Why Personas Matter for Utilities

Utilities are under pressure like never before: affordability crises, rising customer expectations, and the urgent push toward decarbonization. Yet many still rely on outdated demographic segmentation or siloed initiatives that miss the mark. The result? Inefficient spending, inconsistent messaging, and customers left feeling overlooked.

Customer personas offer a way forward. More than just profiles, personas distill complex data into actionable insights that unify teams, prioritize resources, and enable utilities to meet customers where they are. By providing a shared language and data-backed framework, personas transform customer engagement from guesswork to precision.

Case in Point: A Top U.S. Utility

One of the nation’s largest utilities faced exactly this challenge. Without a cohesive way to describe their diverse customer base, planning and engagement often happened in silos. Marketing, customer care, and program teams were misaligned, making it difficult to coordinate efforts or deliver consistent value.

To solve this, the utility partnered with BlastPoint to harness AI and machine learning, uncovering six Foundational Customer Personas that now anchor their customer strategy.

The analysis revealed critical insights: which households were most likely to embrace green programs, which faced financial strain, and which valued simplicity and reliability over tech-driven solutions. This clarity gave every department a shared foundation, enabling consistent messaging, smarter targeting, and measurable improvements in customer satisfaction and program participation.

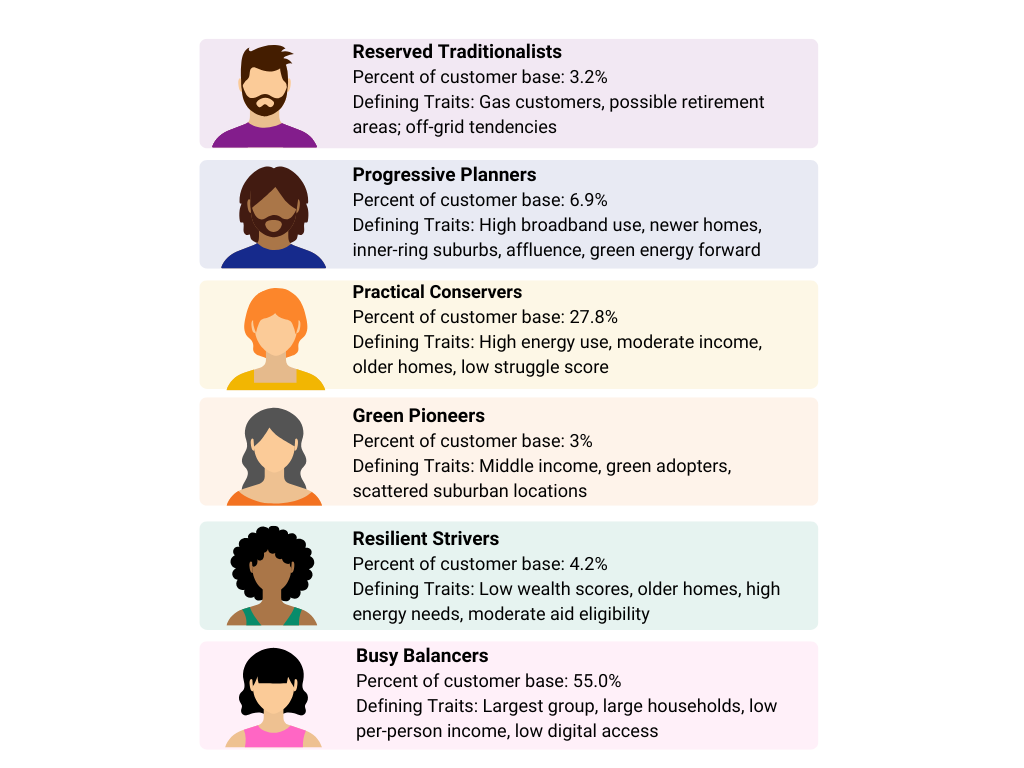

Meet the Personas

Six distinct personas emerged, each representing a meaningful share of the customer base:

- Reserved Traditionalists (3%): Older or semi-retired, primarily gas customers with limited digital engagement. Value peace of mind and stability.

- Progressive Planners (7%): Affluent, educated, sustainability-minded households eager to stay ahead of energy trends.

- Practical Conservers (28%): High energy users in older homes, financially stable, motivated by comfort and efficiency.

- Green Pioneers (3%): Eco-conscious early adopters ready to pilot new programs and champion environmental change.

- Resilient Strivers (4%): Households with high energy needs and financial constraints, requiring empathetic, stigma-free support.

Busy Balancers (55%): The largest segment — big households with limited income, low digital access, and high energy usage.

Turning Personas into Action

Identifying personas is only the first step. The real impact comes when utilities use data to tailor strategies, programs, and communications to each group. By comparing each persona’s behaviors and characteristics to the broader customer base, utilities can see why certain interventions are needed and how they will deliver results.

Reserved Traditionalists (3%)

Who they are: Older or semi-retired, primarily gas customers, limited digital engagement. Value peace of mind and stability.

Key Differences:

- Gas service agreements: 80% vs. 55% audience average.

- Average gas bill: $69 vs. $74 audience average.

- New accounts opened in last 12 months: 35% vs. 12% audience average.

Implications: High new-account activity plus lower-than-average bills suggests a group that may be overlooked in digital adoption and long-term engagement.

Recommendations:

- Encourage alerts (billing, usage, service) to reduce uncertainty and improve confidence.

- Promote MyAccount / autopay as a low-effort way to manage accounts — important for those opening new accounts at higher rates.

- Use onboarding to build long-term trust, positioning the utility as a reliable partner.

Expected Outcomes: Increased alert enrollment, stronger digital engagement, and higher retention.

Progressive Planners (7%)

Who they are: Affluent, educated, sustainability-minded households eager to stay ahead of energy trends.

Key Differences:

- Income per household member: $83K vs. $31K audience average.

- Higher education: 98% vs. 43%.

- Green affinity score: 10 vs. 8.

- Hybrid car ownership: 9% vs. 7%.

Implications: Affluent, eco-forward, and highly educated customers expect forward-looking, tech-driven solutions.

Recommendations:

- Frame efficiency programs as smart investments in future-ready homes.

- Highlight EV charging and electrification as lifestyle upgrades.

- Share thought leadership (e.g., webinars, newsletters) to reinforce your role as a trusted advisor.

Expected Outcomes: Stronger adoption of green programs, EV incentives, and brand alignment with innovation.

Practical Conservers (28%)

Who they are: High energy users in older homes, financially stable, motivated by comfort and efficiency.

Key Differences:

- Home ownership: 90% vs. 71%.

- Average home age: 69 years vs. 49.

- Efficient product adoption: 30% vs. 24%.

- Propensity to struggle to pay: 1 (low) vs. 4.

Implications: This group has stability and resources but faces efficiency challenges tied to older homes.

Recommendations:

- Offer energy audits to reveal hidden savings.

- Promote rebates for insulation, smart thermostats, HVAC.

- Provide dashboards and usage tools to help track bills and comfort.

Expected Outcomes: More rebate participation, measurable energy reductions, and improved comfort.

Green Pioneers (3%)

Who they are: Eco-conscious early adopters eager to pilot new programs and champion change.

Key Differences:

- Home ownership: 88% vs. 71%.

- Green affinity >8: 59% vs. 25%.

- Electric usage per person: 317 kWh vs. 199 kWh.

Implications: High green affinity and above-average usage signal both motivation and opportunity for leadership in sustainability.

Recommendations:

- Invite to pilot programs (demand response, community solar).

- Share carbon impact data and peer comparisons.

- Incentivize EVs, heat pumps, and other clean tech.

Expected Outcomes: Early adoption of new initiatives, peer influence within communities, and accelerated decarbonization.

Resilient Strivers (4%)

Who they are: Households with high energy needs and financial constraints, requiring empathetic, stigma-free support.

Key Differences:

- Propensity to struggle to pay: 5 vs. 4 audience average.

- Consumer stability index: 65 vs. 70.

- Direct debit adoption: 7.8% vs. 25%.

- On payment arrangement since 2023: 18% vs. 7%.

- Energy usage: 460+ kWh higher than average.

Implications: High usage plus elevated payment struggles signals vulnerability that needs proactive, dignity-centered support.

Recommendations:

- Target with early outreach about assistance programs.

- Use empathetic messaging to reduce stigma.

- Prioritize low-cost, high-impact upgrades that lower long-term usage.

Expected Outcomes: Reduced arrears, lower shutoffs, and improved community trust.

Busy Balancers (55%)

Who they are: The largest segment — big households with limited income, low digital access, and high energy usage.

Key Differences:

- Income per household member: $24K vs. $31K.

- Home ownership: 45% vs. 71%.

- Monthly usage: 764 kWh vs. 704 kWh.

- Monthly bill: $386 vs. $357.

Implications: Largest and most burdened segment — high usage and lower income make them cost-sensitive and harder to reach digitally.

Recommendations:

- Use SMS, mail, or in-person outreach for accessibility.

- Simplify energy education with non-tech guidance.

- Bundle offers with family-centered messaging (comfort, safety, savings).

Expected Outcomes: Broader program reach, higher satisfaction among low-access households, and reduced energy burden.

The Bigger Picture

Customer personas are more than marketing tools. They’re strategic assets that unify customer engagement, operations, and planning. By grounding each persona in both behavioral insights and geographic context, utilities can:

- Break down silos: Teams across marketing, customer care, program management, and operations align on a single framework for describing and prioritizing customers.

- Allocate resources with precision: Knowing not just who customers are but where they live allows utilities to deploy programs, rebates, and outreach in the right neighborhoods whether it’s suburban hubs of early adopters, rural communities facing affordability pressures, or urban areas with lower digital access.

- Personalize engagement: Messaging and channel strategies adapt not only to customer attitudes, but also to regional realities, such as broadband access, home age, or typical fuel mix in a given community.

- Strengthen trust locally: By understanding geographic clusters of personas, utilities can engage through community partnerships, local events, and place-based initiatives that meet customers in their daily lives.

By layering geographic insights on top of personas, BlastPoint enables utilities to move from abstract profiles to place-based strategies ensuring outreach, program design, and infrastructure planning are both customer-centric and community-specific.

Final Takeaway

The experience of this East Coast utility shows how data-driven personas can transform customer engagement. By moving from siloed strategies to a unified, persona-based approach, utilities can strengthen trust, improve program adoption, and deliver meaningful value to every customer segment.

The energy transition won’t wait. Utilities that embrace personas today will be positioned to lead with confidence, empathy, and innovation while those that don’t risk being left behind.

Ready to Get Started?

If you’re looking to bring persona-driven strategies to your utility, we’d love to help. BlastPoint’s AI-powered platform makes it simple to uncover customer personas, map them to geographic realities, and activate engagement strategies across your organization.

👉 Schedule a meeting with our team to see how personas can accelerate your utility’s customer engagement and program success.