Utilities are utilizing BlastPoint’s powerful household-level predictive insights to enroll more customers in assistance programs to help mitigate loss and make the most of opportunities to grow revenue.

The Census Bureau reported that after the start of the pandemic over 37 million US citizens were living below the poverty line. Currently, according to NEADA, more than 20 million families are behind on their utility bills.

So, why are only a fraction of income-eligible utility customers enrolled in Customer Assistance Programs (CAP)?

It’s likely that many utilities are not engaging with assistance-eligible customers with the right messages, in the right channels, at the right time.

From what our partners’ experience and data indicate, when utilities create actionable customer campaigns aimed at engaging low-income customers through the right channels with the right messages at the right time, utilities will not only experience an increase in assistance enrollment rates, but also have the ability to surpass industry benchmarks and decrease their overall operating costs.

In this article, we share these data-backed experiences of how each utility utilized BlastPoint’s Customer Intelligence Platform to engage income-eligible customers and increase CAP enrollments.

Success Story #1: How a Mid-Atlantic gas company boosted CAP enrollment AND recouped lost revenue.

The pandemic took its toll on this utility’s region of customers. Over 12% of their 1 million customers were living below the poverty line. Realizing that expensive service terminations were in its future, the utility needed to find a solution to enroll more income-eligible individuals in customer assistance programs.

Enrolling income-eligible customers in assistance programs is notoriously difficult. They found the traditional, one-size-fits-all approach to building awareness of their state’s Customer Assistance Program (CAP) was going unnoticed, hardly ever reaching the targeted customer. Furthermore, teams across the organization found its customer data was fragmented, making it difficult to understand their payment behaviors and communication needs.

So, the natural gas utility sought BlastPoint’s predictive software to help satisfy 4 goals:

- Enroll more low-income, at-risk customers in CAP

- Cut costs of employee time spent attempting to recoup lost payments

- Minimize expensive service terminations

- Generate more early, consistent payments to secure revenue

Through data integration and enhancement, BlastPoint gave the company a proactive tool to drive precision-targeted customer engagement campaigns. The user-friendly software was implemented within 3 months and generated customized, household-specific, appropriate CAP personas.

BlastPoint uncovered which modes of communication the utility’s customers were most likely to respond to including Facebook, snail mail, radio, TV, or direct email. As part of their first campaign, they chose email as their first channel to promote CAP.

The targeted email campaign was sent to 6K income-eligible customers with information about how they could get help through CAP. The response? Within weeks, more than 20% of those customers enrolled in the program.

Not only did the utility increase enrollments, but fewer shut-offs, write-offs, and customers in the dunning process saved the utility thousands of dollars in potentially lost revenue. From there, the utility expanded its campaign outreach to each channel furthering its CAP enrollment progress.

Download the full case study to learn how BlastPoint’s propensity scores and predictive personas can help your utility prioritize channel communication strategies and CAP enrollment here.

Success Story #2: This PA energy utility increased assistance enrollment AND surpassed industry benchmarks.

Duquesne Light Company provides energy to more than 600,000 residents in the Pittsburgh, Pennsylvania area. When the pandemic struck, hundreds of thousands of residents in the area filed for unemployment, leaving many unable to pay their utility bills. DLC needed a solution to help mitigate rising consumer debt levels during the Covid-19 crisis and its immediate aftermath.

DLC is committed to more than keeping the lights on – pledging to their customers, “We’re here to help.” The DLC teams knew they needed to work together to ensure their current and new low-income segment customers had assistance available to them. To keep their word, they sought BlastPoint’s customer intelligence solutions to identify target customer segments for low-income email outreach campaigns.

However, like many utilities, DLC customer systems were fragmented and therefore difficult to make sense of. BlastPoint provided a platform solution that integrated all of DLC’s internal customer intelligence (including call center, billing and payment information, program engagement, and customer journey data information) with BlastPoint’s data (including open data, 3rd party data, and our own proprietary data) into one platform. DLC now had a 360-degree customer profile accessible to each team throughout the organization.

With this information at hand, their teams could personalize customer experiences at scale, using the highest impact channels and messaging to increase CAP engagement.

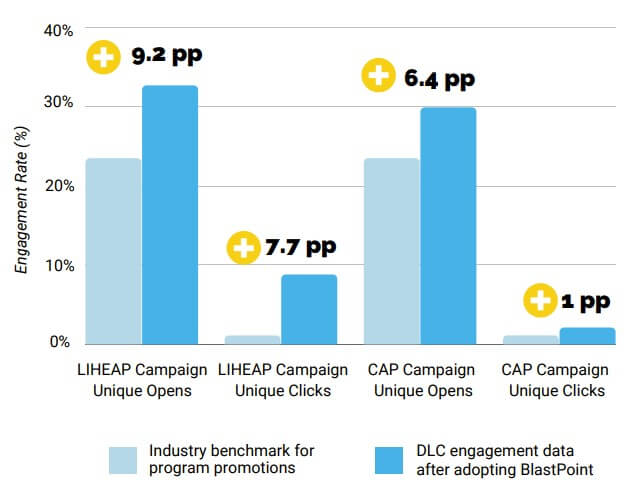

As a direct result, DLC increased engagement with customer assistance programs up to 670% over industry benchmarks using BlastPoint’s data-driven customer insights.

Unique email open & click rates surpass industry benchmarks by as much as 9.2 percentage points

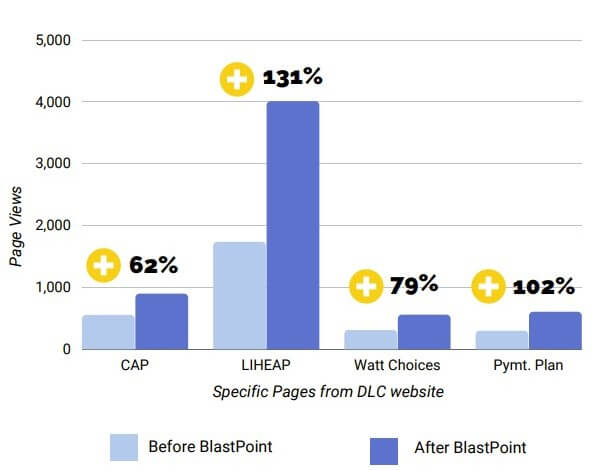

Assistance webpage engagement more than doubled over the previous period

Additionally, they boosted payment-in-full rates by targeting customers who had recently received a dunning letter with relevant information about energy assistance and other payment programs, such as Budget Billing. Payment-in-full rates were 10% higher among customers who had received targeted communications than those who did not.

Download the case study to learn exactly how DLC utilized BlastPoint’s customer intelligence to identify target customer segments for low-income email outreach campaigns here.

BlastPoint helps utilities predict payment problems by defining their Customer Balance Risk Zones.

Preparing for a crisis is an enormous challenge, even when you put decisive action plans into place early on. But in a prolonged crisis, such as the coronavirus outbreak, events unfold and change quickly over the course of days, weeks and months, and utility companies especially face threats on many fronts. Revenues plummet. Employees suffer. Customers struggle. Services are limited. More and more customer balances go unpaid.

However, applying household-level data analysis of customer payment histories allows utility companies to find and prioritize customers most at-risk for accruing high balances and being unable to pay.

Preparing a Customer Balance Risk Zone analysis will reveal:

- Customer benchmarks, or a household’s typical payment behavior over time;

- Irregularities to that benchmark which would indicate whether that household has hit hard times or is maintaining financial security;

- Overall payment patterns within a utility’s footprint which indicate the average dollar amounts that are due and overdue by neighborhood; and

- Thresholds that show the exact dollar amounts that customers are willing or able to pay, either in full, in part, or not at all.

BlastPoint offers solutions that enable your team to identify and prioritize customers who are most at risk for defaulting on payments – within a matter of weeks and are implemented with ease across your org chart.

Check out our free resources for getting started with your crisis engagement strategy here. Your customers are your lifeline, and when they fall behind on payments, so does your business strategy.

BlastPoint’s platform democratizes customer intelligence, so that every organization, no matter the size of their staff or the state of their data, can improve their campaign outcomes almost immediately. With our predictive insights at their fingertips, teams know exactly where customers are on their journey and engage effectively.

Visit our case studies page to see more results we’ve helped companies achieve, and get in touch with our team to talk about how customer intelligence can help your team boost engagement and improve customer experience.