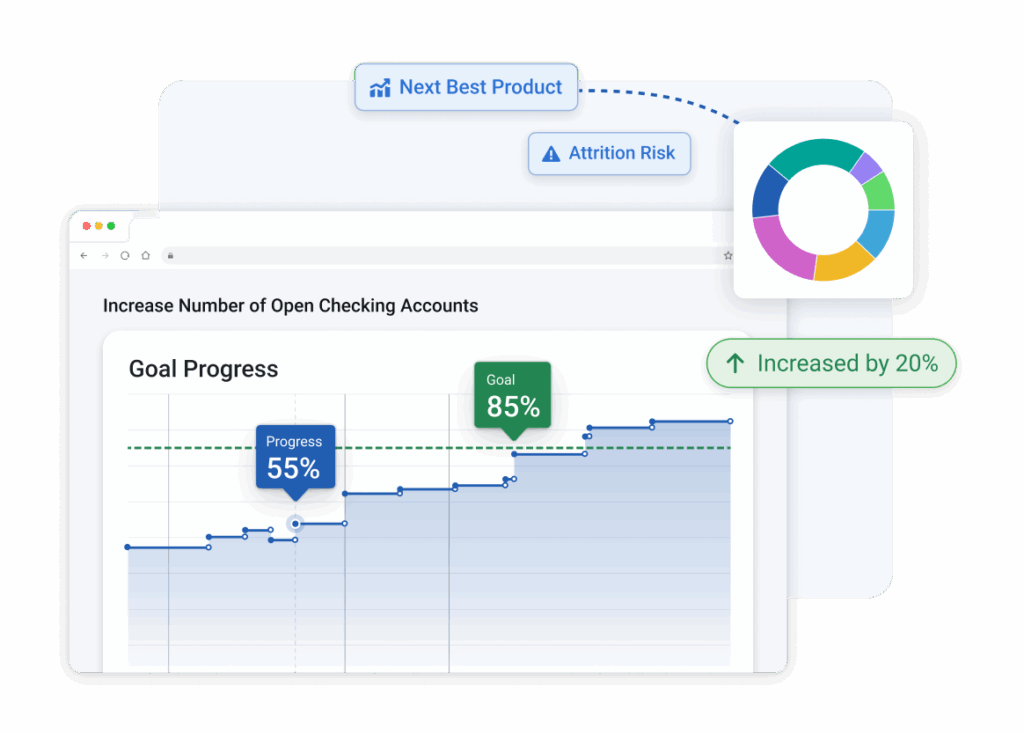

Unlock Deeper Insights Across Your Membership

Commercial Lending

Target and assess commercial opportunities

Competitive & Branch Analysis

See which members are engaging relative to your branches

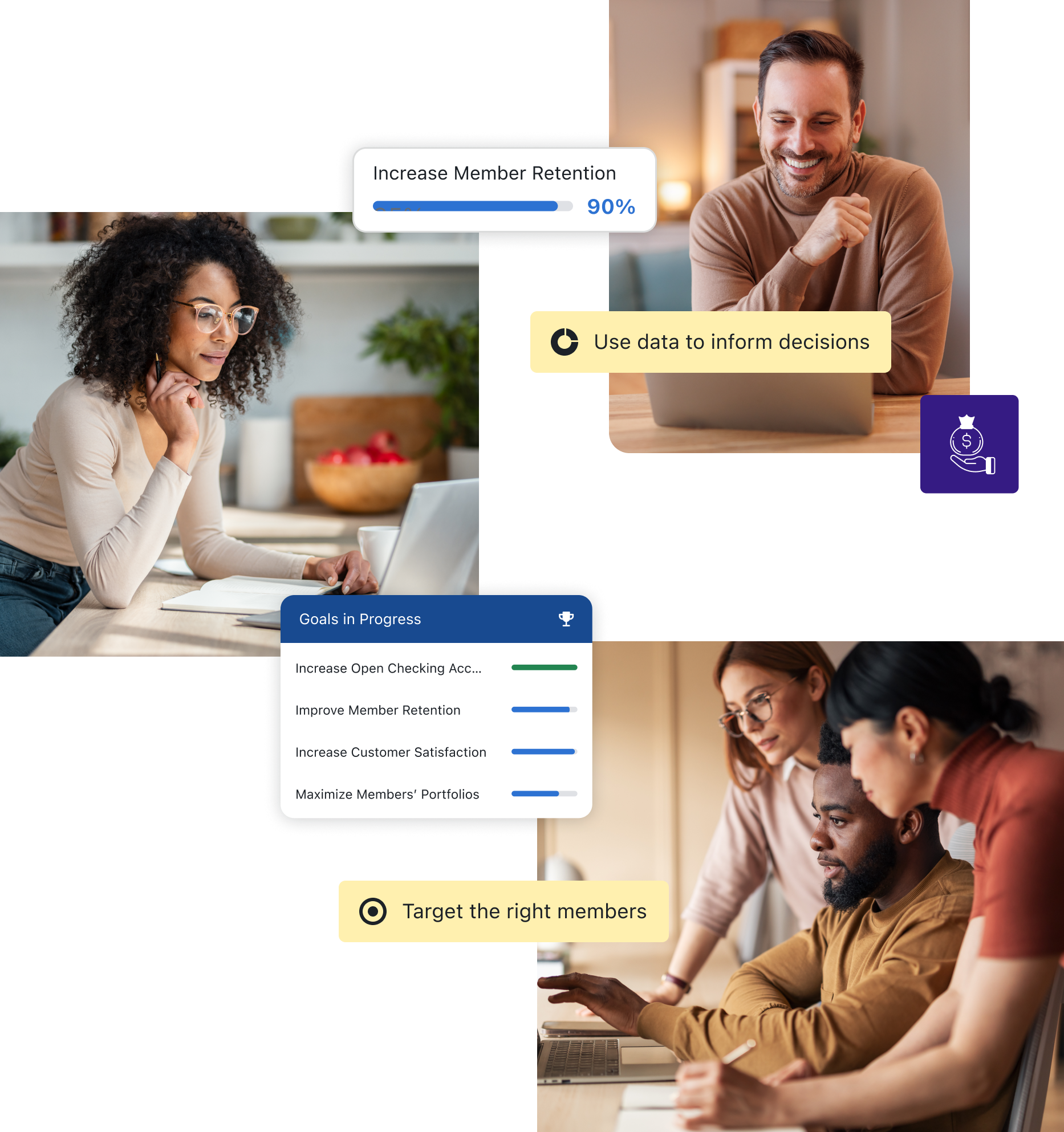

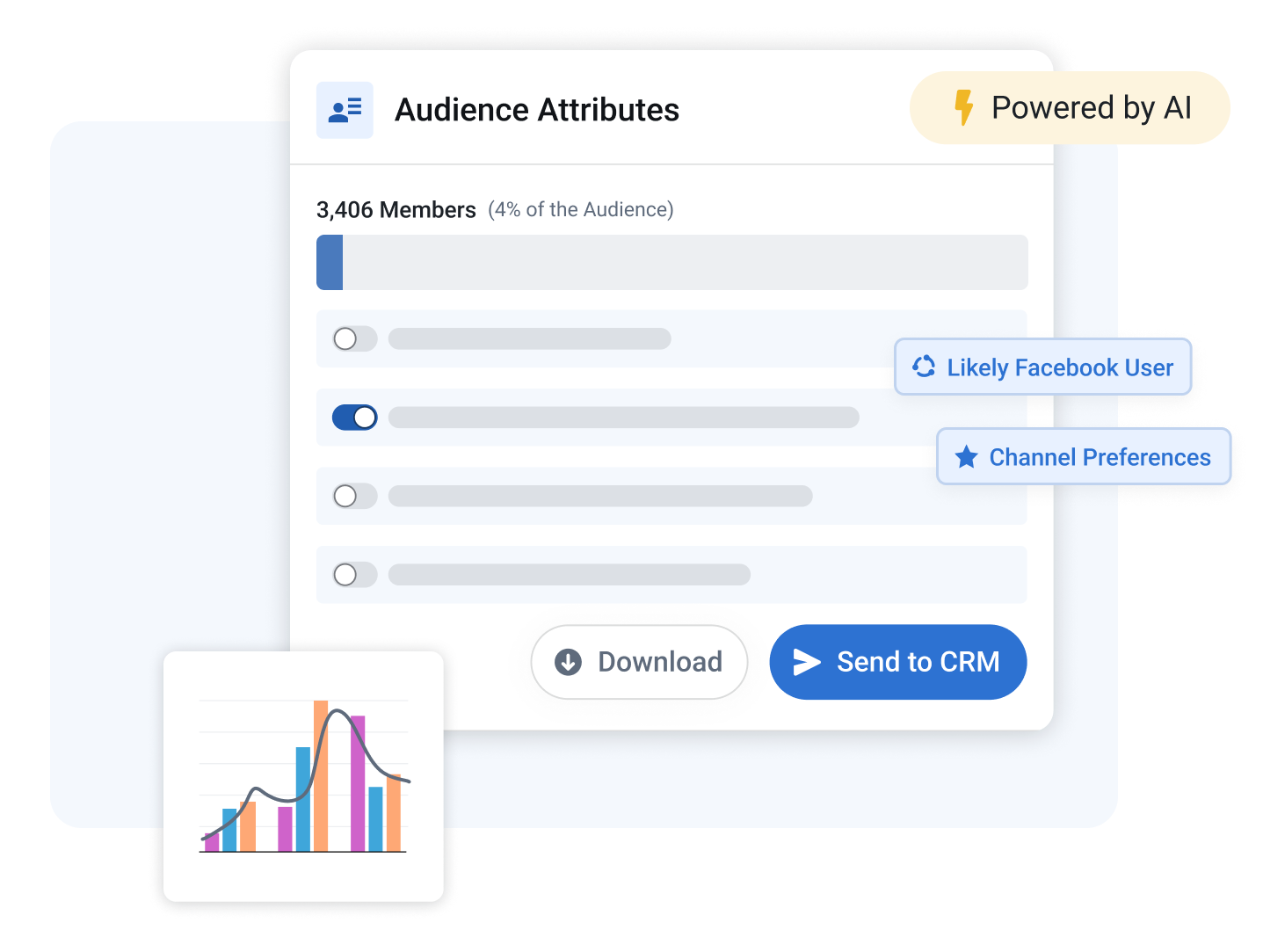

Enhance Cross Sell Opportunities

Identify members who are most likely to open strategic products through segmentation

Onboard New Members

Use data to drive your onboarding strategy