People who are curious about electric vehicle ownership and expressing mild interest in buying one eventually are Emerging EV Buyers. They share certain demographic, lifestyle and consumer traits that we’re sharing today, in Part 2 of our 3-part series on EV Readiness. Drive EV adoption in your region by targeting Emerging EV Buyers now, with outreach that resonates.

In case you missed it: Ready-to-Buy EV: Part 1 of our EV Readiness Series

Emerging EV Buyers: Overview

According to our research, emerging EV Buyers tend to exhibit the following general traits:

- Middle-range incomes,

- Some college education,

- Own at least one vehicle,

- Live in single-family homes,

- Show moderate engagement with online accounts.

Let’s dive deeper into these characteristics to better understand the unique individuals who make up the customer segment of Emerging EV Buyers.

Emerging EV Buyers: Demographic Profile

Emerging EV Buyers are most likely to occupy single-family homes where an of average two adults live, many with children. They are somewhat college-educated and generally work in white-collar jobs (think administrative, government, IT, healthcare support roles, education, etc.). But you’ll find blue-collar workers and the occasional homemaker among this group, too.

Unlike the Ready to Buy EV group, who earn higher-than-average incomes, Emerging EV Buyers earn middle-range incomes. Depending on regional costs of living, this number varies, of course. But several main factors will contribute to their household earnings and, therefore, overall buying power.

Children in the Home + Career Advancement

Emerging EV buyers, if they have kids, are likely to have younger children than those who are Ready to Buy EV. What we know about higher-earning consumers, generally, is that they tend to have ’empty nests’, or older children living at home who can work and contribute to household expenses. Or they have no kids at all.

This suggests:

A) Emerging EV Buyer parents are somewhat younger than those who are Ready to Buy;

B) That Emerging Buyers are earlier in their careers than Ready to Buys, which explains their more modest salaries; and

C) One parent in the Emerging EV Buyer household may be taking time off work to raise the kids, meaning the family relies on one income to cover expenses.

Not all Emerging EV buyers have children, of course. But those who don’t might be starting off their careers or paying off college debt before they start families.

Accelerate EV adoption with A.I.-driven data analysis and targeted customer personas. Learn more.

Emerging EV Buyers: Lifestyle & Values

What’s most important to the average Emerging EV Buyer is affordability. They’re juggling finances, feeding families, and during the Covid era, may have struggled with a layoff or furlough, or taken time off work to care for children.

Like most American households, Emerging EV Buyers are managing credit card debt, healthcare bills, school loans, a mortgage or monthly rent on top of groceries and a modest entertainment budget.

When it comes to energy usage, they are mindful of their heat, water, phone, internet and electricity bills. That means this group is looking for ways to save money generally and on their utilities.

Perhaps they live in older homes with drafty windows. Maybe their attics lack sufficient insulation so heat escapes in winter. If they live in the suburbs, they probably drive a lot, paying frequently to fill their gas tanks. If they live in a city, steep parking fees may be a drain on resources. Routine car maintenance is likely adding up.

Anywhere they can save a few dollars–without having to sacrifice comfort (also a top priority)–would give them that wiggle room middle-class earners deeply value.

2021 EV Outlook: Download the Report

What appears to be at least slightly less urgent for this group are environmental issues. But this probably isn’t because they don’t care about the earth. Instead, they may just feel powerless over such an omnipresent issue as global warming.

Harken back, however, to their likelihood to act upon receiving new information. Emerging EV Buyers, when armed with facts, figures, testimonials, proof, engaging content, videos, even ads featuring their favorite celebrities, are motivated to launch into action.

Emerging EV Buyers: Consumer Engagement & Behavior

This group of busy families and professionals are active in life and online. They prefer Facebook and LinkedIn above other social platforms. But newspapers, magazines and television engage them, too. In other words, these folks are tuned in to all kinds of media. They’re likely aware of new trends, the latest music, viral memes and popular shows.

Given their incomes and lifestyles, however, these people are modest shoppers. Their buying choices echo their moderate environmental concern. It’s hard to ‘go green,’ after all, when you’re raising children on a budget. (The amount of single-serve snacks in excessive packaging that kids eat are both the savior and the bane of many parents’ existence!)

But even Emerging EV Buyers who don’t have kids probably view things like organic food as a luxury. Green cleansers and soaps are typically more expensive than traditional, so they don’t buy these as often.

Remember that keeping to a budget is important to this group, as they are juggling expenses and trying to maintain a life of security. Showing how they can save money right at this moment as well as in the future is essential to keep in mind when informing them about electric vehicles.

Emerging EV Buyers: Community Preparedness

Emerging EV Buyers may live in communities that aren’t walkable and/or don’t have good public transit. This explains why they own at least one vehicle. It also suggests they may be in the market for a second one in the coming months or years.

In addition, their homes might not have a garage, or they might live in a multi-family apartment or townhome complex. If they have to park on the street or in a shared lot, the idea of EV charging presents a barrier (most EV owners charge their cars at home).

Identify & Engage Partners to Expand Public EV Charging Infrastructure: Download the case study

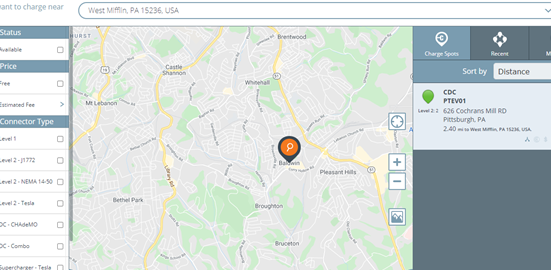

They need to understand their municipality’s rules around sidewalk charging. They need to be reassured that installing an on-street charger isn’t going to mean paying for anyone who comes along to charge. And they need to know that they can access public charging at nearby businesses so they don’t get stranded. That makes fast, public charging in their communities a must to pull them along the adoption curve.

Unfortunately, we’re seeing lackluster growth in EV charging infrastructure in many of these suburban and exurban ZIP codes where they reside. Common retailers like Target, and even fast-food chains like Wendy’s, do have charging. But we see this more often in densely populated urban communities or, recently, at rural highway interchanges, than in residential neighborhoods.

All of that is great progress, of course. But it will take more expansion–like neighborhood hubs equipped with fast-charging, EVSE in multi-family residential complexes, free workplace charging and more–to convince Emerging EV Buyers it’s safe and convenient to go EV.

Emerging EV Buyers: Predictive Personas

A.I-powered predictive personas reveal which households in your company’s internal data fall into the Emerging EV Buyer category. With that knowledge, business teams drive outreach and engagement, pulling these folks farther along the EV adoption curve.

That’s because they know who to target with educational materials centered around affordability, household savings and quality of life, which ought to resonate with their values and behavior. And they know where to reach Emerging EV Buyers: on Facebook and LinkedIn. Sustained targeting with information and offers relevant to their concerns may motivate these customers to adopt.

We typically dive into even more granular detail for our customers when engaging in the EV Readiness analysis. So if you’re interested in discovering the Emerging EV Buyers (and other groups) in your data, please reach out to us here.

Also, sign up for our weekly e-newsletter, be sure to follow us on LinkedIn, Twitter and Facebook. And come back next week for Part 3 of the EV Readiness series: Roadblocked EV Buyers.