on attributes like communication and channel preferences, as well as propensity to enroll in programs or engage with new technologies. However, collections data becomes predictive, revealing patterns in behavior, when enhanced by AI and machine learning algorithms.

Using payment attribution models – ie, models that attribute specific payment actions to specific steps in the collections process – helps teams to enhance their collections strategy. With this method, it’s possible to understand which steps in the collections process are most successful at triggering payments, especially full payments, and which need to be optimized. Resources can then be directed specifically toward those steps in the process.

Step 1: Optimizing Collections Outreach

Reducing collections events begins with predicting future customer household billing trends. However, to predict the future, you have to examine the past.

Uncovering past trends with AI can reveal why customers are diverging from their individualized predictive model. For instance, what prompted customers to pay vs. those who didn’t? What’s causing “good” payers to suddenly partially pay, or not pay at all? Are “bad” payers more likely to view statements by cellphone or email?

By attaching percentages as a measure of effectiveness, you’ll discover that as customer segments vary greatly, so will your approach to outreach.

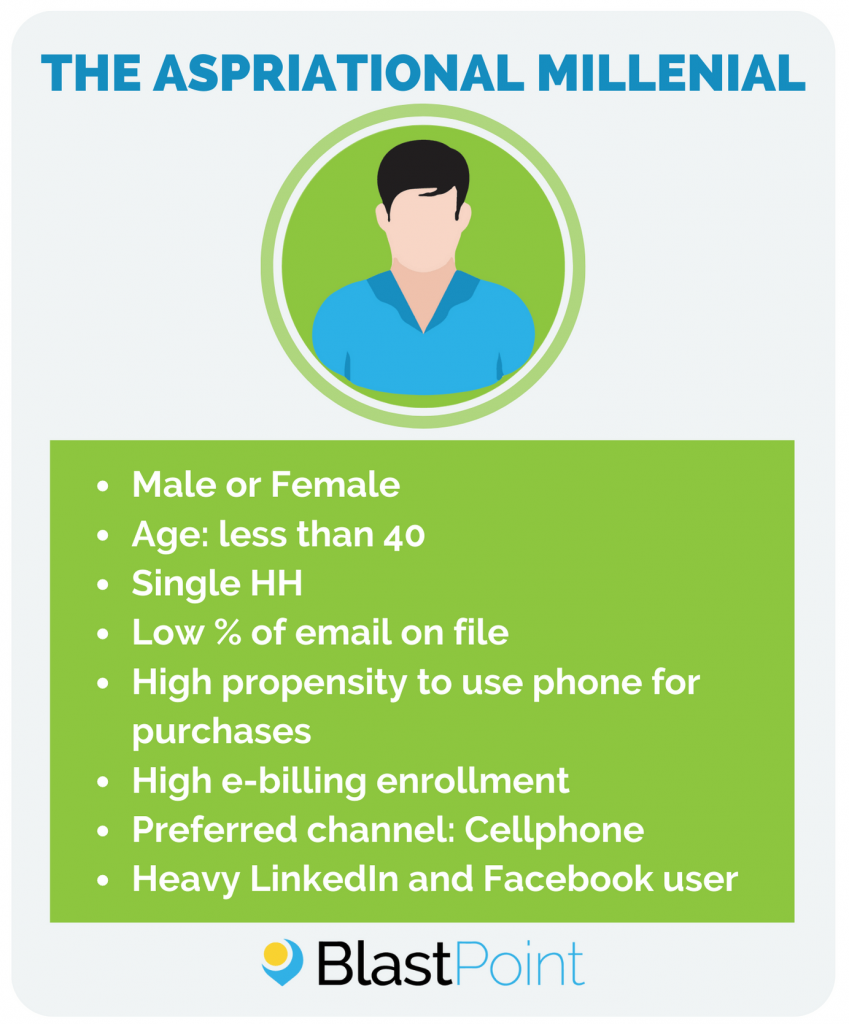

“The Aspirational Millenial”

For example, your data may reveal “The Aspirational Millenial” makes up the largest segment of your past due accounts. The group shares similar characteristics and traits including low income, more likely to be single, and high social media and cellphone activity scores – to name a few.

By understanding how that segment diverged from collections norms, as well as identifying preferred channels and effective messaging opportunities, your team is able to:

- Conduct proactive outreach to this segment prior to collections season to raise awareness of assistance programs,

- Provide new channels and opportunities for engaging with this specific demographic, and

- Take personalized action at specific steps in the collections process.

Reduce Operating Costs by Increasing Paperless Billing Enrollment

Each month, utilities can spend hundreds of thousands of dollars on mailing paper bills to their customers. Those that choose to optimize their collections process by increasing paperless billing enrollment can reduce those costs by millions.

One utility partner sought to do just that. With over 700K customers across three states, the utility spends $.60 per customer for each mailing. To reduce costs and improve customer experience, our partner utilized BlastPoint’s data-driven customer insights to understand what motivates customers to convert to paperless and then targeted customers with the highest propensity of signing up. Within three months of implementation, they saw a $1.3 million reduction in costs. Learn more about how they did it!

Step 2 & 3: Increase Customer Assistance Program Enrollment

According to NEADA, more than 20 million families are behind on their utility bills. Likely, a large portion of your past due customers are in need of assistance program information to help them through these tough times.

From what our partners’ experience and data indicate, when utilities create actionable customer campaigns aimed at engaging low-income customers through the right channels with the right messages at the right time, utilities not only experience an increase in assistance enrollment rates but surpass industry benchmarks and decrease their overall operating costs as well.

Understanding how many customers are going on assistance or other bill pay programs at each step of the collections process can impact your utility greatly. Enrollment in these programs is linked to higher CSAT and teams across the organization can use this information to improve customer service and communication strategies.

DID YOU KNOW?

The Low Income Energy Issues Forum found that nearly 30% of utility customers “aren’t aware of payment assistance options” available to them. Even more, that percentage increased to 39% among 18 to 34-year-old segment.

Having household-level, predictive insights at your fingertips allows you to increase awareness of assistance programs and identify the customers who need it most.

Our partner did, and the results speak for themselves!

Knowing that customers were struggling to pay their bills, they sent a single, targeted email campaign to 6k income-eligible customers with relevant CAP and LIHEAP information. Within weeks, more than 20% of those customers enrolled. Not only that, they saw LIHEAP grants double in 2022.

Learn their strategy by downloading the case study.

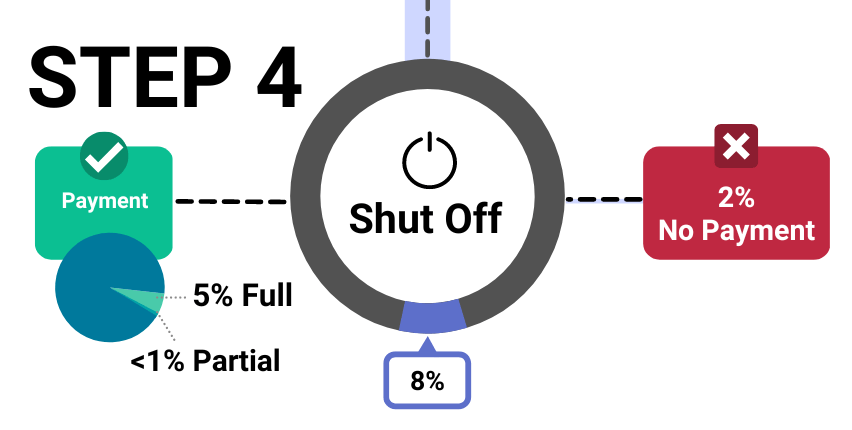

Step 4. Avoid Shut-offs

Utilities want to avoid terminations just as much as customers do. When it comes to delinquent balances, utilities need a way to discern between customers who have the financial means to pay their bills and those who are laid off, have depleted their savings, are facing eviction, battling food insecurity, or struggling with health crises.

Service termination customers need immediate outreach that includes education on how to get help and reassurance that their utility wants what’s best for them. However, customers in this stage vary in communication channel preferences, technology usage, and more – making reaching them with pertinent information difficult, at best.

Furthermore, the goal is to minimize the damage that lies ahead. You can do that by capturing as many partial payments as possible. Enrolling, and likely re-enrolling, customers in payment assistance programs can help reduce and/or prevent major revenue losses and ensure you maintain customer trust which, in the end, is priceless.

Customers experiencing shut-offs are unique and require personalized campaign outreach. Learn more about this segment in “Who’s In The Red Zone & What Do They Need?”

Our partners have taken steps to organize their data, enrich it with third-party consumer insights, and integrate it with AI. With it, they’re able to achieve robust levels of customer engagement, increase revenue, and eliminate wasteful spending. When processes are optimized, and customers are reached with the information they need when they need it most, utility CSAT scores rise.

Be sure to check out our overview of Customer Balance Risk Zones and why they’re critical for customer engagement during a crisis. If you’re interested in taking proactive steps toward engaging customers in new ways to recoup lost revenue, contact us today and schedule a conversation with our Solutions Experts.