Digital Banking in 2026: How Fintech Disruption Is Reshaping the Industry

Digital banking is no longer defined by feature parity or app design. In 2026, competition is being reshaped by relevance, timing, and precision and fintech disruption has permanently raised the bar. Fintechs didn’t just introduce new products. They changed expectations: proactive guidance instead of reactive service personalized engagement instead of mass campaigns faster, simpler interactions […]

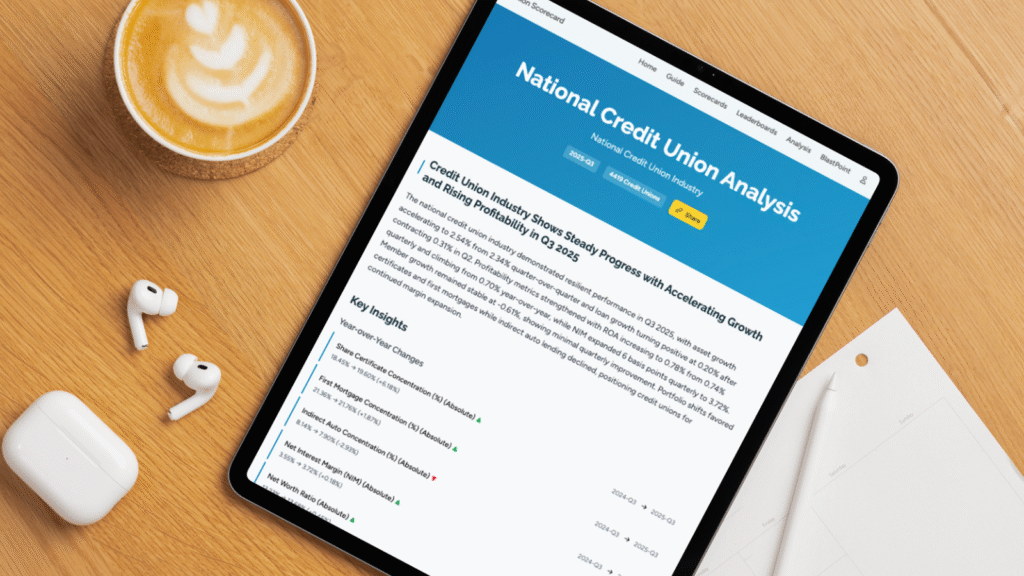

Credit Union Industry Shows Steady Progress with Accelerating Growth and Rising Profitability in Q3 2025

Insight from CU Scorecard data (BlastPoint) The U.S. credit union sector continues to demonstrate resilience and strategic growth through the third quarter of 2025, according to the latest national data from the CU Scorecard. Even as broader economic pressures persist, key performance indicators point to strengthening fundamentals and shifting portfolio priorities across thousands of institutions. […]

What Industry Leaders Learned in 2025 And Industry Benchmark Leading into 2026

As we moved into 2026, one thing is clear: customer expectations aren’t slowing down. Utilities and credit unions alike are under pressure to personalize experiences, improve retention, and make smarter use of customer data, all while operating in highly regulated, resource-constrained environments. That’s why we created two 2025 Industry Benchmark Reports, one for Utilities and […]

From Insight to Impact: How BlastPoint Helped Utilities & Financial Institutions Win in 2025 and What’s Coming in 2026

2025 was a year defined by rapid change. Economic pressures, rising customer expectations, and accelerated digital transformation pushed organizations across industries to rethink how they connect with the people they serve. Utilities faced affordability challenges and electrification shifts, while financial institutions, including credit unions and banks, experienced intense competition, margin pressure, rising expectations for digital-first […]

How Predictive Intelligence is Transforming Deposit Growth in Banking

In today’s financial landscape, deposit growth has become one of the most difficult and most essential — levers for sustainable bank profitability. Rising interest rates have driven intense competition for customer deposits, while digital-first challengers have made switching accounts easier than ever. The result? Traditional marketing campaigns and branch-level strategies no longer deliver the same […]

Building Customer Personas: How Utility Personas Drive Smarter Engagement

Why Personas Matter for Utilities Utilities are under pressure like never before: affordability crises, rising customer expectations, and the urgent push toward decarbonization. Yet many still rely on outdated demographic segmentation or siloed initiatives that miss the mark. The result? Inefficient spending, inconsistent messaging, and customers left feeling overlooked. Customer personas offer a way forward. […]

Utility Call Center Optimization: How to Reduce Costs and Improve Customer Satisfaction

Utility call centers are under more pressure than ever. Customers want fast answers, agents are overwhelmed with high call volumes, and operational costs keep rising. For many utilities, managing the call center feels like a never-ending balancing act between efficiency and customer satisfaction. The solution? Utility call center optimization. A new playbook is helping utilities […]

From Indirect to Irreplaceable: Growing Lifetime Value of Auto Loan Members

Most credit unions acquire new members through indirect lending but far too many of those relationships end at the loan. That’s a missed opportunity. Indirect auto loans are a vital entry point for growth. But if your team isn’t focused on what happens after the loan closes, you’re likely leaving long-term member value on the […]

How AI Is Helping Utilities and Credit Unions Prevent First-Time Delinquency

First-time delinquency is one of the fastest-growing challenges facing both utilities and credit unions today. Customers and members who have always paid on time are suddenly falling behind, often going unnoticed by legacy systems until overdue balances pile up. But leading organizations are getting ahead of this risk by combining AI-powered predictive insights with modern […]

Unlocking Upskilling Value: What Your Team Gains When You Don’t Hire a Data Scientist

Hiring a data scientist sounds like the next logical step, right? After all, if your organization is trying to become more data-driven, wouldn’t bringing in an expert be the smartest way to move forward? Not necessarily. In today’s fast-paced, budget-conscious environment, building a data science team from scratch can be expensive, slow, and often unnecessary—especially […]