In today’s financial landscape, deposit growth has become one of the most difficult and most essential — levers for sustainable bank profitability. Rising interest rates have driven intense competition for customer deposits, while digital-first challengers have made switching accounts easier than ever.

The result? Traditional marketing campaigns and branch-level strategies no longer deliver the same returns. Banks need to know who will grow their deposits, when they’re most likely to do it, and how to reach them effectively.

That’s where predictive intelligence is reshaping the game.

The Deposit Growth Challenge

According to the FDIC, total domestic deposits rose just 0.4% between June 2023 and June 2024 — the slowest rate in over a decade. Recent benchmarks show that retail consumer banks now spend around $561 to acquire a new customer, with acquisition costs continuing to rise across channels according to Swaystack and Focus Digital.

But even with bigger marketing budgets, deposit churn remains stubbornly high. Deloitte found that 20–28% of Gen Z and millennial customers say they are likely to switch their primary bank within two years often due to poor personalization and perceived lack of value.

Bank growth teams are realizing that the solution isn’t simply spending more to acquire customers. It’s about knowing who to focus on next. Predictive intelligence provides that clarity.

Action in real world

BlastPoint’s Customer Intelligence Platform enabled a regional bank to secure an estimated $230K in new deposits from a single AI-driven automated campaign and drive engagement 80% higher than competing banks.

What Is Predictive Intelligence and Why It Matters

Predictive intelligence applies machine learning and behavioral analytics to forecast which customers are most likely to grow their deposits, shift funds, or open new accounts.

Instead of looking backward (“How did our last campaign perform?”), predictive models look ahead (“Which households will likely increase deposits next quarter?”).

This shift transforms how banks plan growth:

| Traditional Analytics | Predictive Intelligence |

| Reports on what happened | Anticipates what will happen |

| Static segmentation | Dynamic, behavior-based microsegments |

| Blanket offers | Personalized, timely engagement |

| Lagging indicators | Real-time opportunity signals |

For example, banks use BlastPoint’s platform to combine transaction, demographic, and local economic data to forecast which customers are most likely to increase savings balances in the near term.

Armed with those insights, the marketing team can craft tailored outreach before those customers even start shopping around.

Building Smarter Deposit Campaigns

Predictive intelligence doesn’t replace deposit campaigns — it makes them smarter.

Here’s how banks are using it:

- Targeting the Right Segments

Instead of mailing every customer a “$200 to open a new account” offer, predictive models identify which existing customers are likely to add funds or open a new savings product.

- One mid-sized financial institution achieved 54% deposit growth within months by partnering with BlastPoint to focus outreach on high-intent deposit customers.

- One mid-sized financial institution achieved 54% deposit growth within months by partnering with BlastPoint to focus outreach on high-intent deposit customers.

- Timing Offers for Maximum Impact

Predictive systems detect when life events or financial behaviors signal readiness, such as tax refund season, new job starts, or loan payoffs, enabling perfectly timed engagement. - Personalizing Messaging at Scale

With dynamic segmentation, the same campaign can look different for every customer cohort: young professionals receive investment starter offers, while retirees see CD laddering opportunities.

The result? Higher engagement, lower acquisition costs, and a meaningful lift in deposits without adding pressure on frontline staff.

The Power of Data Enrichment

Most banks already have the raw materials, such as checking balances, loan data, CRM interactions. The missing piece is context.

Data enrichment layers internal records with external signals like:

- Demographics: household income, life stage, education

- Geospatial trends: community growth, local deposit competition

- Behavioral indicators: spending patterns, credit utilization, digital engagement

With these inputs, predictive models can surface insights that static dashboards can’t, for example, identifying households at risk of attrition or emerging neighborhoods likely to deposit more over the next quarter.

BlastPoint’s platform enriches customer data automatically, making these insights usable by marketers, branch managers, and data teams alike, not just data scientists.

From Insight to Action

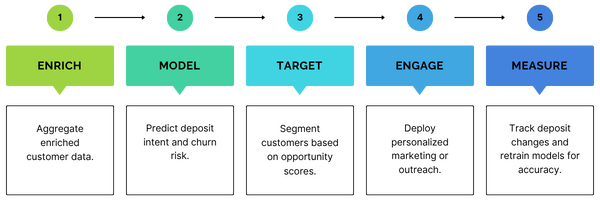

Predictive intelligence creates a continuous feedback loop for growth teams:

- Enrich: Aggregate enriched customer data.

- Model: Predict deposit intent and churn risk.

- Target: Segment customers based on opportunity scores.

- Engage: Deploy personalized marketing or outreach.

- Measure: Track deposit changes and retrain models for accuracy.

Banks using this flywheel see results compound over time. In one case study, a financial institution reduced its deposit attrition rate by 7% within a single quarter, simply by targeting proactive retention campaigns to high-risk households.

Banks using predictive analytics often uncover previously overlooked high-value segments — groups that can account for a significant share of new deposits without increasing marketing budgets.

Why Banking Leaders Are Paying Attention

Bank executives increasingly see predictive intelligence not just as a marketing tool, but as a strategic growth capability.

McKinsey projects that data-driven personalization can drive up to 15% revenue lift in banking. Meanwhile, institutions that use AI for deposit and lending strategies report 20–30% lower acquisition costs and 2× higher retention rates.

The Future of Deposit Growth is Predictive

The next generation of banks won’t just react to customer behavior. They’ll anticipate it.

Predictive intelligence empowers financial institutions to understand their customers’ financial journeys, respond in real time, and invest marketing dollars where they’ll have the most impact.

If your institution is ready to uncover the next wave of deposit growth, explore how BlastPoint’s Customer Intelligence Platform can help.

👉 Learn more about Predictive Intelligence for Banking Growth

Contact us to see how BlastPoint can help your team grow deposits with data-driven precision.