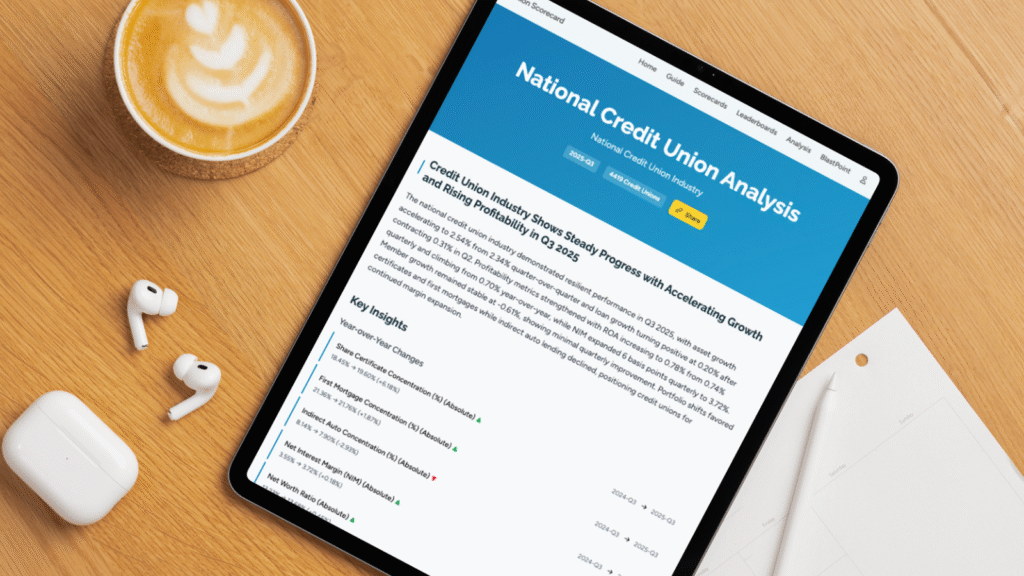

Insight from CU Scorecard data (BlastPoint)

The U.S. credit union sector continues to demonstrate resilience and strategic growth through the third quarter of 2025, according to the latest national data from the CU Scorecard. Even as broader economic pressures persist, key performance indicators point to strengthening fundamentals and shifting portfolio priorities across thousands of institutions.

1. Continued Financial Strength and Margin Expansion

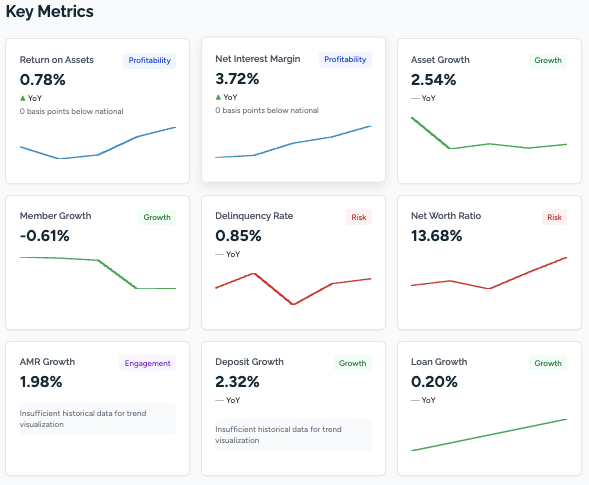

Credit unions nationally posted an accelerated asset growth rate of 2.54% in Q3 2025 compared with the previous quarter — building on steady momentum from earlier in the year. Net interest margins also expanded to 3.72%, suggesting institutions are successfully managing yield in the post-rate environment.

Profitability, reflected in the return on assets (ROA) rising to 0.78%, also edged up both quarter-over-quarter and year-over-year, signaling improved operational efficiency and financial performance across the sector.

2. Member Growth and Engagement Remains Mixed

While financial metrics are strengthening, member growth continues to present headwinds. Year-over-year retail membership contracted modestly (–0.61%) in Q3, though this decline is an improvement compared with earlier quarterly trends. Despite challenges in attracting new memberships, some stabilization suggests member engagement strategies may be starting to bear fruit for institutions that are innovating digitally.

3. Strategic Portfolio Shifts

Data show a noticeable shift in portfolio composition: share certificates and first mortgages gained relative share, while indirect auto lending declined. For example:

- Share Certificate Concentration rose to ~19.6%, indicating a focus on deposit-driven stability.

- First Mortgage Concentration increased modestly, reaffirming a longer-term, higher-yield asset focus.

- Indirect Auto lending slipped, reflecting tighter underwriting or changing member demand.

This shift toward margin-enhancing products aligns with broader industry trends — where credit unions prioritize portfolio quality and balance-sheet resilience amid evolving asset-pricing conditions.

4. Risk Metrics Remain Controlled

Risk indicators across the industry remain favorable. Delinquency rates held near 0.85%, while net worth ratios continued their upward trajectory, pointing to strong capital positions and the ability of credit unions to absorb economic fluctuations.

See the full National Credit Union Industry Analysis.

The CU Scorecard national dashboard provides interactive charts, deeper trend breakdowns, and additional metrics that bring these insights to life, allowing credit union leaders to explore performance across lending, deposits, margins, and risk in more detail.

The CU Scorecard national dashboard provides interactive charts, deeper trend breakdowns, and additional metrics that bring these insights to life, allowing credit union leaders to explore performance across lending, deposits, margins, and risk in more detail.

👉 View the full National Credit Union Industry Analysis on CU Scorecard →

Key Takeaways for Credit Unions & Stakeholders

- Profitability and margins are strengthening, driven by careful balance-sheet management.

- Membership growth, while challenging, appears to be stabilizing, suggesting engagement strategies may be gaining traction.

- Portfolio shifts toward higher-yield assets reflect proactive risk and return positioning across the industry.

- Risk remains well controlled, demonstrating robust capital positions and disciplined underwriting.

These findings show a credit union industry that is adapting to current economic conditions while maintaining activity on growth, risk, and operational fronts.

About CU Scorecard

CU Scorecard is a free, interactive benchmarking tool developed by BlastPoint to help credit unions understand how they compare across national and state-level industry trends. Every insight is backed by official NCUA data from more than 4,800 federally insured credit unions, combined with continuously updated industry signals. CU Scorecard highlights patterns in financial performance, digital presence, and brand reputation, giving credit union leaders actionable context.

Access the full CU Scorecard national and state-level analyses here:

👉 https://cuscorecard.blastpoint.com