Digital banking is no longer defined by feature parity or app design. In 2026, competition is being reshaped by relevance, timing, and precision and fintech disruption has permanently raised the bar.

Fintechs didn’t just introduce new products. They changed expectations:

- proactive guidance instead of reactive service

- personalized engagement instead of mass campaigns

- faster, simpler interactions across channels

For banks, the opportunity isn’t to out-innovate fintechs. It’s to combine what banks already win on trust, compliance, relationships, and scale with modern customer intelligence that makes engagement feel as intuitive and timely as the best digital experiences anywhere.

Customers Don’t Compare Banks to Banks Anymore

Customers now compare their bank to the best experiences they have across industries, such as personalized recommendations, frictionless self-service, and fast resolution without calling support.

When outreach feels generic or disconnected, customers may keep accounts but won’t deepen relationships. They’ll split wallet share, rate-shop, and move when a better offer appears.

What Fintech Disruption Really Means

Fintech disruption is often framed as better UX or faster innovation. The more meaningful shift is how effectively organizations act on signals.

Signals such as life-stage changes, engagement behavior, product readiness, and early signs of churn increasingly determine who wins customer attention. Banks already have many of these signals but they’re often scattered across core systems, CRM, martech, and channel data. The advantage lies in turning those signals into consistent, timely action.

A Practical 2026 Framework: From Data → Prediction → Outreach → ROI

This is a simple framework banks can use to modernize engagement without turning every initiative into a multi-year transformation project.

1) Build 360° Customer and Prospect Profiles

Hyper-personalization doesn’t start with content. It starts with context.

- Internal data: core, CRM, digital banking, martech

- External public data: economic, geographic, demographic, market context

- Third-party data: firmographics, credit/risk attributes (where appropriate)

- Engagement data: channel preference, response history, product usage

If it takes a week to assemble a target list, you don’t have a targeting problem. You have an operational data problem.

2) Raising the Bar on How Predictive Insight Is Used

Most banks already generate predictive insight. The differentiator in 2026 is how selectively and consistently that insight is applied.

Leading institutions are no longer asking whether a customer could take a particular action. They are focused on:

- which opportunities deserve attention now

- which relationships are worth deepening first

- where effort will produce measurable impact

This shift is less about building new models and more about prioritization and focus, reducing noise so teams spend time on the opportunities that actually move outcomes.

When predictive insight is used to guide what not to pursue as much as what to pursue, banks improve efficiency, reduce wasted outreach, and create a more disciplined approach to growth.

3) Operationalize Outreach with a Disciplined Execution Model

Most institutions don’t fail because of strategy. They stall because execution lacks speed, consistency, and focus.

High-performing teams rely on a repeatable outreach model that translates insight into action without friction. At its core, this model ensures that the right opportunities surface at the right time, and teams act on them consistently.

A scalable execution framework includes:

1. Identify the signal

Early indicators that matter to growth or retention.

- Retail: CD-only relationships, low digital engagement, rate sensitivity

- Commercial: payroll complexity, multi-location operations, headcount growth

2. Define the audience precisely

Focused groups built on behavior and operating reality, not broad demographic labels.

3. Prioritize opportunities

Rank customers or prospects so effort is concentrated where impact is most likely.

4. Align channel to context

- Relationship manager outreach for high-value commercial opportunities

- Email or SMS for timely nudges

- Direct mail for regulated or broad-reach communications

- Digital prompts for self-service and adoption

5. Deliver relevance, not volume

Personalization is about why now and why this—not message tokens.

A disciplined execution model removes guesswork, reduces wasted effort, and allows teams to operate with consistency even as scale increases.

4) Track Goals and Prove ROI

Personalization only becomes strategic when impact is measurable.

A practical measurement layer includes:

- conversion rate and cost per acquisition

- product adoption (checking, digital banking, bill pay, treasury services)

- retention and churn reduction

- cost-to-serve reduction (self-service vs call volume)

- pipeline influenced (for commercial growth)

If you can’t translate outcomes into dollars saved or earned, you’ll lose momentum—even if the work is good.

Where Customer Intelligence Enables This at Scale

This is where customer intelligence platforms come into play.

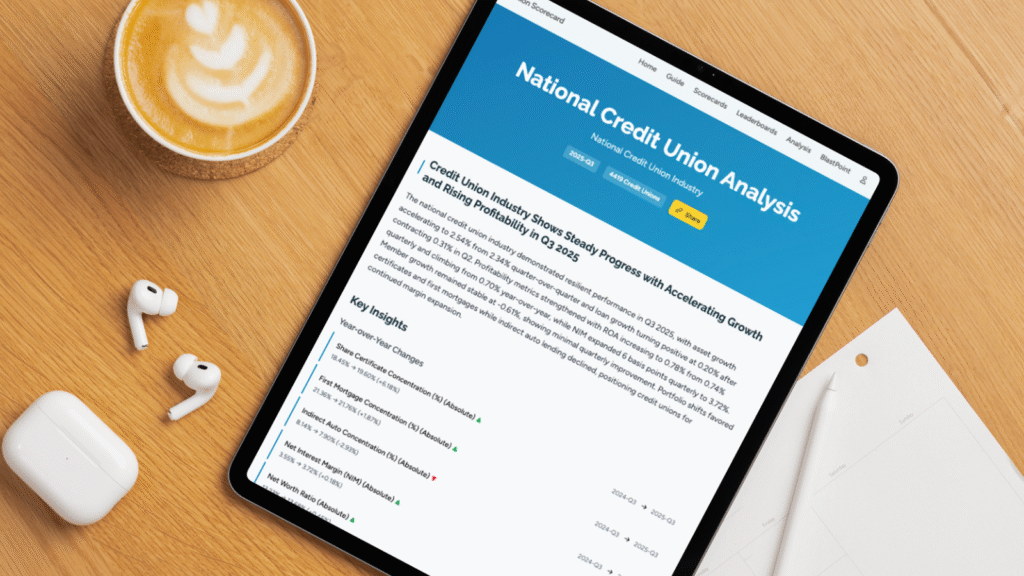

Platforms like BlastPoint help banks operationalize this framework by unifying internal data with external context and explainable predictive models. This enables institutions to:

- anticipate customer and business behavior

- identify next-best products for retail and commercial relationships

- prioritize outreach based on likelihood to engage and expected value

- make insight accessible to frontline teams while maintaining regulatory transparency

In practice, banks apply this to use cases such as identifying SMBs with complex treasury needs, preventing CD churn by deepening retail relationships, and driving digital adoption to reduce cost-to-serve.

The result isn’t more analytics. It’s repeatable, ROI-driven execution.

Looking Ahead

Fintech disruption isn’t about replacing banks. It’s about redefining expectations. In 2026, the institutions that lead will be those that anticipate needs, act with precision, and engage responsibly at scale.

Customer intelligence doesn’t replace trust or relationships. It strengthens them by ensuring every interaction is intentional, timely, and relevant.

If you’d like to explore how this approach can work in your organization, connect with our team to learn how banks are using customer intelligence to prioritize the right opportunities, reduce waste, and drive measurable outcomes.