Nationwide, regulated utility shut-off suspensions are ending, at least for some customers. Several states are leaving the shut-off freeze in place for lower-earning customers while lifting it for those earning above a certain percentage of the poverty line. That means utilities are left with a very small crop of high-earning (albeit delinquent) customers to whom they can send collection notices. How can they know which customers, among the hundreds of thousands they serve, have the means to actually pay what’s due? How can they differentiate them from people who are earning less and legitimately struggling?

The answer lies in good data; specifically, mature data. Utilities with mature data hold the power of business agility, which means they respond quickly, can pivot during a crisis and set proactive plans into motion immediately to fix their problems. One of our partners had already worked toward data maturity last fall as moratoriums were ending, and it managed to salvage $400K in just one week by targeting customers who could afford to pay but, for one reason or another throughout 2020, hadn’t.

Keep reading to learn how they did it.

Skipping payments in the time of Covid

It’s New Year’s Eve, 2019. A young bachelor earning six figures attends a black-tie soiree. Loving life, enjoying success, he’s just bought his first house and upgraded from a middle-of-the-road sedan to a spiffy sports car. As the clock strikes midnight and cheers ring out, he meets the woman of his dreams. The first days and weeks of 2020 go by in a whirlwind of fancy dinners and canoodling.

Then Covid hits. But the lovebirds couldn’t be happier. They’re employed, healthy and spending cozy lockdown weekends nesting and fantasizing about their future wedding day.

Unfortunately, an acute case of lovesickness – and the inattention to practical concerns that comes with it – seems to have caused our otherwise responsible, financially stable professional to lapse on basic duties, such as paying his utility bills. After all, he has been staying at her place most of the time.

“Ugh, adulting,” the bachelor mutters regretfully, wondering how on earth he’s let six months go by without paying a cent toward his gas bill, as he reads the shut-off warning that’s just arrived in the mail.

Knowing who to shut off

Customers like him are exactly the kind of people utilities can, and should, reach out to as power shut-off suspensions get lifted, in order to recoup some of the billions of dollars Americans owe in unpaid utility bills, according to Utility Dive. But how do they know which non-payer is earning six figures and which is struggling on unemployment?

When it comes to delinquent balances, utilities need a way to discern between customers who have the financial means to pay their bills and those who are laid off, have depleted their savings, are facing eviction, battling food insecurity or struggling with health crises.

They can do that through data–as long as they’ve taken necessary steps toward data maturity.

What is mature data?

Data that’s been cleaned, organized, enriched, integrated with deeper insights, is uniform company-wide, and is accessible across the organization can be considered “mature” data. When data is mature, it becomes responsive and can be used to generate real-time answers that allow for immediate solutions. It gives companies agility.

Unfortunately, because utilities are typically huge organizations that have been around for about a century, it’s difficult for them to be agile. Utilities gather data about energy usage, outages, customers, call center volume, billing and more, and that information is hard to store uniformly. One department is bound to enter “Locust St.” into one spreadsheet while another department enters “Locust Street” into their files, causing a simple but perhaps the most common ‘messy data’ problem we find across sectors.

One of our utility partners, thankfully, had mature data for proactive outreach by the time they expected their shutoff moratorium to end. That allowed them to respond with agility and lower overall debt rates.

In fact, they were one of the only utilities in their region with the necessary data infrastructure to enroll thousands of customers into payment assistance programs throughout Covid and collect millions of dollars in unpaid bills when the moratorium was lifted.

How did they do it?

As is typical, BlastPoint’s process began with basic goal-setting, followed by our data scientists performing cleansing and organization of the company’s internal customer data about 6 months prior to the Covid crisis reaching the U.S.

In order to meet the utility’s initial goals–reducing spend on certain programs, boosting enrollment in others–we needed to enrich their data to understand their customers with more clarity.

We discussed options for integrating third party data (psychographics, demographics, behavioral data, social media usage, Census data, etc.) into the information the company already had on their customers, which mainly included contact information, energy usage and billing history.

Deeper insights inform decision-making

Enhancing inside data with outside data meant we could learn customers’ preferred communication channels, the industries they worked in, how many people owned their homes and more, creating a full, vibrant picture of each household.

We then put our machine learning algorithms to work, creating propensity models that unveiled which customers were the best fits for various programs and who would be most likely to adopt a particular technology.

Grappling with Covid

By the time Covid struck in early 2020 and the state utility commission enacted a freeze on late fees and shut-offs, our partner began to worry. They worried about customers kicking the can down the road, allowing balances to skyrocket if no penalties were in place requiring them to pay.

Our partner was right to worry.

As we know, the economy suffered as Covid took its toll. While many consumers still struggle to feed their families and desperately need that shut-off freeze, plenty more who can afford to pay seem to have taken advantage of the billing break anyway.

Our partner, foreseeing the looming crisis, asked us if they could address the coming debt situation using the enhanced data and customer segments we had already put together for them.

Our answer? Absolutely.

Prepared to pivot

This time, we established benchmarks to assess each customer’s typical risk level, then developed propensity models for each customer’s household to predict how their balance was expected to change over time.

We call the result of this analysis Customer Balance Risk Zones. They showed our partner who consistently paid on time (Green Zone customers), who usually paid somewhat late or paid-in-part (Yellow Zone customers), and who consistently paid late or not at all (Red Zone customers).

This meant that our partner could pinpoint in real-time when a typically good-paying customer suddenly stopped paying. If several months went by without payment from them, the utility could infer that the customer had likely suffered a job loss and should receive outreach about assistance.

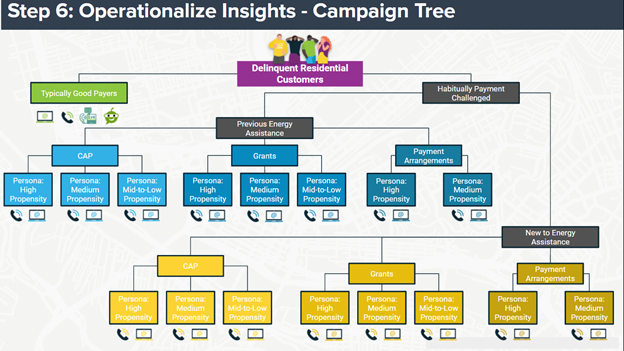

We further performed segmentation analysis that showed which customers were the best fits for payment assistance programs like LIHEAP; which customers were previously enrolled in assistance but had rolled off; and which customers had never been enrolled in a program but probably should be, given a sudden lapse in payment.

Read more about BlastPoint’s customer segmentation and personas here

Segmentation also helped our partner deduce which customers would benefit from programs like budget billing or direct debit, based on behavioral and tech propensity data that revealed who was a good match for set-it-and-forget-it plans.

Data-backed risk analysis helped the Collections team understand which customers needed critical safety nets. Behavioral analysis helped the team know what kinds of messaging and platforms to use to evoke a response.

Toward the end of summer 2020, the utility saw higher enrollment in assistance and payment programs than usual, alleviating the amount delinquent customers owed and bringing the utility much-needed revenue. But customer debt was still raging, and the cold-weather season was only just beginning.

Case study: How one gas utility achieved a 20% CAP sign-up rate from just one email

Preparing for the Moratorium’s End

No utility wants to shut a customer’s power off, ever. But in the fall of 2020, after nearly eight months of hemorrhaging delinquencies, our partner expected more big revenue losses.

Thankfully, having already organized and enriched their customer data, now possessing clearly demarcated customer segments, our partner knew exactly who to contact about anteing up.

Which brings us back to our love-sick bachelor, who, of course, is imaginary, but symbolizes precisely the kind of customer our utility partner sent a shut-off notice to.

Upon receipt of his letter in the fall of 2020, our imaginary bachelor immediately paid off eight months’ worth of unpaid bills and happily resumed planning a post-Covid honeymoon.

Knowing who to target

Instead of scrambling to figure out who to send shutoff letters to–or whether they should even bother sending letters at all–our partner quickly issued shut-off notices to the right households.

As a result, customers who could pay, paid.

In just one week, the company received $400K in payments from typically “good payers,” a.k.a. Green Zone customers. These were the households that, according to our predictive models, should have been on track financially but for some reason had lapsed on payments.

Moreover, in response to warning letters, within a month our partner saw a 16 percent drop in households that had been languishing in the Yellow and Red zones. The number of households owing more than $1K also dropped dramatically.

All of this because our partner had already begun the process, about 6 months prior, to organize and orchestrate their data.

A lot of business leaders believe data maturity takes decades to reach. Throughout Covid, our partner has proven them wrong.

Their data has informed numerous iterative, strategic decisions throughout this crisis. Those decisions have led to a succession of small victories that made a big difference to their bottom line.

Thanks to mature data, our partner responded with agility to unprecedented challenges. To be sure, they’re ready for the next crisis, too–not if, but when, it strikes.

As BlastPoint CEO Alison Alvarez always says, “The best time to plant a tree was 20 years ago. The second best time to plant a tree is now.”

That is to say, it’s never too late to begin working toward data maturity. If your company hasn’t yet begun, today is a great time to start–and begin reaping the benefits.