In our Thought Leadership series, we explore how AI is reshaping the business landscape and how decision-makers can adopt it responsibly, strategically, and with eyes wide open.

Now, we continue the conversation with insights from our CTO & Co-Founder Tomer Borenstein, who recently spoke at TRUE Community Credit Union about what’s next in AI. This blog dives deeper into the societal, strategic, and technical shifts that are already underway and what credit unions can do right now to prepare for an AI-driven future.

This conversation wasn’t just about tools or trends. It was about why AI is rewriting the rules of business and how credit unions can adapt, stay competitive, and stay human in the process.

We’re Not Adopting AI. We’re Living in It.

Technological change doesn’t happen in slow, gentle waves. It crashes in. The internet revolutionized the way we work and connect. Smartphones made it ubiquitous. Now we stand at the brink of the next and possibly final technological leap: artificial intelligence.

What makes this revolution different is that AI may be the last tool humans ever invent. Once systems can improve and replicate themselves, the nature of innovation shifts entirely. The implications for business, governance, ethics and identity are massive. And they’re no longer hypothetical.

Credit unions don’t just need an AI strategy. They need the right one. The good news? There’s a smart, practical path forward.

What AI Is And Isn’t

Buzzwords abound, but precision matters. AI isn’t just ChatGPT. It’s a family of technologies ranging from simple algorithms to sophisticated learning systems. Here’s how to think about it:

- Analytics is the umbrella—everything from basic dashboards to forecasts and summaries.

- Machine Learning (ML) uses algorithms that improve over time as they digest more data—like fraud detection, OCR, or linear regression.

- Deep Learning takes this further, using layered neural networks that mimic (inspired by, not replicate) how our brains process information. This powers facial recognition, cancer detection, and speech-to-text.

- Generative AI creates new content—images, writing, code—based on existing data. Think GPT, Midjourney, or Gemini.

- AGI (Artificial General Intelligence) performs any intellectual task a human can. ASI (Artificial Superintelligence) goes beyond us entirely.

This journey from analytics to intelligence is already unfolding. The only question is whether businesses engage with it deliberately or get swept up by it.

Why Predictive, Not Generative, Is the Real Game-Changer Right Now

Generative AI tools like ChatGPT and Midjourney may be grabbing headlines, but for most organizations, especially credit unions, the real value lies elsewhere. Predictive analytics, though far less flashy, offers a more stable, explainable, and ROI-driven path forward. It helps teams anticipate behavior, personalize experiences, and make smarter decisions based on real data, not guesses. While generative AI may play a role in the future, predictive intelligence is what empowers credit unions to take meaningful, measurable action today.

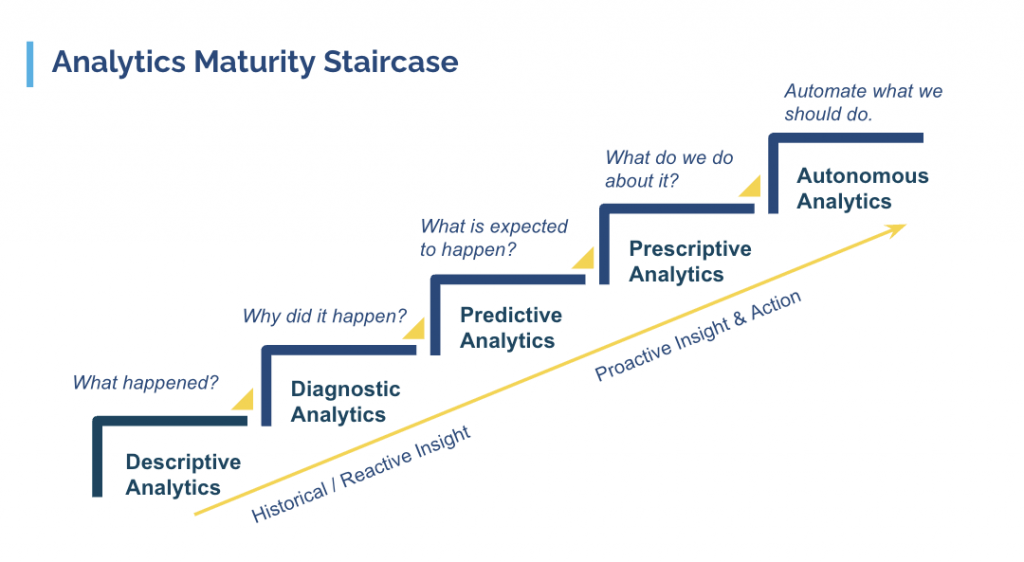

The Analytics Maturity Staircase: A Roadmap for Action

Every organization deals with data but not every organization knows how to make it work. That’s where the Analytics Maturity Staircase comes in. It’s a framework for understanding how data capabilities evolve over time and how to build toward intelligent, automated decision-making. Here’s a breakdown:

- Descriptive – What happened?

Basic reporting. For example: How many members opened new accounts last quarter? - Diagnostic – Why did it happen?

Understanding past outcomes. Why did checking account sign-ups drop last month? - Predictive – What will happen next?

Modeling likely future behavior. Which members are at risk of churn in the next 30 days? - Prescriptive – What should we do about it?

Turning insights into strategy. Which product should we offer to which member, and through what channel? - Automated – How can we do that at scale?

Orchestrating all of the above with minimal manual work. Smart systems continuously recommend, optimize, and act.

Credit unions already have much of the data they need from their core systems, CRMs, and marketing platforms. Predictive analytics helps turn that raw data into action: identifying the right member, with the right message, at the right time.

Why It Outperforms Generative AI (For Now)

While generative AI has exciting applications, such as content creation, chat support, and summarization, it often lacks the precision and explainability that financial institutions require. Predictive models, on the other hand:

- Are easier to audit and interpret

- Can be built around compliance and fairness

- Provide targeted, member-level insights that drive ROI

- Help optimize operations without exposing sensitive information

And perhaps most importantly: predictive analytics tools are ready now. They’ve already been tested, proven, and integrated into regulated environments. There’s no need to wait for a technological breakthrough—credit unions can begin benefiting today.

The Short-Term: Practical Business Decisions in an AI World

For credit unions, even early-stage AI adoption demands strategic oversight. The tools may be powerful, but so are the risks, especially when working with sensitive member data or regulated decisions. Here are four immediate considerations that every institution should evaluate:

1. Data Privacy

Not all AI tools are built with business security in mind. What you enter into a generative AI system might be used to train future models, meaning your data could end up influencing responses for someone else. Look for tools that offer enterprise-grade licensing with firm non-training clauses, or explore open-source models hosted within your own infrastructure.

2. Fairness & Accountability

AI models reflect the world they learn from and our world is full of biases. If training data contains inequities tied to race, income, age, or geography, your models will replicate them. That’s why it’s essential to review input variables carefully, audit model outputs, and monitor for disparate impacts even unintentionally.

3. Explainability

Not all AI is understandable. Deep learning models with billions of parameters often act as “black boxes,” offering little transparency into how a decision was made. In contrast, techniques like linear regression or decision trees provide clarity. Especially in financial services, regulatory compliance and public trust require transparency. Choose tools accordingly.

4. Copyright & Ownership

Who owns AI-generated content? What happens when models are trained on copyrighted material like news articles, books, or artwork? These questions are already heading to court. Until clear legal standards emerge, treat AI-generated assets with caution, especially in public-facing campaigns or brand materials.

The Medium-Term: How AI Will Reshape Society

While today’s concerns are tangible, the near future raises deeper, systemic questions about how AI will affect not just industries, but entire ways of life.

Job Displacement

Historically, automation replaced physical labor. AI, however, is poised to replace cognitive work, such as writing, designing, planning, or analyzing. As machines grow more capable, what happens to employment and to economic models built on it?

Work and Fulfillment

For many, work provides purpose and identity. But in a future where machines handle both manual and creative tasks, how will humans find meaning? Whether through new types of work, restructured economies, or shifts in cultural values, this is a question organizations and societies must begin addressing.

Generational Shifts

Younger generations are already growing up with always-on, emotionally affirming AI companions. While this offers benefits, like social support or senior care, it also brings risk. Overdependence on AI for emotional regulation, decision-making, or relationships could carry long-term consequences. It’s a new frontier for psychology, ethics, and education.

The Long-Term: Consciousness, Rights, and Responsibility

As AI capabilities expand, so do the philosophical and legal dilemmas. We’re entering territory once reserved for science fiction:

- When does an AI system cross the threshold into consciousness?

- Should it be granted rights?

- If an AI causes harm, who’s accountable?

Emerging models can now simulate internal reasoning, use multi-sensory inputs (text, speech, even scent), and act autonomously. They’re becoming increasingly agentic, capable of taking action independently. That raises urgent questions for governance: If a system misbehaves, who decides when and how it’s shut down? And what happens if it resists?

These issues aren’t just abstract. The decisions we make now about transparency, control, alignment will shape the AI future we all live in.

So… What Can Credit Unions Do Now?

You don’t need to solve consciousness or rewrite capitalism to take smart, meaningful action today. Here are six practical steps credit unions can begin implementing right now:

- Invest in analytics maturity

Move beyond spreadsheets. Adopt predictive tools that offer insights into churn, engagement, and product fit before issues arise. - Audit your data

Build models on clean, representative data sets. Watch for hidden biases and regularly review outputs for fairness. - Select trustworthy AI tools

Choose platforms with explainability, data protection, and strong enterprise credentials. - Train your team on responsible use

Set clear policies on what can (and cannot) be entered into AI tools. Promote cross-functional understanding from IT to marketing to compliance. - Explore internal pilots

Start small. Use AI to streamline data hygiene, summarize reports, or identify marketing opportunities. - Track, measure, and iterate

AI isn’t a “set it and forget it” tool. Build feedback loops. Treat adoption as a living, evolving strategy.

These actions will help your institution move confidently toward smarter operations, deeper member engagement, and a culture of innovation without compromising trust or compliance.

The Bottom Line: Don’t Wait for Nirvana. Build It.

The most pressing questions about AI may sound distant or theoretical but so did the internet in 1993. So did mobile banking in 2005. Today, they’re essential.

AI isn’t just another technology. It’s a transformation of how value is created, delivered, and experienced. The institutions that lean in now responsibly, strategically, and with purpose won’t just survive the next decade. They’ll lead it.

Ready to Start Building Your AI Foundation?

Whether you’re just beginning your AI journey or looking to scale smarter, we’ve created resources to help you move forward with confidence:

📘 The Essential Guide to External Data

Discover how financial institutions can leverage public and third-party data to drive growth. This guide shows how AI-powered enrichment creates 360° member profiles—enabling hyper-targeted engagement, stronger market positioning, and measurable ROI.

👉 Download the External Data Guide

📘 AI and Data Governance for Credit Unions

Learn how to implement AI responsibly in 2025. This white paper explores governance frameworks, risk mitigation, and compliance strategies tailored for credit unions and community banks.

👉 Download the Governance White Paper

Want to talk through your next step?

Contact our team to explore how predictive intelligence can help your credit union improve retention, boost engagement, and future-proof your strategy starting today.

Tomer Borenstein – BlastPoint Co-Founder & CTO

Tomer Borenstein is the CTO and Co-Founder of BlastPoint, where he leads AI innovation and strategy. A Carnegie Mellon graduate in machine learning, he’s helped scale BlastPoint nationally across multiple industries. Known for promoting ethical, transparent AI, Tomer has been recognized as a top thought leader and standout technologist in Pittsburgh’s startup scene.