Personal billing default stories from the BlastPoint team inform our development of predictive analytics tools for utility companies.

Utility companies now have the capacity to prevent customer billing defaults before they ever happen. BlastPoint’s development team has created predictive customer profile technology based on data analytics that study human behavior, so that more utility companies can find out who’s at risk of defaulting on their bills and stop it from happening before it’s too late.

This is a huge win for utility providers, and it has the potential to be a game-changer in the energy industry for a number of reasons. We are living in the age of energy efficiency, but customer engagement and power grid transformation continue to be major considerations at the forefront of many utility employees’ minds. And yet none of these issues can be treated individually: one inherently depends on the other.

And when it comes to ensuring that low-income or at-risk consumers receive the services they need in today’s energy landscape, utility companies that want to gain a competitive advantage must learn to lean on data tools.

Why Utilities Want to Prevent Billing Defaults

It may come as a surprise, but utility companies want to prevent billing defaults before they happen, and many are doing all they can to reach customers before they fall behind in their payments. Here are some reasons why:

- When consumers fall behind on their bills (for any reason), it costs companies money to try and recoup those costs: in postage to send overdue notices, in call center employee time, and in service crew time when they’re sent to shut off power.

- As they say in the finance world, a dollar today is worth more than it will be tomorrow. If utilities can recover payments people owe now, in other words, they’re better off than they would be if they tried to recoup that same payment six months down the road.

- Once a customer falls behind on their bills, it becomes more difficult for them to climb out of the default hole. Late fees rack up, they stop answering their phones when customer service reps attempt to call, and a snowball effect begins to occur, making it harder for them to recover from the initial setback.

- Utilities save money and make customers happier when they proactively reach out to enroll people into budget billing programs, which keep customer costs controlled and deliver consistent bills, month after month.

- A certain amount of federal dollars get set aside each year for energy assistance programs like CAP and LIHEAP. If utilities can demonstrate with hard evidence (i.e., an accurate count of budget billing or low-income customers in their territory), they can secure a comfortable, set amount of that federal funding for their company ahead of the competition before the coldest winter months arrive.

- Utility companies really don’t like to shut off anyone’s services. They’re not in the business to badger folks who’ve hit hard times.

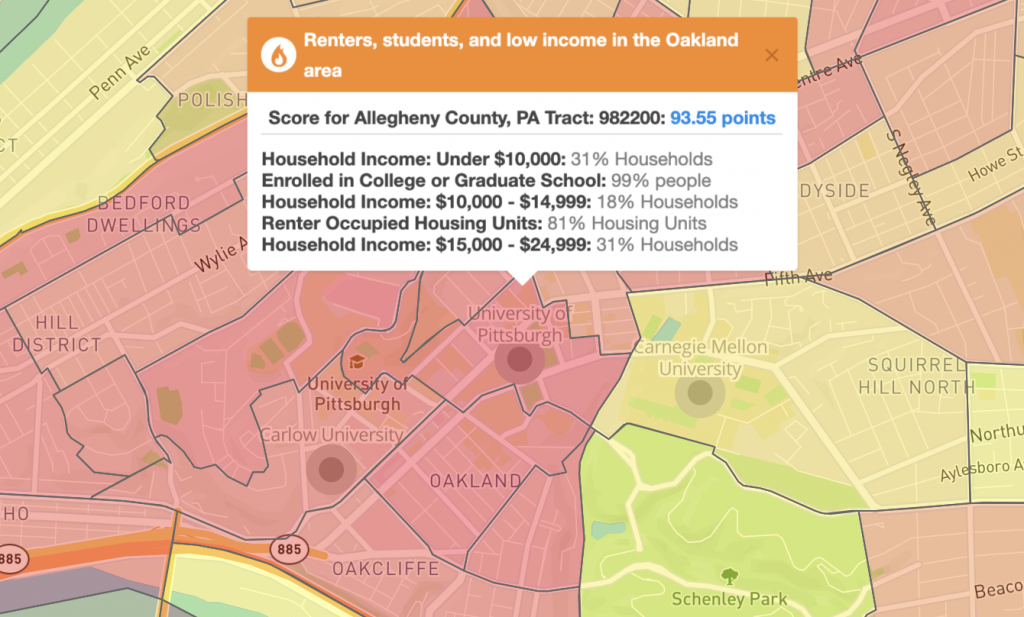

The heatmap above shows the percentage of university students (99%), renters (81%), and households with an income below $15K/year (80%) living in the area immediately surrounding the University of Pittsburgh. Based on these patterns, this area can be considered a default billing hotspot, and the BlastPoint tool enables utility companies to target specific customers in this area to help prevent billing defaults. Image credit: BlastPoint.

How can utilities predict whether someone is likely to default on their bill?

Obviously, no two people are alike, and life circumstances vary from one extreme to the other across a wide spectrum. When it comes to personal finances, there are all kinds of reasons for why someone might fall behind on their bills, and we know that treating everyone who defaults the same is problematic: It overlooks unique, human differences and fails to distinguish the reasoning behind one person’s missed payment versus another.

Perhaps one person defaults on a bill because they just had a baby, their life is upended and they’re sleep-deprived. Maybe another just got laid off. Still another just moved to a new apartment or went through a messy divorce. Life happens, and any one of the above circumstances could cause someone to miss a bill payment once or twice.

For more info on BlastPoint for Utilities, explore our software solutions here

But beyond unforeseen life situations, certain personality traits can predispose us to become bill defaulters over and over again. Forgetfulness and disorganization are two of those unfortunate traits. Hey, we all have our strengths, and for those of us who aren’t perfect (but do have the means of paying our bills), it’d be helpful to be enrolled into automatic payment plans or to receive impending due date reminders.

So, what if utility companies could treat customers like individuals when it comes to billing defaults, and take into account payment history and additional circumstances? What if they could reach out to us before we miss a bill, before the late fees rack up, before their employees have to call and bother us to pony up?

Debt.org reports, “The U.S. Department of Energy estimated in 2018 that the average family spends $2,200 a year on home utility bills.” And Fortune.com explains a full 40 percent of Americans are only one paycheck away from poverty.

That means any one of us could be at risk of missing a utility bill payment at some point. In fact, most of us here at BlastPoint actually have, for one reason or another, done that very thing. (Ahem, not pointing to anyone in particular for being disorganized or forgetful!) We understand this is an area that’s extremely personal and sensitive for everyone, and we also know that how we handle our finances is unique to each of us; completely dependent upon our individual circumstances.

That’s why using predictive analytics is so crucial. They help us to uncover customer behavior patterns, giving us the clarity we need to:

A) understand where variations in billing defaults are likely to arise,

B) spot the patterns that might predispose people to defaulting, and

C) determine the best ways to reach different kinds of customers who may be undergoing different circumstances.

In the process of building customer billing default profiles, we as a team sat down to talk about our own experiences as people who have struggled to pay or defaulted on our utility bills. We realized that most of us had experienced this, despite generally considering ourselves high-functioning, responsible citizens.

These are some of our billing default stories:

“I’m originally from the South. As a grad student, I moved to Pittsburgh during the summer. My utility bills were manageable throughout July, August and September. But I turned the heat on as it got chilly toward the end of October, and when my heating bill arrived a month later, I was completely shocked. I was not prepared for the cost of my first Pittsburgh winter in an old house with poor insulation. I never expected the bill to be so high, and I had not budgeted for owing that much. I just barely made that payment but I worried how I’d pay for all the cold months that still lay ahead. I immediately turned the heat down and hurried to cover my windows with plastic to try and weather-proof a little, but that winter was tight, and a real eye opener for me.”

-BlastPoint Team Member

“I followed the six-year college plan, but I paid my own tuition by waiting tables, taking semesters off here and there so I could work full-time in between and save up cash when I needed to. I’d keep all my cash tips from waitressing in a big wad in my sock drawer until I could deposit it at the bank, and after a good weekend of double shifts there’d be several hundred dollars in there, which was always meant to go straight toward paying my bills. At one point, I shared an apartment with two other women. It was great but I was living paycheck to paycheck trying to keep up with classes and work and rent and everything else. One Monday afternoon, our apartment got broken into—I hadn’t gotten to the bank yet. The thieves apparently ate a ton of food out of our fridge, stole some CDs, and also wiped out my wad of cash tips. It was a significant enough setback that I couldn’t pay my portion of the rent that month. I paid what I owed for utilities, but ended up having to move back home to my mom’s, and my roommates had to find someone else to live with them, because I knew it was going to take me a few months to recover from that.”

-BlastPointTeam Member

“We had to move my mom into a nursing care facility a few years ago when she fell ill, and I took over managing her finances. Apparently, I didn’t make sure to get every last bill transferred over to my name. I didn’t realize it, though, until the overdue notices started showing up. The utility company was super nice about waiving the fees, but it really did make me panic.”

-BlastPoint Team Member

(Note: These anecdotes are presented anonymously for the sake of discretion & privacy.)

Having these first-hand experiences provides us with a clear and unique perspective as we move forward in building predictive customer profiles for billing defaults. We know that compassion is just good business, so we look forward to helping our utility partners better understand their at-risk customers and prevent billing defaults before they happen.

Are you interested in learning more about BlastPoint’s Utility Solutions?