As we moved into 2026, one thing is clear: customer expectations aren’t slowing down. Utilities and credit unions alike are under pressure to personalize experiences, improve retention, and make smarter use of customer data, all while operating in highly regulated, resource-constrained environments.

That’s why we created two 2025 Industry Benchmark Reports, one for Utilities and one for Credit Unions. While the data reflects 2025 performance, the insights are designed to help organizations evaluate their current position and prioritize action in 2026 and beyond.

Each report combines real-world performance benchmarks, benchmark cohort charts, and practical strategies to help leaders move from insight to action.

2025 Utilities Benchmark Report: See Where Your Utility Really Stands

Utilities across the U.S. are under pressure like never before. Rising arrears, increasing regulatory scrutiny, and climate-driven reliability concerns all converge on a critical challenge:

How effectively are you engaging your customers — especially those who are most vulnerable?

The 2025 Utilities Benchmark Report goes beyond high-level trends by analyzing aggregated, anonymized data from BlastPoint’s utility partners. It provides a rare view into how utilities are performing across essential customer engagement and affordability programs, including:

- Email on file and web account adoption

- E-bill and auto-pay enrollment

- Budget billing participation

- Income-eligible assistance programs (CAP, discount programs, USF/HEA, FERA, and more)

A key highlight of the report is the benchmark cohort chart, which allows utilities to quickly see how their performance compares to peers from foundational adoption to top-quartile leaders. But the report doesn’t stop there.

It also explains:

- Why certain engagement gaps persist

- Which customer segments are most under-engaged

- How data-driven strategies can reduce bad debt while improving equity and customer trust

- How BlastPoint helps utilities activate insights across digital channels and assistance programs

Download the Utilities Benchmark Report to see the full benchmarks and strategies:

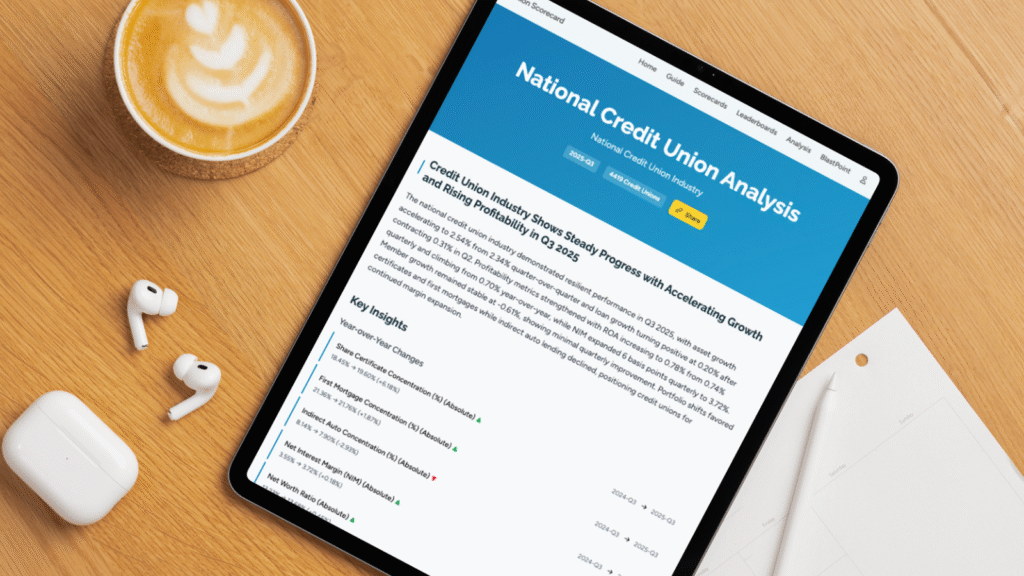

Credit Unions: Identifying Growth Gaps in a Hyper-Competitive Market

Credit unions are facing one of the most disruptive periods in decades. Members expect seamless digital experiences and personalized offers, while competition now includes national banks and fintechs built for speed and scale.

The 2025 Credit Union Benchmark Report answers two critical questions:

- Where do credit unions stand today?

- Where are the hidden opportunities to deepen relationships and drive sustainable growth?

Using aggregated data from BlastPoint’s credit union partners, the report benchmarks real-world adoption and penetration across:

- Digital services and engagement

- Core products like checking and credit cards

- Lending products including auto, mortgage, and HELOCs

The benchmark cohort chart highlights how credit unions cluster by performance, revealing a mixed picture. While digital adoption is improving, gaps in credit card and lending penetration threaten primary financial institution (PFI) status for many institutions.

Beyond the benchmarks, the white paper outlines:

- Why strong checking adoption doesn’t always translate into deeper product relationships

- Where lending demand is being left on the table

- Practical strategies credit unions can use to close adoption gaps

- How BlastPoint supports data-driven member engagement and growth

Download the Credit Union Benchmark Report to explore the data and strategies:

Why These Benchmarks Matter in 2026

Although these reports are labeled 2025, they capture the baseline many organizations are bringing into 2026. The benchmark cohort charts, in particular, provide a practical lens for answering critical questions:

- Are we ahead of, aligned with, or behind our peers?

- What capabilities should we prioritize this year?

- What does “best-in-class” actually look like in our industry?

Instead of guessing, you can see exactly where you stand and what it will take to move into a higher-performing cohort.

📥 Download the Utilities Benchmark Report

📥 Download the Credit Union Benchmark Report