BlastPoint’s 2023 EV Adoption Outlook draws upon our proprietary AI-powered models to predict which US states, cities, and neighborhoods will have strong electric vehicle (EV) demand, or face underperformance due to infrastructure barriers or equity challenges in 2023.

Click here to download the full report, or read on for an overview of our findings.

Past the Tipping Point

Sales data from Kelley Blue Book shows that 2022 represented a tipping point for EV adoption in the US:

- EV sales went up by a “shocking” 65% over 2021

- EVs represented 5.8% of new car sales in 2022, up from 3.2% in 2021

- EVs became more affordable, with the average price per car going down 5.5% – lower than the cost of the average luxury car, at $61K

- In total, more than 800K EVs were sold in the US in 2022

What changed last year to support faster EV growth?

First, gas prices soared to the highest they’ve ever been as a result of international unrest. Many consumers were paying double the amount they had in 2021 to fill up their tanks, enough to push some to go electric.

Second, the Inflation Reduction Act (IRA) was signed into law in August 2022, which included some key benefits to lower the cost of EVs and expand charging infrastructure. These two events helped take the US past the 5% sales tipping point for EVs, but does the US have the charging infrastructure in place to sustain growth and meet 2030 climate goals?

The Inflation Reduction Act & EVs

Meant to support the Biden Administration’s goal to “reduce emissions by more than 1,000 million metric tons of CO2e in 2030” (see the Inflation Reduction Act Guidebook), the IRA expanded the Section 30D $7,500 EV tax credit through 2032 and removed the previous sales cap of 200K per automaker.

Per the IRA, tax credits can be transferred to auto dealers and be received directly as a rebate starting in 2024, making EVs more affordable at the point of sale, according to Electrification Coalition. Used EVs are also now eligible for a tax credit of up to $4,000 or 30% of the sales price, making EVs more affordable to the middle class.

Another significant provision of the IRA is the new commercial tax credit of 6% with a maximum credit of $100,000 per unit (up from $30,000 per property) for charging units – with the stipulation that chargers are placed in a low-income community or non-urban area. This new provision has the potential to expand charging infrastructure equitably in 2023 and beyond.

The key to a successful rollout, however, is understanding where to strategically expand charging infrastructure.

Is EV demand being suppressed by inadequate charging infrastructure?

Concerns about access to charging are the main reason, aside from sticker shock, why consumers hesitate to go electric. Having public and private charging options nearby assures consumers that they won’t be stranded at a critical moment, or have to go out of their way to charge. Research from the World Economic Forum shows that expanding charging infrastructure removes common barriers to going electric and is key for transportation equity and meeting climate goals.

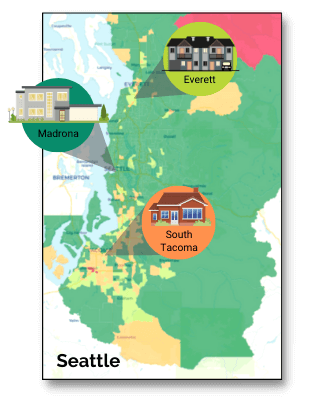

To understand the impact of charging infrastructure on EV adoption in 2022, BlastPoint utilized our proprietary AI-powered technology to analyze multiple datasets related to EV ownership and charging, including housing, EV registration, income, and charging location data. We found that housing type (single or multi-family residence), home ownership, and availability of nearby charging did suppress EV demand in 2022.

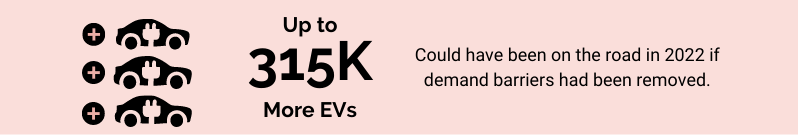

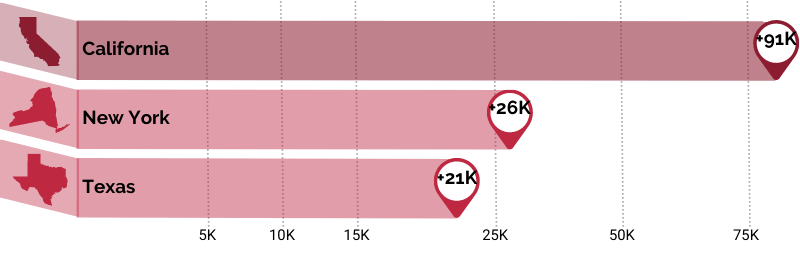

Based on our model, we estimate that up to 315K more EVs could have been sold in 2022 – which would have led to sales over 1M vehicles – if more public and private charging were available. We found that neighborhoods with a high population density had the most suppressed EV demand due to few available public chargers (or high competition for existing chargers) and no options for private charging, particularly in rentals.

Using BlastPoint’s Demand Suppression Model, we estimated the number of EVs that could have been sold in each state during 2022 if charging availability had been higher.

BlastPoint’s Demand Suppression Model is designed to identify where suppressed demand is occurring and support targeted infrastructure growth, removing charging as an obstacle.

Understanding levels of charging demand across the US

Where are EV chargers in highest and lowest demand? Being able to identify these areas is key to supporting EV growth.

BlastPoint created Charging Demand Segments that weigh relevant datasets for every Census Tract, such as population density, EV registrations, and housing types, and assign a score of Highest Demand, High Demand, Moderate Demand, Low Demand, or Lowest Demand to every Tract. Areas with Highest and High Demand will need more chargers to support EVs currently in the neighborhood.

Areas with Moderate, Low, or Lowest Demand often have very few EVs registered and few, if any, charging stations. These areas will need charging infrastructure in order to make EV ownership feasible within the neighborhood.

Areas with few or no EV chargers are called charging deserts, and they are a major obstacle to equitable EV growth. These neighborhoods, whether urban or rural, often have a history of underinvestment that has led to their current lag in EV adoption.

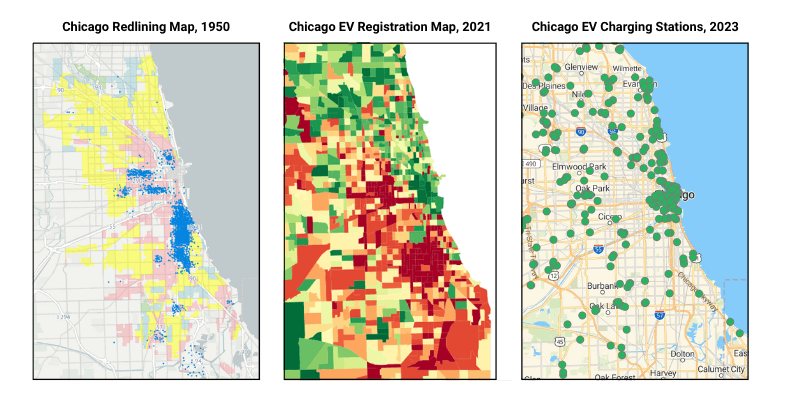

The three maps of Chicago illustrate the connection between historical underinvestment and EV charging inequity. When compared, it’s clear that areas with low EV registrations – and low charging demand – correlate with redlined communities.

BlastPoint’s Charging Demand Segments are a tool that empowers stakeholders in these neighborhoods to benefit from the IRA’s commercial charging credit, which enables businesses and landlords to install chargers and increase transportation equity.

Be a part of the EV revolution with the help of AI.

Learn more about BlastPoint’s AI-powered tools for growing EV adoption. Download the report and get in touch with our experts to find out how to get EV insights at your fingertips.