A special holiday shopping edition of BlastPoint’s Map of the Month series!

Were you one of the 9.3 million people who went shopping the day after Thanksgiving this year? If so, you may be feeling a pang of regret from spending too much cash on items you didn’t need, or from swiping your credit card too many times to get gadgets nobody really wants. But fear not, friend. You are not alone. According to Finder.com, more than half of us who shopped this year (52%) are likely feeling that old, dreaded feeling of buyer’s remorse.

Perhaps it was the adorable Chia Pet Gremlin you were certain, at 5 a.m. on Black Friday, that Aunt Sylvia would love to find under her Christmas tree. Maybe it was the bacon toaster you convinced yourself Dad could surely use. Or the Yodeling Pickle toy for niece Susie that seemed like a good stocking stuffer idea at the time…

Whatever the devilish item that overtook you that fateful day, consider the fact that most of us make purchases we regret at one point or another.

buy·er’s re·morse

noun: a feeling of regret experienced after making a purchase, typically one regarded as unnecessary or extravagant.

dictionary.com

According to Ramit Sethi at Iwillteachyoutoberich.com, “…buyer’s remorse typically happens after BIG purchases. The most common are: Buying a house, buying a car [and] getting a degree.”

But even small purchases can make us feel regretful. And this sensation of disappointment we feel in ourselves after over-consuming can hit anyone: old or young, male or female, Steelers fan or Vikings fan.

Regret-o-Meter

| % of men who regret a purchase | 56 |

| % of women who regret a purchase | 49 |

| % of Millennials who regret a purchase | 66 |

| % of Baby Boomers who regret a purchase | 42 |

Source: Finder.com

Generational Regret Threshold

| AGE GROUP | $ AMOUNT SPENT BEFORE REGRET KICKS IN |

| Millennials | $360 |

| Gen X | $1,300 |

| Baby Boomers | $980 |

Source: Finder.com

Even if it’s just that bacon toaster that has you feeling down, don’t fret. Knowing that you are among the majority of shoppers who’ve possibly made a mistake, returning or exchanging said item, or making peace with the fact that you bought it, might be just a little more palatable this year.

Black Friday 2019 Quick Stats:

- # of shoppers worldwide: 9.3 million

- Brick-and-mortar store foot traffic: down 6%

- Online sales: up 17%

- Online sales total (as of this writing): $7.4 billion

- Online purchase/in-store pickup orders: up 43%

- Average spend per shopper: $168

- Biggest winners: Target & Walmart

- Surprising losers: The Gap & Ulta

Sources: Maggie Fitzgerald at CNBC, Pam Danzig at Forbes.com, Ina Steiner at ecommercebytes.com, and Adobe Analytics

We see the jump in online orders with in-store pickups (up 43 percent) as one of the most interesting developments this year. It might suggest something important about people’s continued willingness to spend money, find deals and physically go to stores while simultaneously expressing the desire to avoid crowds and not partake in the experience of wandering aisles.

But let’s explore buyer’s remorse at a more localized level by zooming in on the one place that jumps to everyone’s mind when they think about shopping in the United States: Minneapolis, Minnesota!

Minneapolis: Marvelous, Mid-West & Mall-tastic

Lush with greenery, twin sister to St. Paul, Minnesota, Minneapolis boasts the nickname City of Lakes due to its 90K miles of shoreline. It is also home not just to the world-renowned artist Prince, but also to the corporate headquarters of both Target Corp. and Best Buy.

These big box retailers also happen to be two of the biggest winners in sales numbers, according to early results from this Black Friday (along with Walmart and Kohl’s).

A 15-minute drive from downtown Minneapolis to the suburb of Bloomington will bring you to the famed Mall of America. At 78 football fields large, packed with 520 stores, it’s the biggest mall in the U.S.

Complete with an amusement park and aquarium, it draws over 40 million visitors each year. And, on Black Friday 2019, more than 3K people lined up outside to get into the place at 5 a.m., according to Jackie Crosby, reporter for the Star Tribune.

While Minneapolis is one of the most literate cities in the U.S. (rivaled only by Seattle), and has more shoreline than Florida, Hawaii and California combined, it would be fair to argue that the 3.4 million people who live in the Twin Cities region are outdoorsy bookworms. However, it wouldn’t be outlandish to assume there’s a bit of a shopping culture happening there, too.

So, let’s drill down to find out who in that area is likely feeling the most buyer’s remorse after Black Friday 2019.

Minneapolis/St. Paul Demographics

- Regional total population: 3.4 million

- City of Minneapolis Adults: 330,000

- Median age: 32

- Female 49.4%

- Male 50.6%

- White: 63.93%

- Black or African American: 18.90%

- Asian: 6.05%

- Other race: 4.94%

- Two or more races: 4.91%

- Native American: 1.24%

- Native Hawaiian or Pacific Islander: 0.02%

Source: Worldpopulationreview.com

If Finder.com is right, more men are struggling with pangs of regret. And for Millennials, regret kicks in after around $350 of spending, while their older counterparts have a higher regret threshold.

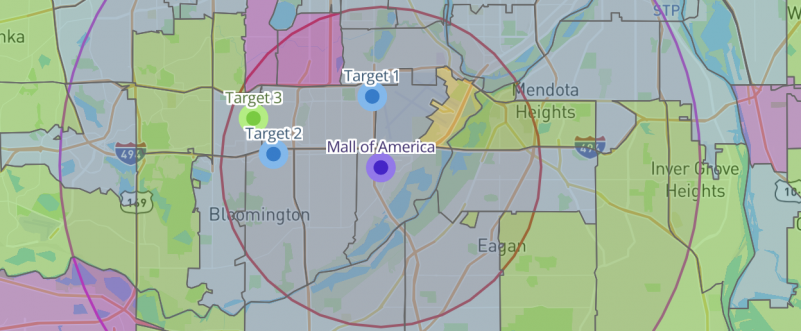

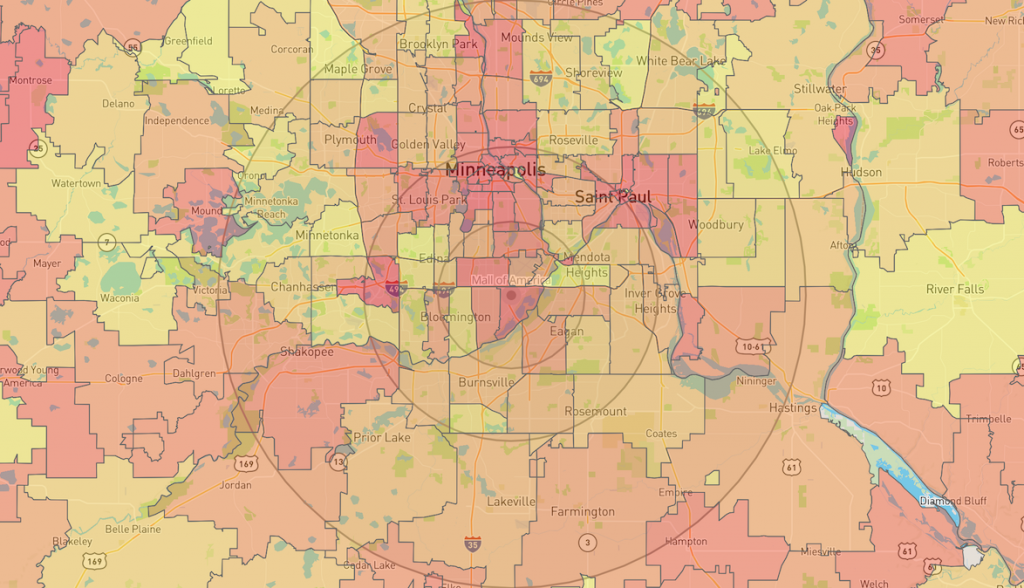

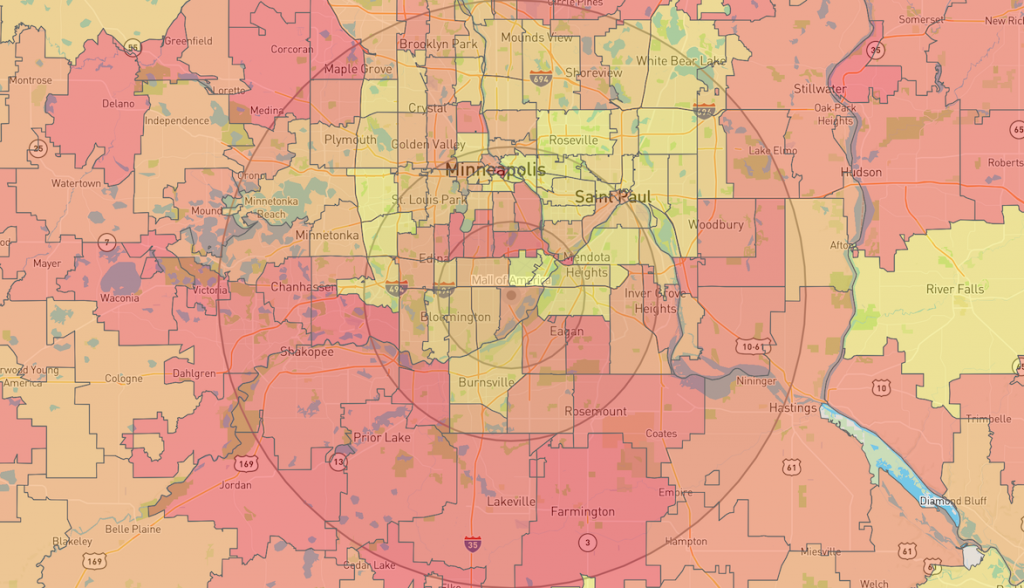

Is it ironic or just cruel, then, that a heavy concentration of Millennial males just so happen to live all around Mall of America?

The least regretful shoppers, according to Finder.com’s report, fall into the Generation X category. Writing as a member of said group, I can surmise that’s either because, A), we’re more likely to shrug rather than care all that much in the face of adversity, or B), because we’re at the top of our careers and making more money than we used to.

Either way, it’s an interesting twist that more Twin City Gen Xers have situated themselves farther away from the MOA than their younger counterparts.

What does this say about shoppers’ regret in Minneapolis? That there’s potentially a whole lot of it happening right about now.

Learn more about BlastPoint’s Customer Engagement Solutions here.

For help on combatting buyer’s remorse, check out Elliott.org, where author Christopher Elliott recommends researching your purchase thoroughly ahead of time, taking advantage of “cooling off” periods where returns are gracefully accepted, and talking over your budget endlessly so that you know how much money you really have to work with before you reach for your wallet.

For companies who are trying to learn more about their customers, what do these trends tell you about the people you serve?

Below are some questions to explore through this map snapshot:

- Why do more men regret spending than women?

- How might knowing that help you to serve them better?

- How can you ensure that all of your customers feel satisfied with the value you provide?

- What might knowing that Millennials have a lower regret threshold than older generations tell you about their financial priorities?

- How can you use that knowledge to fulfill their needs or communicate with them more effectively?

- What does this year’s online shopping/in-store pickup development tell you about the experience people are seeking when spending money?

- How can you use that data to your advantage?

At BlastPoint, we find this information very useful and are putting it to work for our own customers. How about you? Share what you come up with by shooting us an email with your ideas.

Thanks as always for reading, friends. Stay tuned in 2020 for our next Map of the Month!