A 20% CAP sign up rate! A 47% payment-in-full response! Two new case studies available for download demonstrate how powerful a single outreach campaign can be – when you know who to target. We’re thrilled to share preliminary results from one of our energy partners who’s been applying BlastPoint’s predictive analytics software throughout COVID-19.

They’ve enhanced and streamlined their collections strategy with the support of A.I.-powered customer segmentation, predictive personas and behavioral analysis, allowing them to keep revenues rolling in despite the economic downturn.

At the same time, the company is ensuring that at-risk customers stay connected to power, avoid late fees and shut-offs, and keep themselves afloat as we head into what’s looking like a bumpy autumn.

It’s a true win/win for everyone involved. Read more by downloading the case studies below.

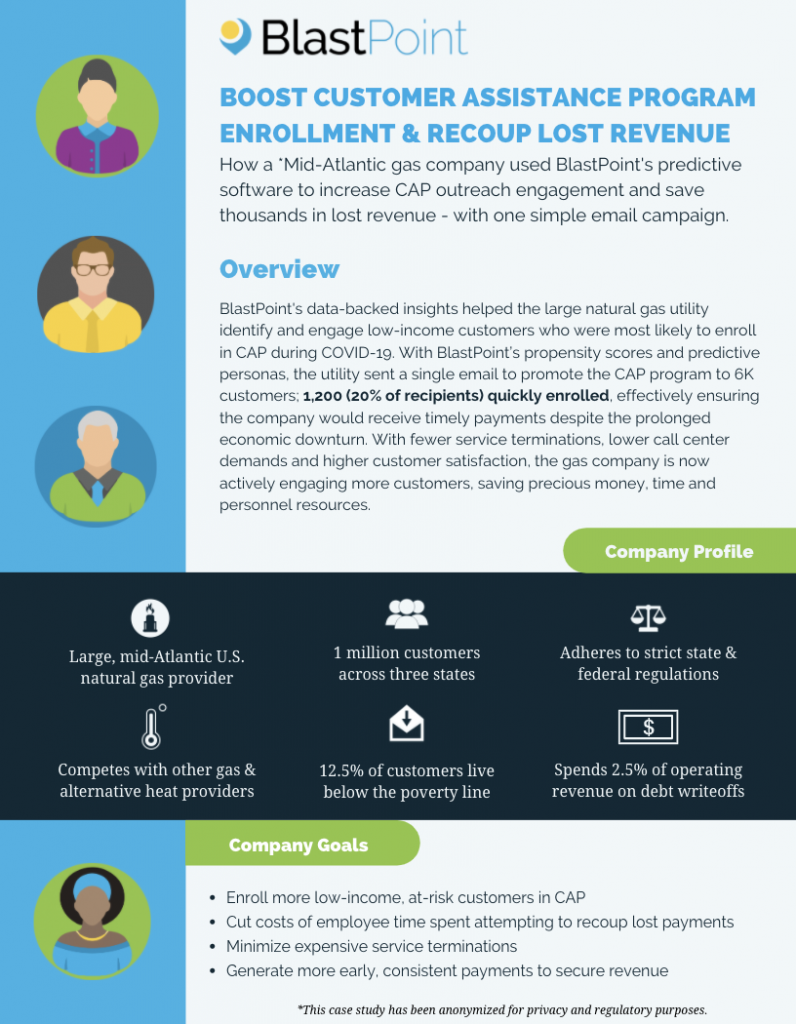

Learn how our partner achieved a 20% CAP sign-up rate with one simple email campaign!

Read about how our partner generated a 47% follow-through rate of FULL payments from overdue customer accounts!

Are you interested in enhancing, enriching and strengthening your collections strategy? If so, let us know right away so we can help you build a tactical plan for getting through the coronavirus economy successfully.