Digital engagement is up across industries due to coronavirus-related shut-downs. Virtual meetings, remote classes and online grocery shopping have become the norm for many, which could mean that more people are ready to say goodbye to paper bills forever. For one of our energy partners, converting just 5 percent of customers to e-billing helped them save millions of dollars.

More people are attached to their digital devices more of the time, thanks to COVID-19. An April 2020 Pew Center poll reported that, “Fully 87% of adults say the internet has been at least important for them personally during the coronavirus outbreak, including 53% who describe it as essential. Relatively few Americans – 13% – think the internet has been not too or not at all important for them during the outbreak.”

Different business sectors are reporting higher open and click-through rates than they saw in previous years, too. According to retail media technology company Criteo, average open rates across industries was 20.8 percent in 2019, and click-through rates were just 2.4 percent last year.

Meanwhile, per HubSpot’s 2020 analysis, open rates for broadcast media, internet, telecom and wireless companies currently averages at 21 percent, and average click-through rates are now a staggering 7.11 percent.

For financial services, like accountants, banks, capital markets, private equity firms and investment management companies, email open rates are currently averaging 23 percent and click-through rates average 6.82 percent (the lowest of all industries, notably, but much higher than last year’s average).

So, it seems, as people have been stranded at home, tied to their computers or phones, they’ve had more time or inclination to read what their service providers are putting out over email. They have adjusted to this ‘new normal’ of daily Zoom meetings, online grocery orders and remote school.

As such, now may be the ideal time for companies, looking to trim their budgets in this uncertain economic environment, to focus their advertising dollars on converting more customers to paperless communication.

The Perks of Paperless

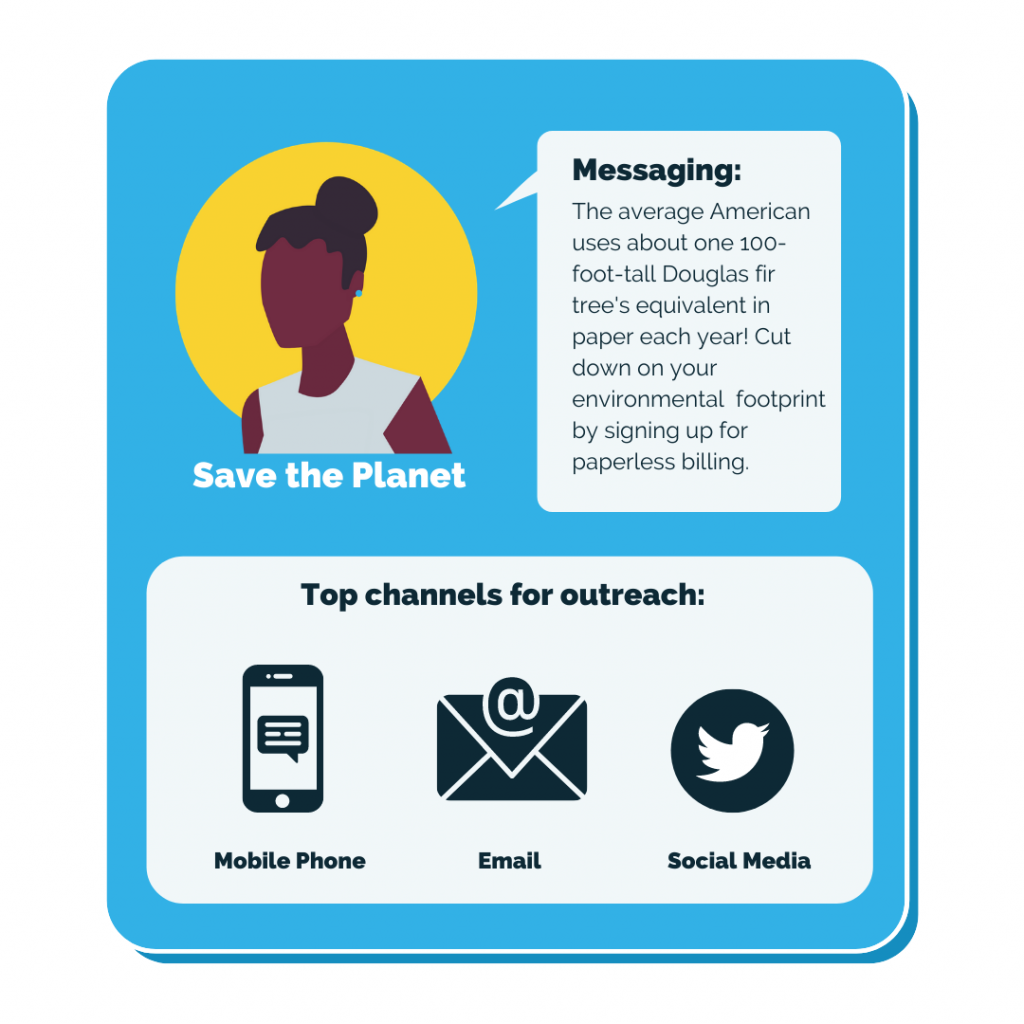

This recent piece from The Balance explains some of the benefits that prompt consumers to switch to e-bills: “According to the U.S. Environmental Protection Agency, the average American uses about one 100-foot-tall Douglas fir tree’s equivalent in paper each year. Fewer billing statements means less demand for paper and less air pollution from paper production.”

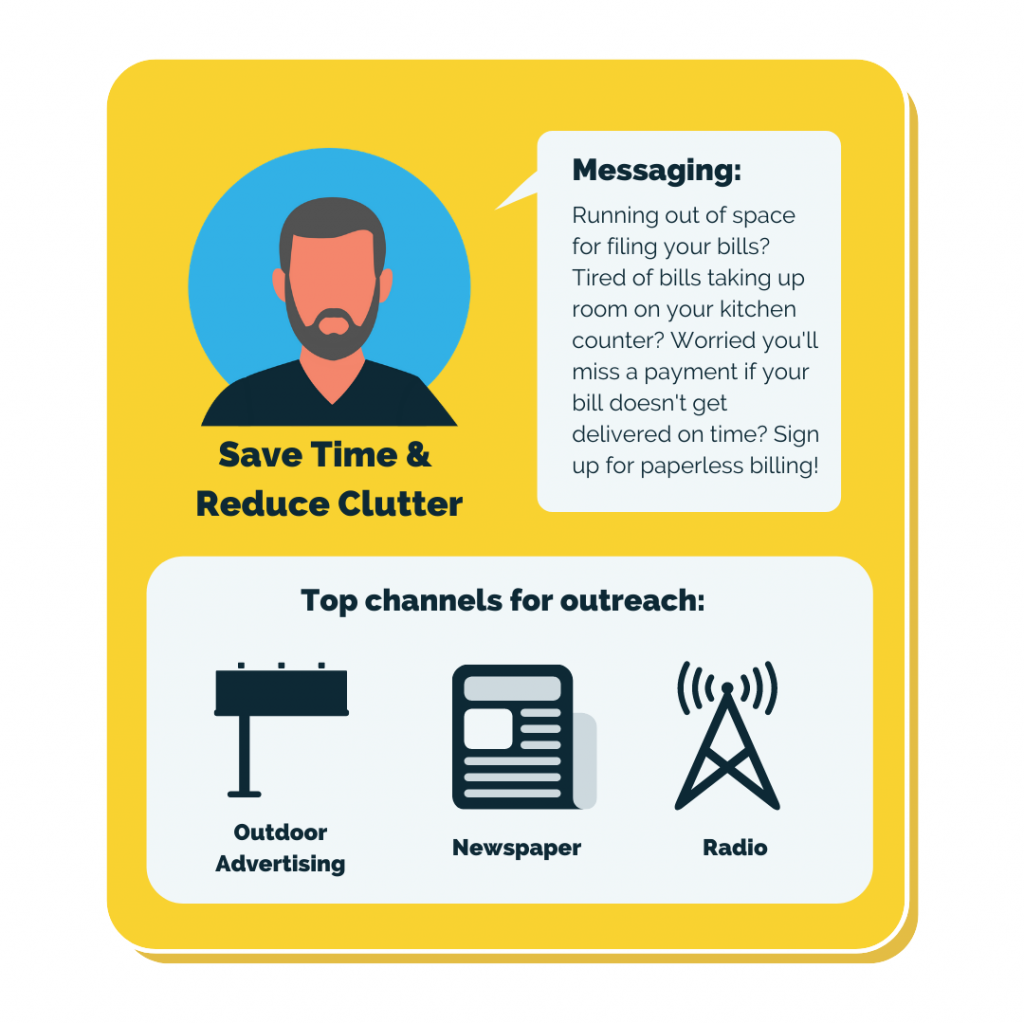

That’s just one of many perks that come with electronic communication. Some other perks, says The Balance, include saving money on postage and reducing the amount of clutter that gets piled on your dining room table (or wherever the admin of life accumulates in your home).

For companies, eliminating paper and postage brings major perks, too – by way of saving millions of dollars.

As we reported in our 2019 case study, “Paper Billing Costs, Eliminated,” one utility (who prefers to remain anonymous for regulatory purposes) used BlastPoint to reduce the amount it was spending on postage and paper to send customers their bills, allowing the company to generate three times its ROI in one quarter of 2018, which meant a 5 percent increase in customer enrollment and millions of dollars in savings.

Here’s how it worked: BlastPoint performed a detailed analysis of the company’s customer base, unearthing thousands of active customers who were more likely than the rest to convert to paperless but who had yet to make the switch.

Next, the utility targeted those customers only — avoiding any expensive, widespread, spray-and-pray, multi-channel campaigns — with messaging that those customers were most likely to respond to, and only through the channels that BlastPoint’s analysis proved they most often used. For example, BlastPoint was able to distinguish the customers who were interested in ‘going green’ from those who were concerned about sticking to a budget.

Sample paperless billing personas. Please note that these customers are hypothetical and not based on actual data.

Having awareness of this slight nuance gave the utility more power to craft appropriate messaging so that it appealed more to those individual customers.

As a result, the utility managed to successfully:

- sign thousands of new customers up for electronic billing,

- and save thousands upon thousands of dollars, year over year.

Here are BlastPoint’s founders, CEO Alison Alvarez, and CTO Tomer Borenstein, explaining how it works.

Customer Intelligence for the Win

But it’s important to recognize that not everyone is ready to eliminate hard copy statements. The Pew study cited above highlights the very real and problematic ‘digital divide’ that exists between lower income consumers and those with higher levels of personal wealth – although it’s important to note that many low-income customers ARE a good fit for paperless programs.

People who earn less have access to fewer devices overall, though 96 percent of Americans own at least a cell or smart phone, according to Pew’s Mobile Fact Sheet. So, while low income customers may rely solely on smart phones for internet access, our research revealed that many lower-income customers enrolled in digital programs at moderate to high rates.

Meanwhile, rural residents may have the biggest digital disadvantage due to less access to broadband. And people with disabilities face challenges as well, as not every website meets ADA compliance regulations.

Sample “anti-persona” for paperless billing. Anti-personas have low propensity for enrollment, so companies can save time and money by targeting other customers instead.

Consumer Action’s 2018/2019 article “Paper or Digital?” explains that, for these groups, “…paper documents are not just an option, they’re a necessity. Those who are not tech-savvy, have difficulty using a computer or have no internet access at home find paper statements essential.”

Which is precisely why discovering the humans in your data is so important.

Precision-Target Outreach is Key

Companies that know who, among the people they serve, are most willing to convert to paperless and why, have the power to save a lot of money. They can conduct precision-targeted outreach by contacting the right customers, sending only the most relevant information about switching to paperless. They can contact these customers through the channels those people use most, and in an appealing way that will prompt them to respond.

Sample messaging and channel preferences for paperless billing personas.

If you’re interested in precision-target outreach and would like to have a detailed data analysis performed on your data to uncover who is the best fit for paperless, get in touch with us right away so we can get you started on the path to major savings.